Why Non-USD Stablecoins Matter: Diversification Strategies for Global Crypto Investors

For years, USD-pegged stablecoins like USDT and USDC have dominated the crypto landscape, providing a familiar anchor in volatile markets. But if you’re building a resilient global portfolio, relying solely on the dollar is a strategic blind spot. Non-USD stablecoins: those pegged to the euro (EUR), Japanese yen (JPY), Chinese yuan (CNY), and other major currencies, are quietly rewriting the playbook for crypto diversification and risk management.

The Systemic Risks of Dollar Dominance

Currently, over 90% of stablecoin market capitalization is tied to USD-backed assets. This concentration may seem convenient but introduces systemic vulnerabilities for investors worldwide. A sudden regulatory clampdown or liquidity shock impacting the US dollar could ripple through every corner of DeFi and cross-border payments. For investors outside the United States, or those seeking genuine diversification, overexposure to USD-pegged assets is a risk hiding in plain sight.

“Diversification isn’t just about holding more coins, it’s about reducing correlated risks. “

Why Non-USD Stablecoins Matter: Four Core Benefits

Top 4 Benefits of Non-USD Stablecoins for Investors

-

1. Reduced Exchange Rate Risk: Non-USD stablecoins like EURT and EURS allow investors to transact in their local currencies, minimizing exposure to USD fluctuations and saving on conversion fees.

-

2. Efficient & Affordable Cross-Border Transfers: Stablecoins pegged to local currencies, such as XSGD (Singapore Dollar) or BRZ (Brazilian Real), streamline international payments—especially in regions with limited USD access—making remittances faster and more cost-effective.

-

3. Portfolio Diversification & Risk Mitigation: Holding a mix of stablecoins pegged to different fiat currencies spreads risk across issuers and economies, enhancing portfolio resilience against systemic shocks in any single currency.

-

4. Improved Regulatory Compliance: Using stablecoins aligned with local regulations, such as those adhering to the EU’s MiCA framework, helps investors navigate legal requirements and reduces compliance uncertainties.

Diversifying into EUR, JPY, CNY stablecoin options gives you more than just portfolio variety. Here’s why global investors are making the switch:

- Currency Matching: Transact and settle in your local currency, slashing conversion fees and mitigating exchange rate risk. For example, European users can leverage euro-backed stablecoins like EURT and EURS for seamless DeFi participation without touching dollars (source).

- Smoother Cross-Border Transfers: In regions where USD liquidity is scarce or banking access is limited, non-USD stables unlock affordable remittances and business payments (source).

- Risk Mitigation: Holding multiple fiat-pegged stablecoins spreads issuer risk and enhances your portfolio’s resilience against shocks tied to any single currency or regulatory regime (source).

- Simplified Compliance: Non-USD stables aligned with local frameworks can streamline KYC/AML processes and reduce legal uncertainty (source).

