How to Use EUR Stablecoins (EURC, EURAU) on Ethereum and Solana: A Practical Guide

Euro-backed stablecoins are rapidly gaining traction as a viable alternative to USD-based digital assets. For investors and DeFi users seeking exposure to the euro, EURC and EURAU stand out as the dominant options. Both offer a 1: 1 peg to the euro, robust regulatory compliance, and seamless interoperability with leading blockchain ecosystems. This practical guide breaks down how to use these euro stablecoins on Ethereum and Solana, with step-by-step instructions, current price data, and actionable strategies for maximizing their utility in decentralized finance.

Euro Stablecoin and Major Crypto Price Comparison (Ethereum & Solana)

6-Month Price Performance of EURC, EURAU, and Major Stablecoins on Ethereum and Solana (as of 2025-09-19)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Euro Coin (EURC) | $1.17 | $1.13 | +3.5% |

| Euro Tether (EURAU) | $1.17 | $1.13 | +3.5% |

| USD Coin (USDC) | $0.0487 | $0.0487 | +0.0% |

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| Dai (DAI) | $0.9999 | $0.9999 | +0.0% |

| Ethereum (ETH) | $4,483.97 | $4,483.97 | +0.0% |

| Bitcoin (BTC) | $116,011.00 | $116,011.00 | +0.0% |

| Binance USD (BUSD) | $0.9964 | $0.9964 | +0.0% |

Analysis Summary

Over the past six months, euro-backed stablecoins EURC and EURAU have appreciated by 3.5%, while major USD stablecoins and leading cryptocurrencies have maintained their price levels. This slight appreciation in euro stablecoins reflects minor euro strength or market dynamics, whereas USD stablecoins and major assets like Bitcoin and Ethereum remained stable or unchanged in USD terms.

Key Insights

- EURC and EURAU both saw a +3.5% increase over the past six months, maintaining their euro peg but appreciating against the US dollar.

- USD-backed stablecoins (USDC, USDT, DAI, BUSD) showed no price change, reflecting strong peg stability.

- Major cryptocurrencies (BTC, ETH) remained flat in USD terms over the period, according to the provided data.

- The slight appreciation of EURC and EURAU may indicate euro strength or increased demand for euro stablecoins on Ethereum and Solana.

All prices and changes are sourced directly from the provided real-time market data as of September 19, 2025. The table compares current and 6-month historical prices for each asset, calculating the percentage change over the period.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/euro-coin/historical_data

- Euro Tether: https://www.coingecko.com/en/coins/euro-tether/historical_data

- USD Coin: https://www.coingecko.com/en/coins/usd-coin/historical_data

- Tether: https://www.coingecko.com/en/coins/tether/historical_data

- Dai: https://www.coingecko.com/en/coins/dai/historical_data

- Ethereum: https://www.coingecko.com/en/coins/ethereum/historical_data

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin/historical_data

- Binance USD: https://www.coingecko.com/en/coins/binance-usd/historical_data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

