Bank-Backed Stablecoins in Japan: Project Pax and the Rise of Institutional JPY Tokens

Japan’s financial sector is on the cusp of a transformation, boldly embracing blockchain technology to redefine the future of cross-border payments. The recent surge in bank-backed stablecoin initiatives signals a new era for institutional JPY tokens, with Project Pax at the heart of this movement. As Japanese megabanks and fintech pioneers accelerate their efforts, the yen is poised to become a global digital currency contender.

![]()

Project Pax Stablecoin: The Megabank Alliance

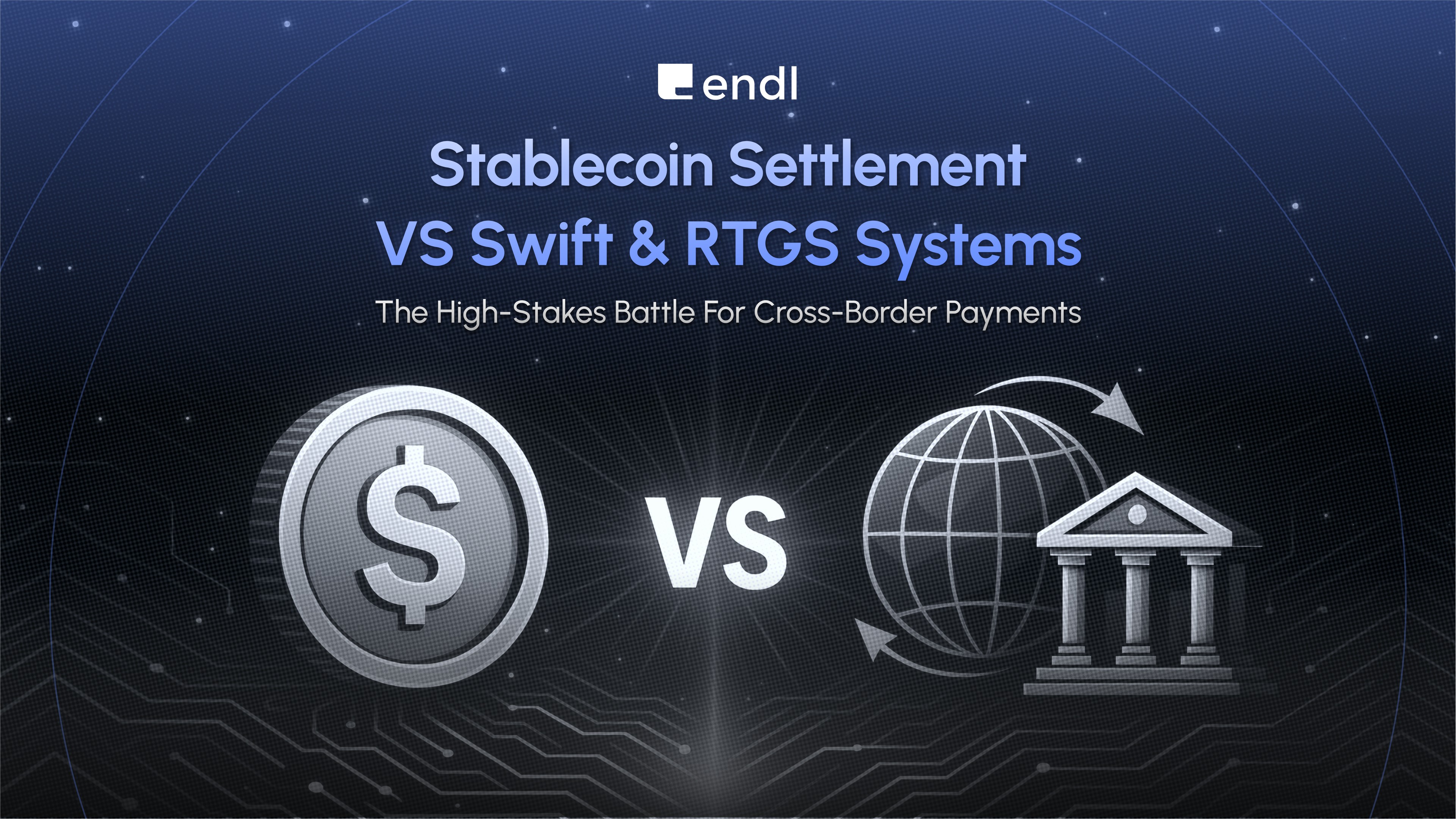

The launch of Project Pax marks an unprecedented collaboration among Japan’s three financial titans: Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho. This ambitious project leverages Progmat’s blockchain platform, supported by SBI Holdings and the Japan Exchange Group, to create a robust infrastructure for yen-backed stablecoins. With interoperability as its cornerstone, Project Pax integrates directly with SWIFT APIs, allowing banks to settle transactions seamlessly on-chain while maintaining rigorous compliance standards like anti-money laundering protocols.