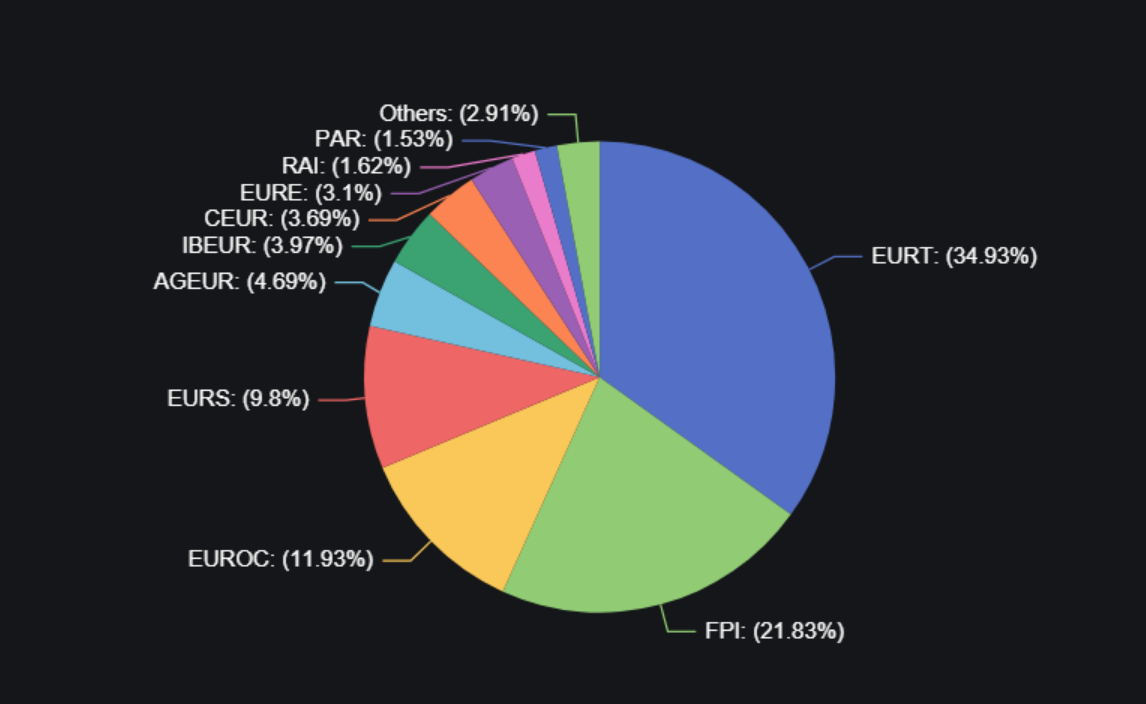

The Acceleration of Non-USD Stablecoin Adoption

The past year has seen a remarkable surge in non-dollar stablecoin innovation. Regulatory clarity from frameworks like Europe’s MiCA has emboldened issuers to launch euro-pegged tokens with robust compliance features. Meanwhile, decentralized exchanges are boosting on-chain liquidity for JPY and CNY stables, making it easier than ever to trade or hedge without touching dollars.

This momentum isn’t just theoretical. In Latin America, non-USD stables are already revolutionizing decentralized finance by enhancing financial inclusion where dollar access is limited (source). Corporate giants are exploring integrations that could bring these assets into mainstream treasury operations by 2026 (source). The writing is on the wall: multi-currency stability is fast becoming a cornerstone of smart crypto investing.

But for all the momentum, real-world adoption depends on overcoming a few critical hurdles. Liquidity remains fragmented across chains and exchanges, especially for less-established EUR, JPY, and CNY stablecoins. Education is another barrier: too many investors still view stablecoins as synonymous with USDT or USDC, unaware of the advantages that currency diversification can unlock.

Tactical Moves: Building a Diversified Stablecoin Portfolio

If you’re ready to step beyond USD-centric strategies, consider a tactical approach. Start by identifying which non-USD stablecoins have the strongest backing, transparency, and regulatory alignment in your jurisdiction. For European investors, tokens like EURT and EURS offer direct euro exposure without the headaches of forex conversion. In Asia-Pacific markets, JPY- and CNY-pegged stables can provide seamless access to DeFi protocols and payment rails denominated in local currencies.

Remember: diversification isn’t about abandoning USD entirely. Instead, it’s about hedging against macro risks, like regulatory shocks or dollar liquidity crunches, that could impact your entire portfolio if you’re overexposed. By holding a mix of USD-, EUR-, JPY-, and CNY-backed stablecoins, you can optimize for both stability and flexibility in any market environment.

The Road Ahead: Regulatory Clarity and Institutional Adoption

The next wave of growth will be driven by two forces: smarter regulation and institutional participation. Europe’s MiCA framework is already setting the tone for compliant euro-backed stables (source). Meanwhile, major banks and fintechs are piloting integrations that could see non-USD stablecoins become standard fare in cross-border settlements by 2026 (source).

For investors attuned to these shifts, the time to act is now. By proactively incorporating non-USD stables into your holdings, whether for trading, DeFi yield farming, or treasury management, you’re positioning yourself ahead of the next big trend in digital assets.

Final Takeaways for Global Investors

- Monitor liquidity: Choose stables with deep order books across major exchanges.

- Stay informed on regulation: Policy changes can impact stability and access overnight.

- Balance your portfolio: Use allocation models that reflect your risk tolerance and geographic needs.

- Embrace innovation: The ecosystem is evolving fast, don’t get left behind by clinging to dollar-only strategies.

This quiet revolution isn’t just about new coins, it’s about building a more resilient global financial system where everyone has options beyond the dollar. If you want to ride the waves and respect the risks in today’s crypto markets, expanding your toolkit with non-USD stablecoin benefits is no longer optional, it’s essential.