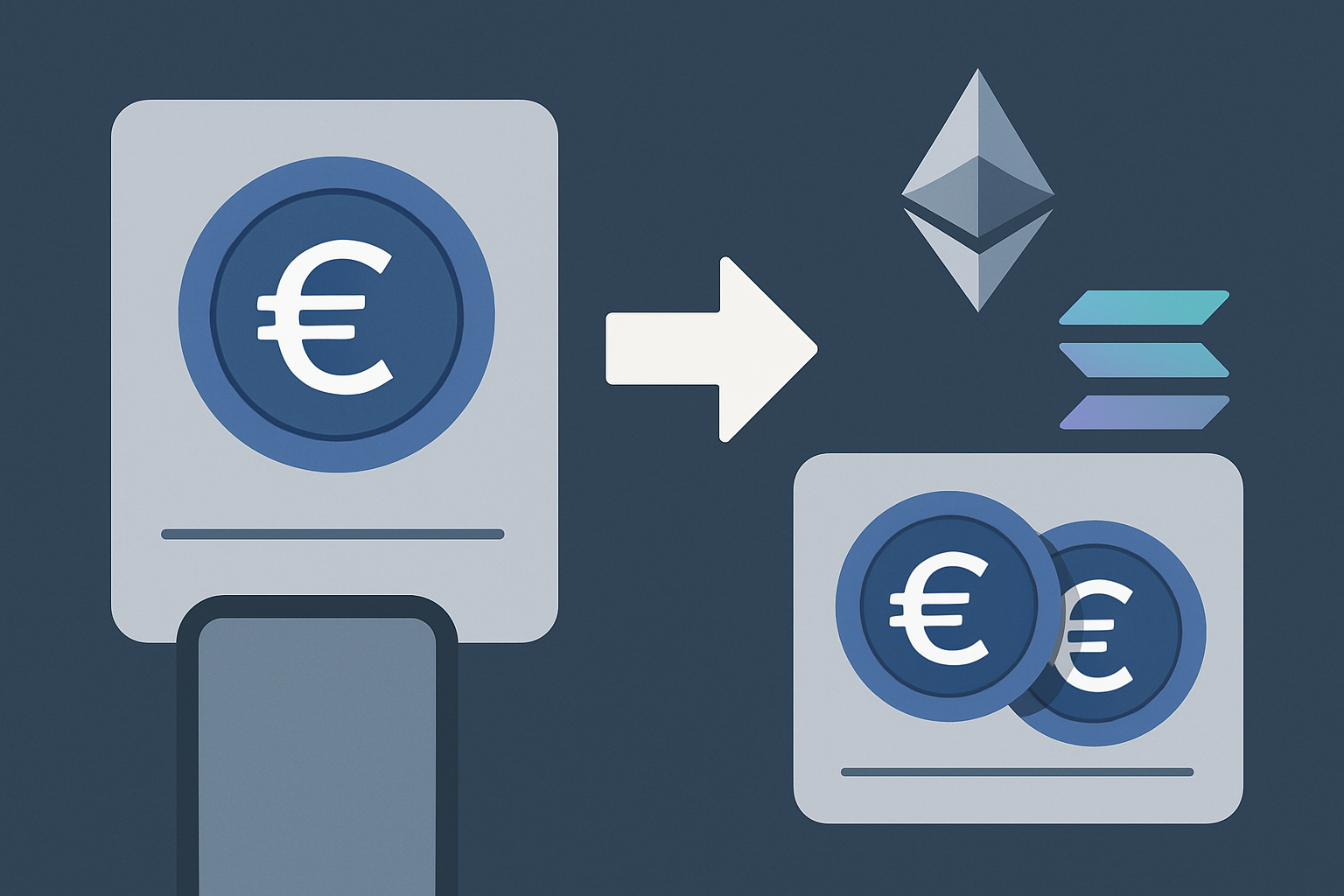

EURC on Ethereum: Wallet Setup, Acquisition, and DeFi Integration

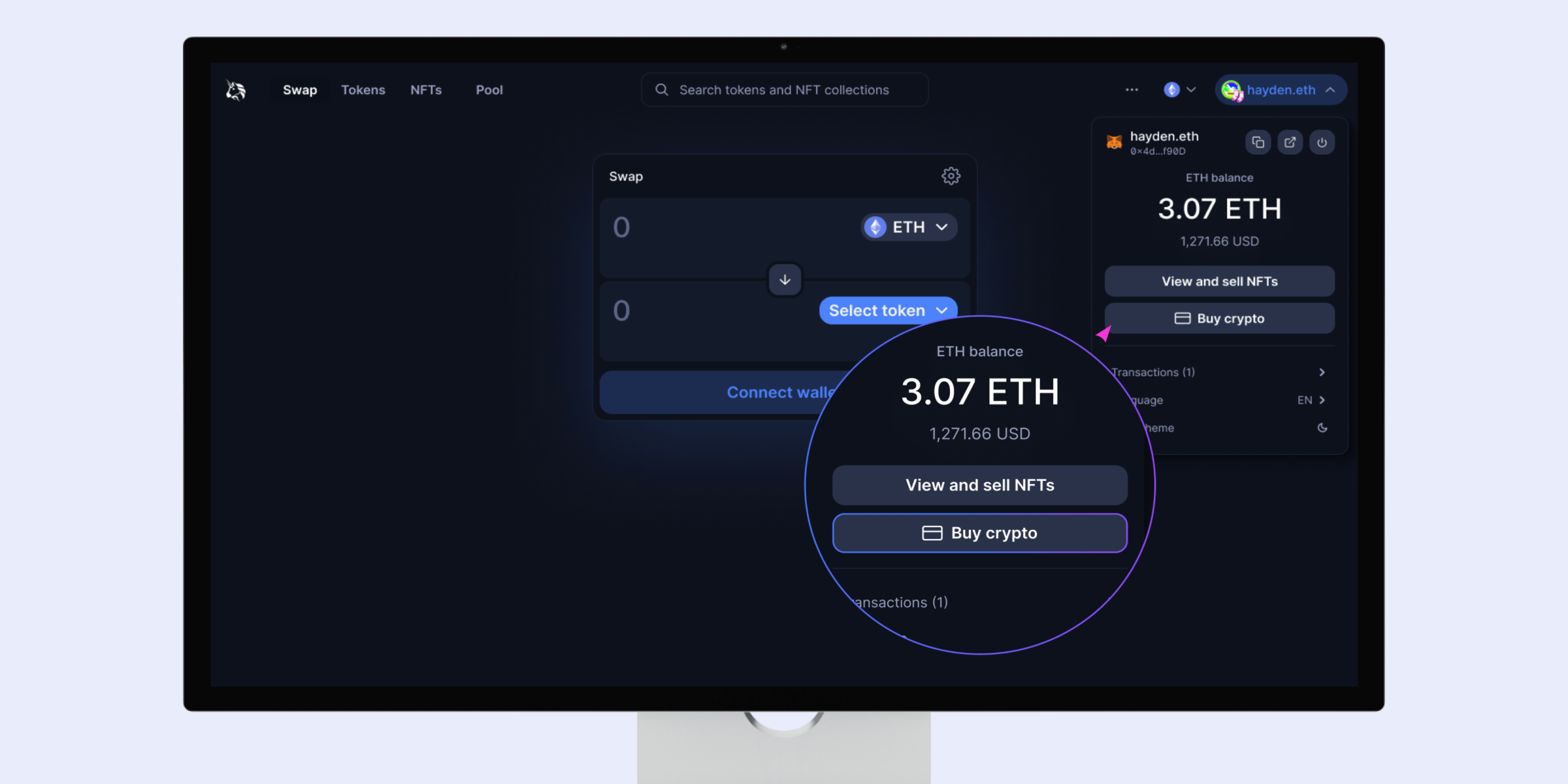

EURC, issued by Circle, is available natively on Ethereum as an ERC-20 token. As of September 19,2025, EURC trades at $1.17, maintaining its peg despite minor intraday fluctuations (24h high: $1.18; low: $1.17). To get started:

Once your wallet is ready:

