Unlocking Yield: How to Earn 4.8%+ APY with Euro Stablecoins on Aave and Other DeFi Platforms

Euro stablecoins are quietly carving out a lucrative niche in the DeFi landscape, offering savvy investors a compelling way to earn yield while sidestepping USD exposure. As of September 19,2025, Aave’s Euro Coin (EURC) stands out with a 4.9% APY on deposits, an eye-catching figure for anyone tired of near-zero rates from traditional European banks. But how does this work, and what sets these euro-denominated DeFi opportunities apart?

Why Euro Stablecoins? Diversification Meets Opportunity

For years, USD-pegged stablecoins like USDT and USDC dominated DeFi lending and liquidity mining. But for European crypto users or those seeking FX diversification, euro stablecoins like EURC are an attractive alternative. They offer:

- Reduced exposure to dollar volatility and US regulatory risk

- Easier fiat on-ramps for EU residents

- Smoother integration with local payment rails

- Competitive yields, as protocols incentivize non-USD liquidity pools

The growing appetite for non-USD stable assets is reflected in rising yields and increased support across major DeFi platforms.

Aave’s EURC Yield: How the 4.9% APY Works (and Why It Beats TradFi)

Aave remains the go-to protocol for earning interest on euro stablecoins. On its Ethereum market, users can currently supply EURC and earn a variable annual percentage yield that hovers around 4.9%. This is significantly higher than what you’d get from even the most generous European neobanks or savings accounts.

The mechanics are simple: you deposit your EURC into Aave’s liquidity pool, which other users can then borrow against collateral. In return, you receive interest payments that accrue in real time, withdrawable at any moment without penalties or lockups.

Top Reasons DeFi Euro Stablecoin Yields Outperform Banks

-

Decentralized, Open Markets Enable Higher RatesDeFi platforms like Aave operate on open, global liquidity pools where supply and demand directly set interest rates. This means yields on Euro stablecoins like Euro Coin (EURC) can reach 4.9% APY (as of September 2025)—far above most traditional European banks—because there are fewer intermediaries and more efficient capital allocation.

-

Innovative Yield Strategies and Protocol IncentivesDeFi protocols frequently offer additional rewards and flexible yield strategies. For example, Bitget Wallet’s Stablecoin Earn Plus combines Aave’s lending markets with wallet-based yield subsidies, offering up to 10% APY on USDC. These incentives, unavailable in traditional banking, boost overall returns for depositors.

-

Lower Overhead and Borderless AccessUnlike banks, DeFi platforms run on blockchain infrastructure, reducing operational costs and eliminating geographic restrictions. This allows users worldwide to earn competitive yields on euro stablecoins through protocols like Morpho and Spark Protocol, which offer customizable risk and simplified savings—making higher APYs accessible to anyone with an internet connection.

This model isn’t just theoretical; it’s powering new features for mainstream wallets too. For example, MetaMask now lets mobile users earn yield directly through its Stablecoin Earn product, powered by Aave’s lending markets (source). This seamless integration signals just how accessible euro stablecoin yields have become.