The pilot phase kicked off in September 2024, with full-scale commercialization targeted for 2025. This timeline demonstrates Japan’s urgency to address inefficiencies in global remittance identified by the G20 and positions its banking sector at the forefront of digital asset adoption. According to datachain. jp, this move is set to streamline cross-border settlements, reduce operational costs, and offer near-instant transfers, all while preserving the trust inherent in traditional banking.

JPY Institutional Tokens: From Vision to Reality

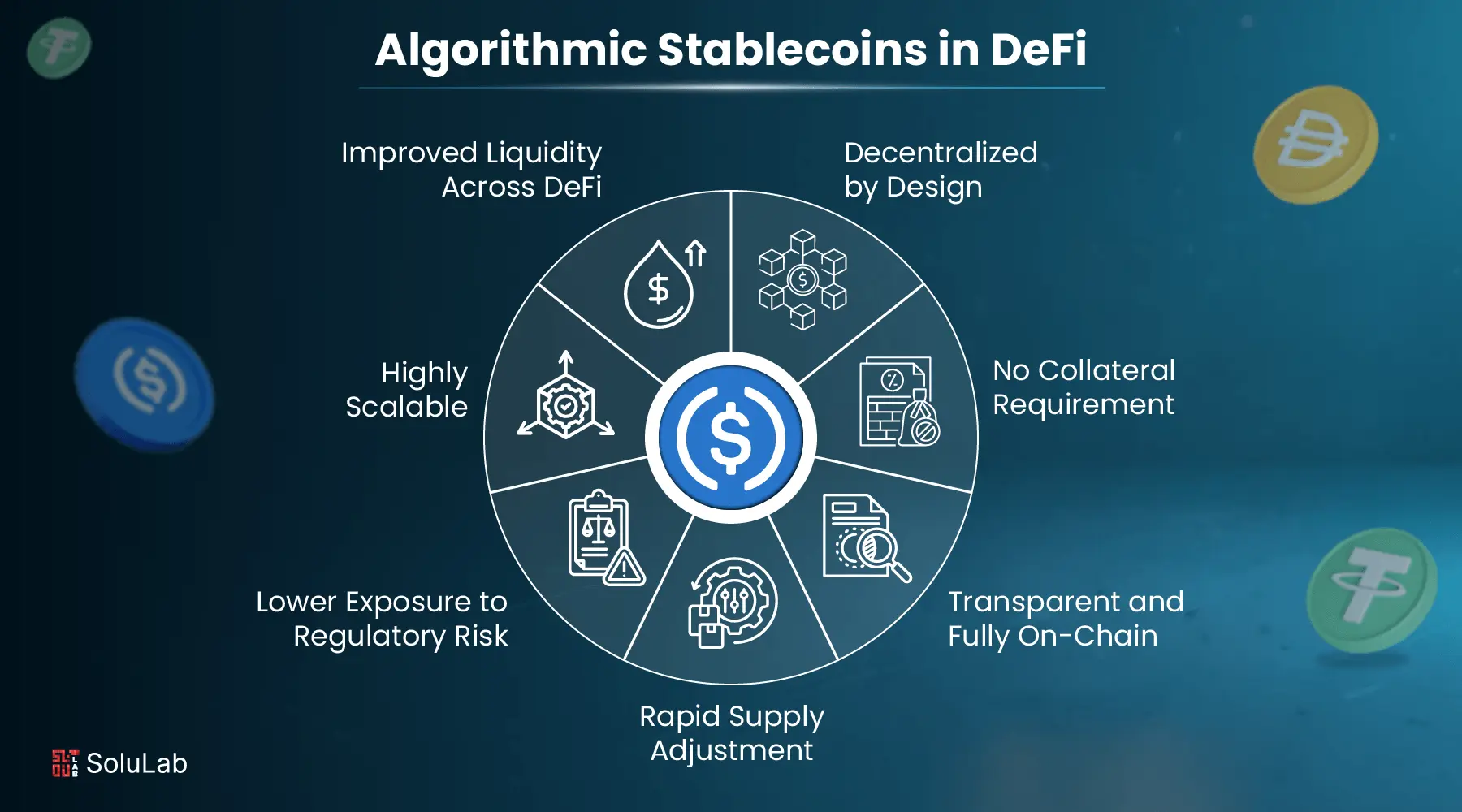

The momentum doesn’t stop with Project Pax. In August 2025, Japanese startup JPYC announced regulatory approval for its own yen-pegged stablecoin, one that will be fully convertible into fiat yen and backed by domestic savings as well as Japanese government bonds. Initially targeting institutional investors, JPYC aims to issue tokens equivalent to nearly $7 billion over the next three years (Reuters). This bold move seeks not only domestic adoption but also international recognition of a digital yen standard.