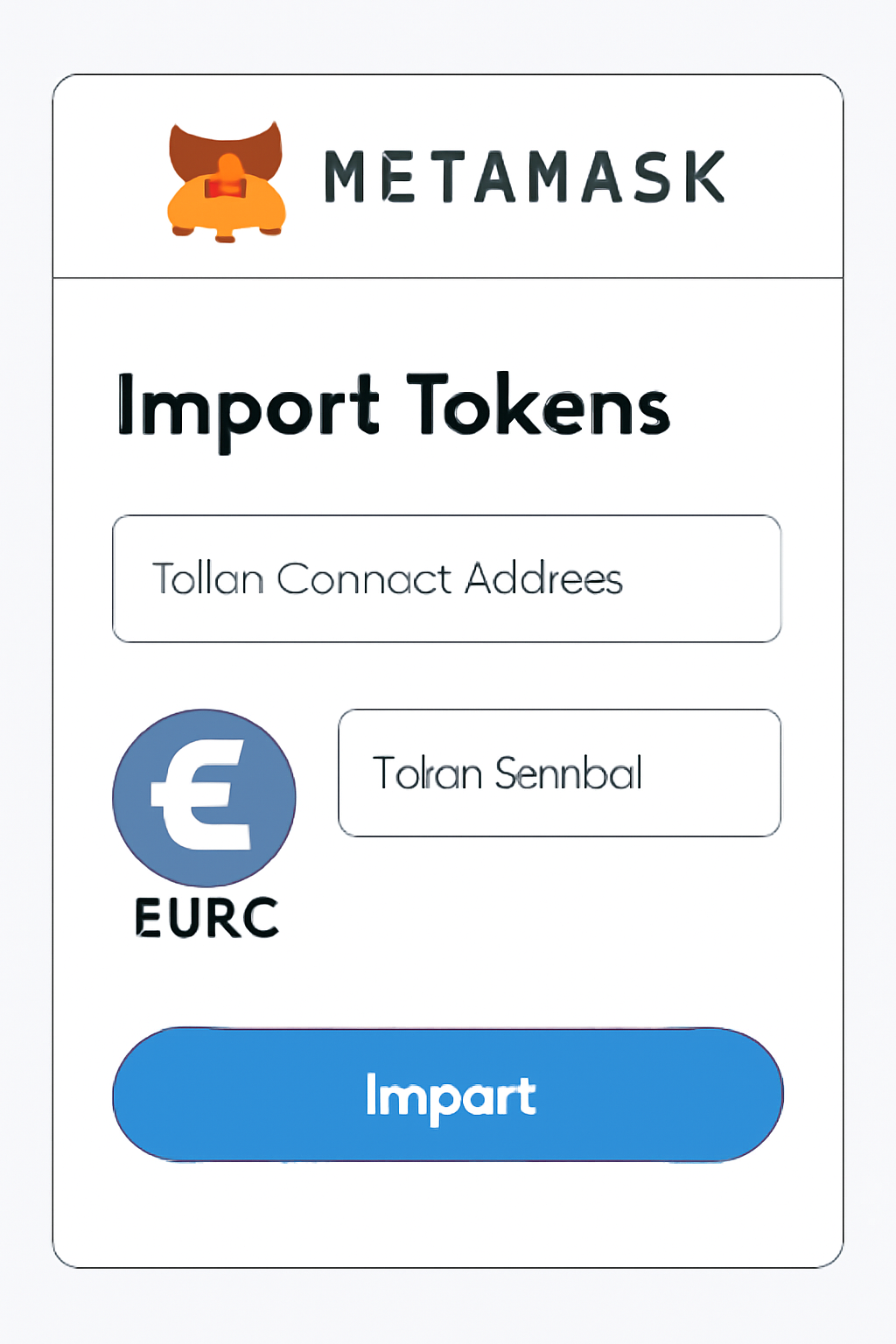

- Acquire EURC: Buy directly from major exchanges or swap euros through platforms supporting direct issuance.

- Transfer EURC: Move tokens into your MetaMask address for full custody.

- Utilize in DeFi: With EURC in hand, access lending protocols like Aave or trade on DEXs such as Uniswap that support euro pairs.

This interoperability allows you to diversify away from USD stablecoins while leveraging Ethereum’s expansive DeFi ecosystem.