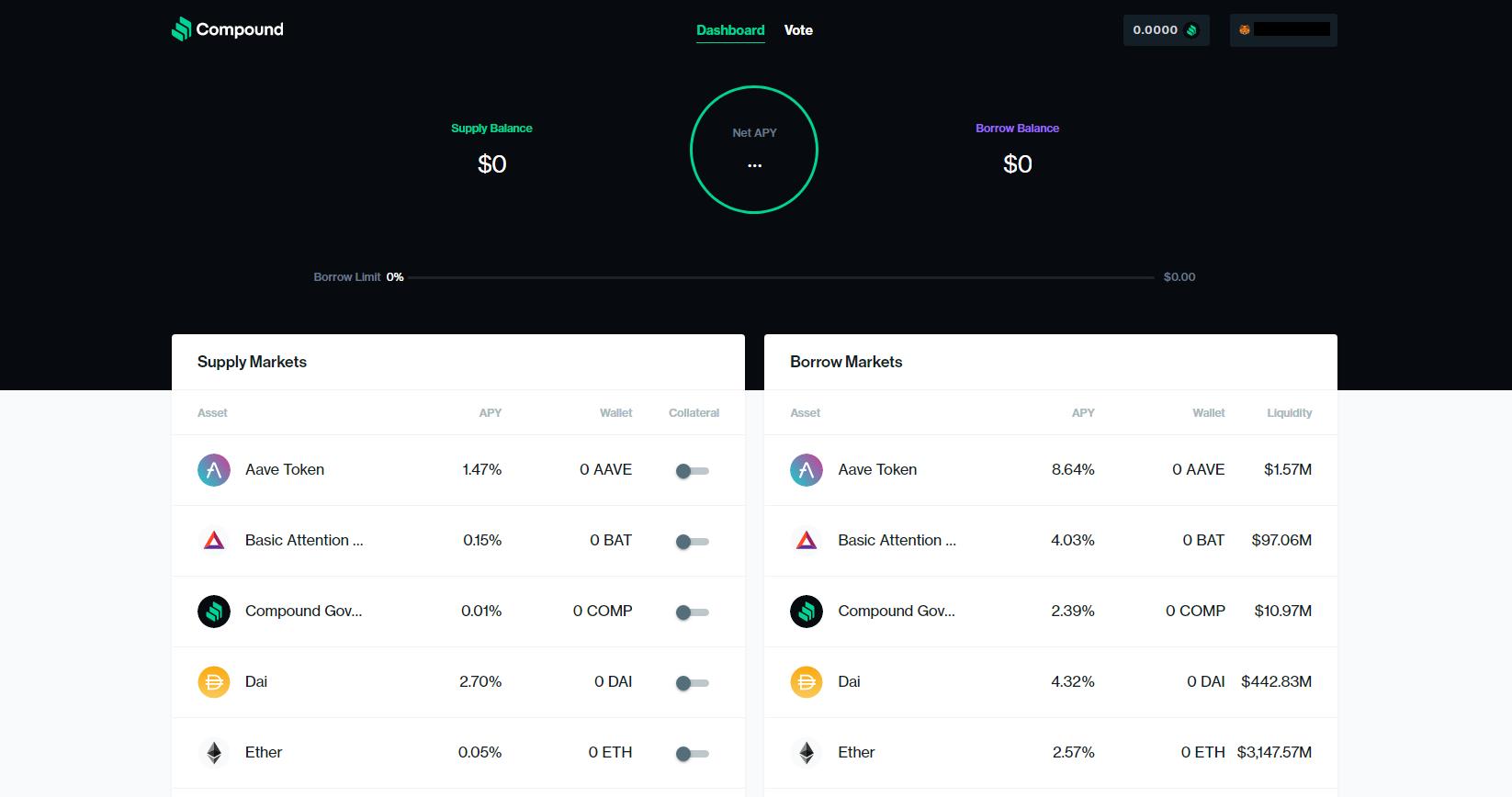

Beyond Aave: Exploring Other Euro Stablecoin Yield Platforms

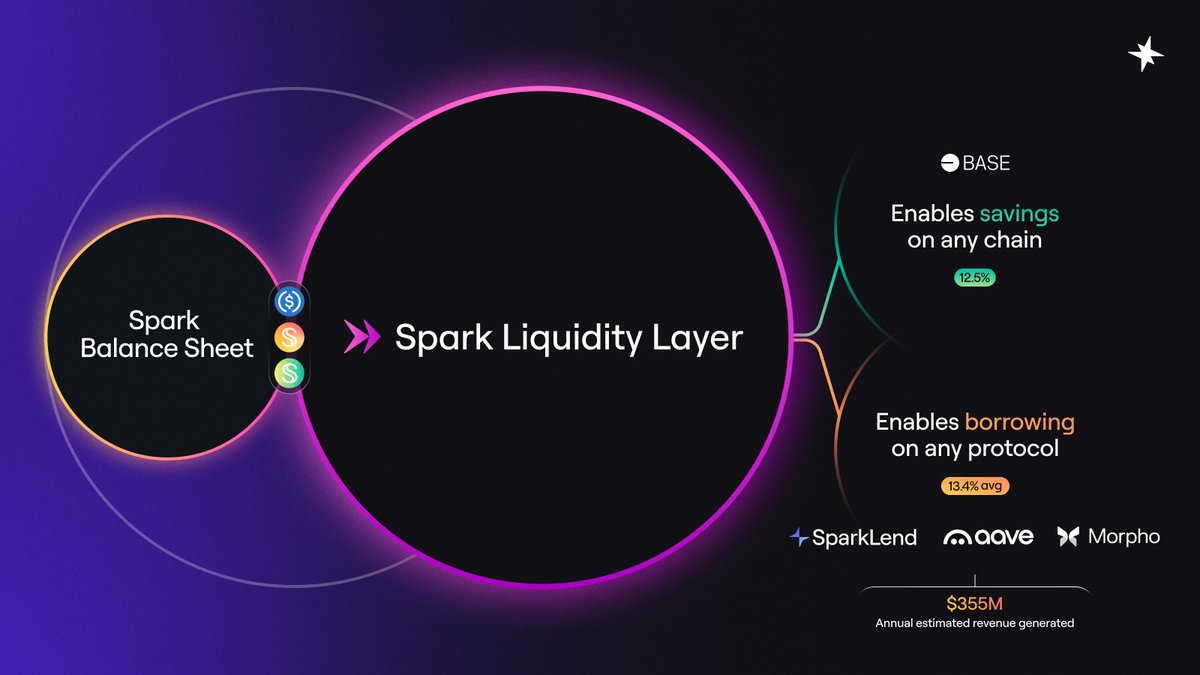

Aave may be leading the charge, but it’s not alone in offering attractive returns on euro-pegged assets. Platforms like Morpho and MakerDAO’s Spark Protocol are innovating with isolated lending pools and simplified savings solutions tailored to European users:

- Morpho Blue: Customizable risk pools with competitive APYs on various stablecoins.

- Spark Protocol: sDAI savings rate provides passive income via DAI, but watch for new euro integrations as demand rises.

- Bitget Wallet x Aave: While their headline 10% APY is currently only for USDC, their collaboration hints at future expansion to euro-denominated products (source).

This multi-platform competition is great news for investors seeking to maximize returns while managing risk across different protocols.

But let’s be real: chasing yield in DeFi isn’t just about picking the highest number on the dashboard. You need to understand what drives these returns, and more importantly, how to protect your capital while earning them.

Understanding the Risks: What Every Euro Stablecoin Yield Hunter Should Know

While earning 4.9% APY on EURC is enticing, there are a few critical risks that every investor should consider before diving in:

Essential DeFi Risk Checklist for Euro Stablecoin Yield

-

Protocol Insolvency Risk: If a lending protocol becomes undercollateralized—due to price swings or liquidation failures—depositors may lose part or all of their funds. This risk exists even on major platforms such as Spark Protocol and Aave.

-

Regulatory Changes: Shifts in EU or global crypto regulations can impact stablecoin operations, DeFi platform access, or user eligibility. Stay updated on evolving policies affecting euro stablecoins like EURC.

-

Euro Peg Stability: Euro stablecoins (e.g., Euro Coin (EURC)) rely on maintaining a 1:1 peg with the euro. Depegging events can result in losses or reduced yields for depositors.

-

Platform-Specific Risks: Each DeFi platform (Aave, Morpho, Spark Protocol) may have unique risks—such as governance attacks, oracle failures, or technical outages. Review each protocol’s documentation and risk disclosures before depositing.