The significance? For crypto traders and global institutions alike, JPY stablecoins offer diversification beyond USD-based assets, hedging against dollar volatility while tapping into Asia’s vast liquidity pools. With Ripple’s technology underpinning many integrations and SBI Holdings playing a pivotal role in distribution (see FinTech Magazine), cross-border synergy is no longer just theoretical, it’s happening now.

Key Benefits of JPY Institutional Tokens for Traders & Investors

-

Instant Cross-Border Settlements: JPY-backed stablecoins like those in Project Pax enable rapid, near-instant settlement of international trades, eliminating traditional banking delays.

-

Reduced Transaction Costs: By leveraging blockchain rails, institutional JPY tokens significantly lower remittance and forex fees compared to legacy wire transfers.

-

Robust Regulatory Compliance: Issuers such as Progmat and JPYC operate under Japan’s strict financial regulations, ensuring anti-money laundering (AML) and know-your-customer (KYC) standards are met.

-

Full Yen Convertibility & Security: Tokens like JPYC are fully backed by domestic savings and Japanese government bonds, offering 1:1 convertibility with the Japanese yen for institutional investors.

-

Seamless Integration with Financial Infrastructure: Platforms such as Project Pax are designed to work with SWIFT’s API framework, allowing banks and investors to bridge traditional and blockchain-based systems efficiently.

-

Enhanced Transparency and Auditability: All stablecoin transactions are recorded on blockchain ledgers, providing real-time visibility and traceability for traders and institutional clients.