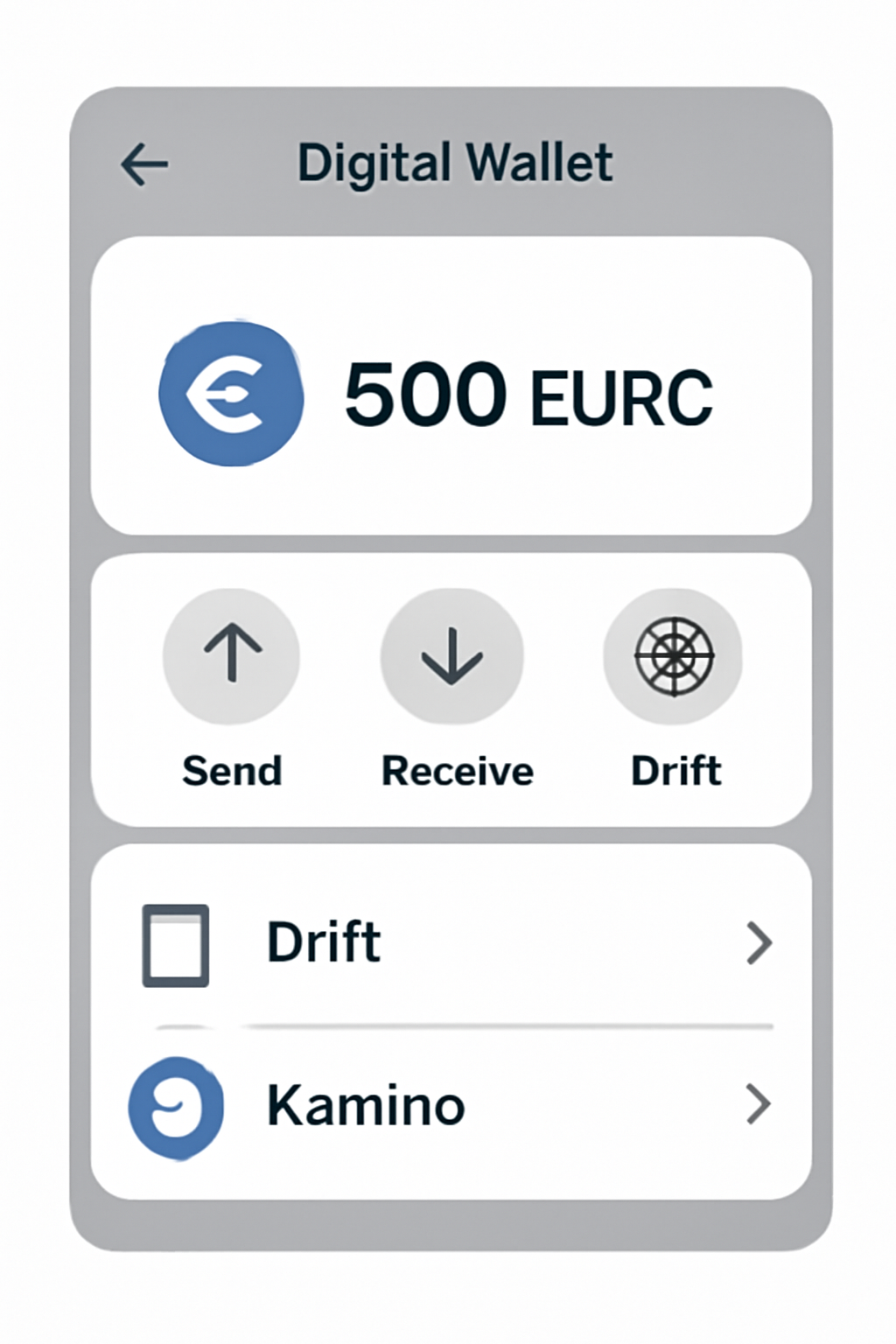

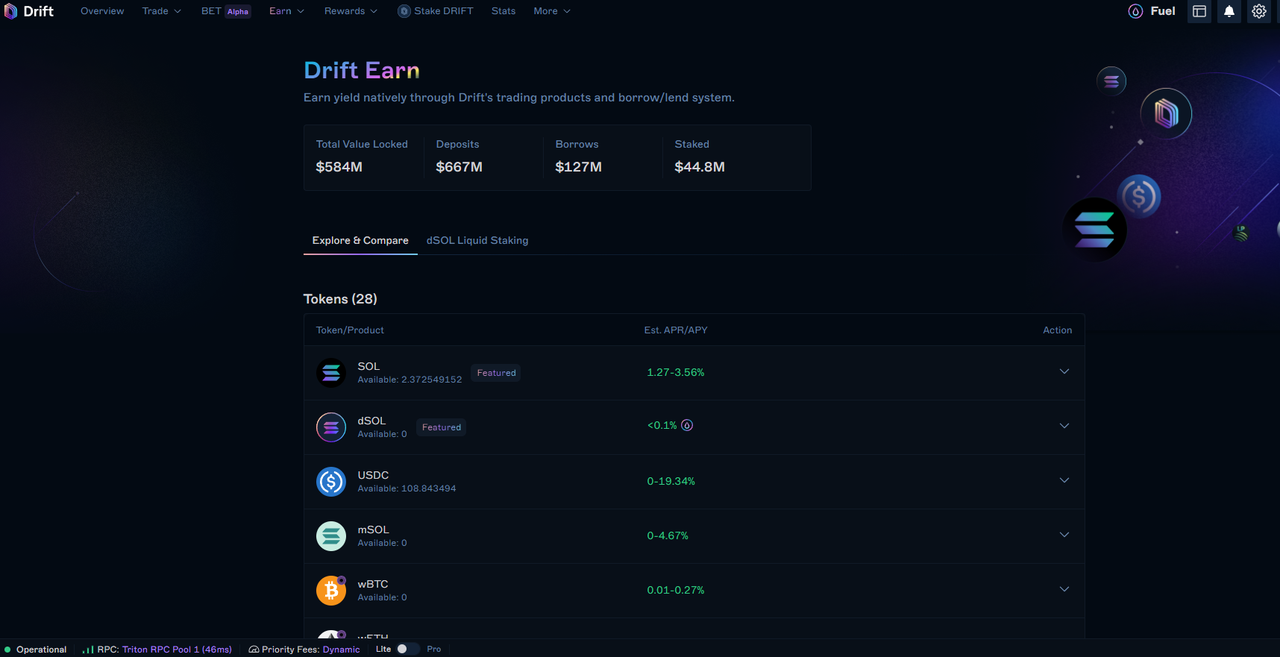

Navigating EURC on Solana: Fast Settlement and Yield Opportunities

Solana’s high throughput unlocks new possibilities for euro-denominated transactions. Here’s how to put EURC (still pegged at $1.17) to work on Solana:

Beyond simple transfers, Solana-native protocols like Drift Protocol offer lending APYs up to 8.33%, while Kamino provides yields around 3.94%. These rates are competitive compared to traditional savings accounts denominated in euros.

EURAU Launches: Deutsche Bank-Backed Euro Stablecoin Enters the Market at $1.18

EURAU, recently launched by AllUnity with backing from Deutsche Bank, is currently available as an ERC-20 token on Ethereum at a price of $1.18. Like EURC, it is fully MiCA-compliant, regulated by BaFin, and designed for institutional-grade transparency.

- Create or access an Ethereum wallet (e. g. , MetaMask).

- Purchase EURAU via exchanges such as Bullish Europe.

- Engage in DeFi or cross-border payments using your newly acquired tokens.

EURAU aims to expand across multiple blockchains throughout 2025, positioning itself as a key player in the non-USD stablecoin landscape.

Euro Coin (EURC) Price Prediction 2026-2031