Smart contract vulnerabilities are always present in DeFi. Even blue-chip protocols like Aave undergo regular audits, but exploits can and do happen. Diversifying across platforms and keeping up with security updates is non-negotiable.

Liquidity risk is another factor. While Aave boasts deep pools for EURC, smaller or newer euro stablecoins may have thinner markets, potentially complicating withdrawals during periods of high volatility.

Peg stability is also worth watching. While EURC has maintained a solid track record so far, always double-check that your chosen stablecoin reliably tracks the euro.

How to Start Earning: Step-by-Step Guide for Euro Stablecoin Yield on Aave

If you’re ready to put your euros to work in DeFi, here’s a quick roadmap:

The good news? With integrations like MetaMask’s Stablecoin Earn (source), you don’t need to be a coding wizard or hardcore DeFi degen to get started. The process is increasingly user-friendly, even for those new to crypto finance.

What’s Next for Euro Stablecoin Yields?

The competitive landscape is evolving fast. As more protocols race to attract European liquidity, and as traditional banks struggle to keep pace, expect further innovation around euro-denominated savings products. Watch for:

- Multi-chain support: More networks beyond Ethereum integrating EURC and other euro stablecoins.

- Diversified products: From fixed-term vaults to automated liquidity strategies tailored for EU users.

- Bigger rewards: Protocols may offer extra incentives (like governance tokens) as they fight for market share.

Earning nearly 5% on your digital euros isn’t just possible, it’s becoming the new normal for crypto-savvy Europeans who want more from their money without USD exposure.

If you’re still relying solely on dollar-based stables or letting your cash languish in a zero-yield bank account, now might be the time to explore what euro stablecoins can do for your portfolio. As always, research carefully and diversify smartly, the future of non-USD DeFi yields looks bright from here.