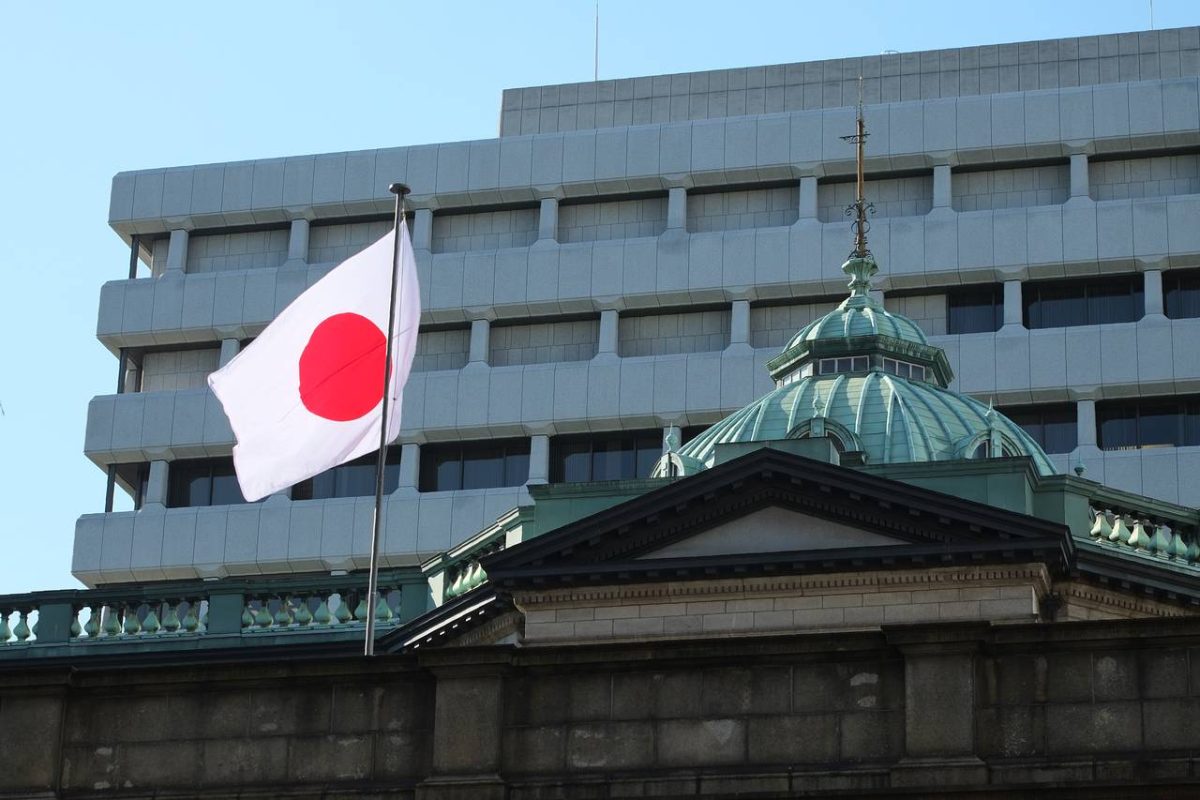

Japan Post Bank and The Digital Yen Revolution

The landscape is evolving beyond private initiatives. By late 2026, Japan Post Bank will introduce its own tokenized deposit currency, a true “digital yen” developed alongside DeCurret DCP (Reuters). Unlike traditional stablecoins, this digital currency will be fully backed 1: 1 by fiat yen held at the bank. For depositors and businesses alike, it promises instant settlement for digital securities and blockchain-based assets while maintaining full transparency and regulatory oversight.

This convergence of private innovation (JPYC), consortium-driven platforms (Project Pax), and public sector action (Japan Post Bank) sets Japan apart as a leader in non-USD stables, offering unmatched stability, security, and speed for both domestic users and global partners.

For traders and institutions, the emergence of JPY-backed stablecoins is more than a technical upgrade, it’s a strategic leap. The ability to move large sums across borders with minimal friction, all while maintaining yen-denomination, is a game-changer for both liquidity providers and multinational corporations. As regulatory clarity sharpens and infrastructure matures, the competitive edge once held by USD stablecoins is being challenged head-on by Japan’s digital yen initiatives.

The synergy between Ripple’s distributed ledger technology and Japan’s banking giants cannot be overstated. Nearly 80% of Japanese banks are on track to integrate Ripple-based payment rails by 2025, amplifying interoperability with global partners. This means that yen-pegged tokens can be sent, received, and settled in seconds, without the legacy costs or delays of SWIFT-only corridors. For crypto investors seeking diversification or arbitrage opportunities, JPY institutional tokens unlock new trading pairs and access to Asia-Pacific markets previously gated by fiat constraints.

Risks and Opportunities Ahead

While the promise is immense, it comes with caveats. Regulatory scrutiny remains high as authorities balance innovation with anti-money laundering mandates. The stability of JPY tokens hinges on robust reserves, JPYC’s model of backing each token with domestic savings and government bonds sets a gold standard for transparency but also demands vigilant oversight.

Yet the opportunity set is undeniable:

Key Risks & Opportunities for Japan Bank-Backed Stablecoin Early Adopters

-

Access to Faster, Lower-Cost Cross-Border Payments: Project Pax and yen-backed stablecoins like JPYC promise near-instant settlement and reduced fees for international transfers—especially compared to traditional SWIFT-based remittances.

-

First-Mover Advantage in Digital Yen Ecosystem: Early adopters can shape standards and integrations as Japan Post Bank and major banks roll out digital yen and stablecoins, gaining influence and technical know-how ahead of competitors.

-

Regulatory Uncertainty and Compliance Risks: Despite government support, evolving Japanese FSA regulations on AML, KYC, and stablecoin issuance may create compliance hurdles and operational risks for early participants.

-

Liquidity and Conversion Challenges: While JPYC and bank-issued tokens are designed for easy conversion, initial liquidity may be limited, affecting the ability to move large sums or convert between fiat and digital yen seamlessly.

-

Potential for Global Expansion and Partnerships: Integration with Ripple and SWIFT APIs positions Japanese stablecoins for global reach, enabling new business models and cross-border collaborations for early users.

-

Technology and Cybersecurity Risks: Adopting new blockchain-based platforms like Progmat introduces exposure to smart contract bugs, cyberattacks, and operational outages—demanding robust risk management.

With Project Pax targeting full commercialization in 2025 and JPYC poised to issue billions in digital yen over the next three years, Japan stands at the vanguard of non-USD stablecoin adoption. This isn’t just about faster payments, it’s about redefining trust in digital finance through public-private collaboration.

What Comes Next?

The race to digitize national currencies has only begun. As Japan Post Bank moves toward launching its own tokenized deposit currency by late 2026, expect further integration between traditional finance and blockchain ecosystems. The result? A future where yen-backed digital assets flow seamlessly between exchanges, wallets, banks, and enterprises, fueling innovation not just in Japan but across global markets hungry for alternatives to dollar dominance.

For those watching from the sidelines: now is the time to study these new rails, understand their mechanics, and position portfolios accordingly. The rise of institutional JPY tokens isn’t just a local phenomenon, it’s setting benchmarks that will ripple (pun intended) across continents.