Projected price range and market outlook for EURC, the euro-backed stablecoin, considering regulatory, adoption, and market developments.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.15 | $1.18 | $1.21 | +0.8% | Stable with minor volatility; MiCA compliance solidifies trust |

| 2027 | $1.14 | $1.18 | $1.23 | 0.0% | Deeper DeFi integration, more cross-chain usage, slight premium possible |

| 2028 | $1.13 | $1.19 | $1.25 | +0.8% | Potential euro volatility, higher DeFi yields, slight uptrend |

| 2029 | $1.12 | $1.19 | $1.27 | 0.0% | Competing euro stablecoins emerge, but EURC maintains peg |

| 2030 | $1.12 | $1.20 | $1.29 | +0.8% | Digital euro rollout increases demand, EURC sees more utility |

| 2031 | $1.12 | $1.20 | $1.32 | 0.0% | Mature stablecoin market, EURC premium possible in high-demand scenarios |

Price Prediction Summary

EURC is expected to maintain a narrow trading range close to its euro peg ($1.18), with average prices showing slight upward drift due to increasing demand in DeFi and cross-border payments. Regulatory clarity and broader adoption support stability, but minor premiums may occur in times of high demand or euro volatility. The stablecoin’s price is unlikely to deviate significantly from the euro, but market-driven premiums or discounts can still appear, particularly during periods of market stress or rapid adoption.

Key Factors Affecting Euro Coin Price

- Strict regulatory compliance under MiCA enhances stability and investor trust.

- Growing use in DeFi and cross-chain protocols increases demand and utility.

- Competition from other euro-backed stablecoins (e.g., EURAU) and the digital euro may affect market share and pricing.

- Macro volatility in the euro or European economy could impact the peg or premiums.

- Liquidity conditions and exchange support on Ethereum, Solana, and other blockchains.

- Potential for brief de-pegs during crypto market stress or liquidity crunches.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Regulatory Edge: MiCA Compliance Drives Adoption

The European Union’s Markets in Crypto-Assets Regulation (MiCA) has set a new global standard for stablecoin transparency and consumer protection. Both Circle’s EURC and AllUnity’s EURAU are structured around full reserve requirements and clear audit trails, key factors driving institutional adoption across Europe’s digital asset ecosystem.

For developers or businesses looking for technical integration details or compliance documentation, refer directly to official sources such as Circle (EURC launch details here) or Cointelegraph’s coverage of AllUnity’s launch (read more here).

Adoption of euro stablecoins is accelerating as both retail and institutional participants seek alternatives to dollar-denominated assets. The technical simplicity of integrating EURC and EURAU into existing wallet infrastructure, coupled with robust regulatory frameworks, makes these tokens a compelling choice for anyone transacting or building in the European crypto sector.

Practical Use Cases: Payments, Yield Generation, and Portfolio Diversification

With euro stablecoins like EURC ($1.17) and EURAU ($1.18), users gain access to a growing suite of decentralized applications that support euro transactions natively. Here are some actionable scenarios:

Key Use Cases for EURC and EURAU in DeFi and Payments

-

Decentralized Finance (DeFi) Lending and Yield Earning: EURC is supported on platforms like Drift Protocol and Kamino on Solana, enabling users to lend EURC and earn yields—up to 8.33% APY on Drift and around 3.94% APY on Kamino, with additional point farming rewards.

-

Stable Euro-Pegged Trading Pairs: Both EURC and EURAU are available on decentralized exchanges (DEXs) such as Uniswap (Ethereum) and Orca (Solana), facilitating direct trading against major cryptocurrencies like ETH and SOL with minimal volatility risk.

-

Cross-Border Payments and Remittances: EURC and EURAU offer fast, low-cost euro-denominated transfers on Ethereum and Solana, enabling near-instant cross-border payments—especially beneficial for businesses and individuals operating in the Eurozone.

-

Regulatory-Compliant Digital Euro Exposure: Both EURC (MiCA-compliant, issued by Circle) and EURAU (regulated by BaFin, issued by AllUnity) provide secure, transparent euro-backed stablecoins, allowing users to hold and transact with digital euros while meeting strict European regulatory standards.

-

Seamless On-Chain Payments for Merchants: Merchants can accept EURC and EURAU for goods and services using crypto payment processors like Due, enabling euro-denominated checkouts and borderless commerce with real-time settlement.

Payments and Remittances: Both tokens enable near-instant cross-border transfers at a fraction of traditional banking costs. Merchants can accept euro-denominated stablecoins without FX risk or settlement delays.

DeFi Yield: Platforms like Drift Protocol (Solana) or Aave (Ethereum) allow you to lend your EURC/EURAU holdings for passive income, with rates currently outpacing most fiat savings accounts denominated in euros.

Diversification: Allocating part of your portfolio to non-USD stablecoins can hedge against dollar volatility while maintaining on-chain liquidity.

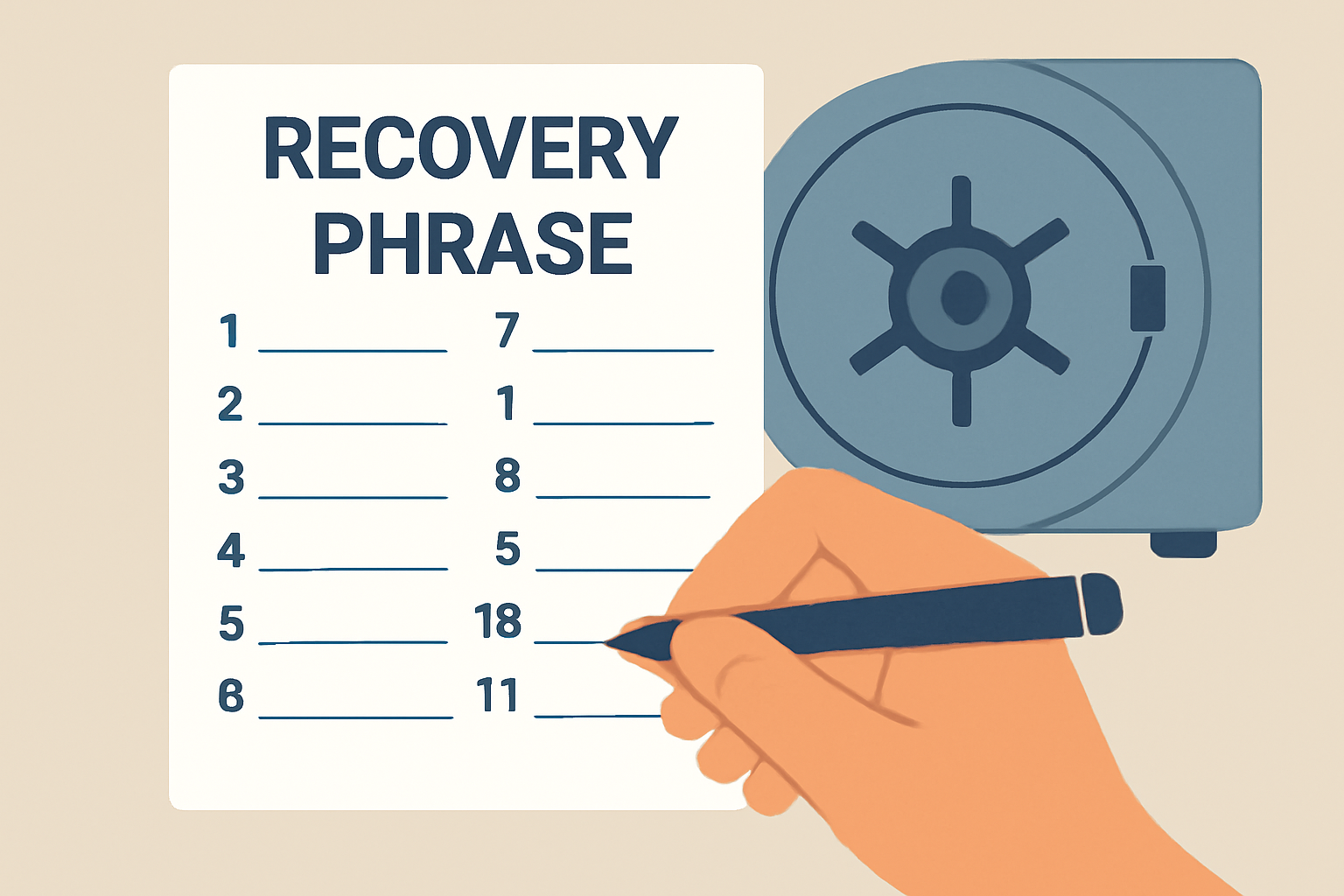

Security and Best Practices

The non-custodial nature of wallets on Ethereum and Solana means users retain full control over their assets, but also full responsibility. Always double-check contract addresses when transferring tokens, use hardware wallets for significant holdings, and be wary of phishing attempts. For DeFi participation, ensure platforms are audited and reputable within the community.

Looking Ahead: The Evolving Euro Stablecoin Ecosystem

The next phase for euro-backed stablecoins will likely see deeper integration with payment processors, more sophisticated DeFi products tailored to European users, and further network expansion, EURAU’s planned rollout beyond Ethereum is one example to watch closely. As MiCA enforcement matures, expect increased confidence from both retail investors and corporate treasuries seeking digital euro exposure.

Numbers never lie, but context is king, always assess liquidity depth, regulatory news, and evolving network support before making allocation decisions with any stablecoin asset.