Real-World Assets (RWA) on Chain: How Euro Stablecoins Are Powering New DeFi Markets

Euro stablecoins are quietly rewriting the rules for how real-world assets (RWAs) enter the decentralized finance (DeFi) ecosystem. With the global stablecoin market valued at $230 billion, euro-backed stablecoins like EURC (Circle), EURS (STASIS), and EURCV (Société Générale) have carved out a niche with a combined market cap of approximately €350 million as of September 2025. While this figure is dwarfed by their USD counterparts, the strategic role of these tokens in powering new DeFi markets cannot be ignored.

Euro Stablecoins: The Foundation for RWA Tokenization

The past year has seen euro-backed stablecoins become essential instruments for on-chain transactions involving tokenized RWAs. These digital euros provide a stable medium of exchange, crucial for mitigating crypto volatility when trading or using assets like real estate, commodities, or even government bonds in DeFi protocols. Platforms such as Centrifuge are already leveraging these stablecoins to unlock liquidity from traditionally illiquid assets by transforming them into on-chain collateral.

This is more than just technical innovation – it’s about bridging the gap between traditional finance and digital markets. By using EUR-backed tokens, European institutions and investors can participate in DeFi without taking direct currency risk against the US dollar. That means more practical use cases for local businesses, asset managers, and fintechs seeking regulatory-compliant digital payment rails within the eurozone.

The Regulatory Landscape: Stability Meets Compliance

The European Central Bank (ECB) has recognized both the promise and risk of non-USD stablecoins in its jurisdiction. ECB President Christine Lagarde has called for stringent safeguards and equivalence requirements for foreign issuers to protect financial stability across Europe (source). This regulatory clarity is beginning to pay off: new entrants like Schuman Financial’s MiCA-compliant EURØP and Quantoz’s EURQ are launching with full adherence to EU standards, making it easier for institutional players to engage without legal uncertainty.

Still, adoption remains modest compared to USD-based stablecoins. Euro tokens are primarily used within crypto trading pairs and DeFi protocols rather than mainstream payments (source). The infrastructure is growing but needs further integration with established banking rails before euro stablecoins can rival their dollar equivalents in volume or utility.

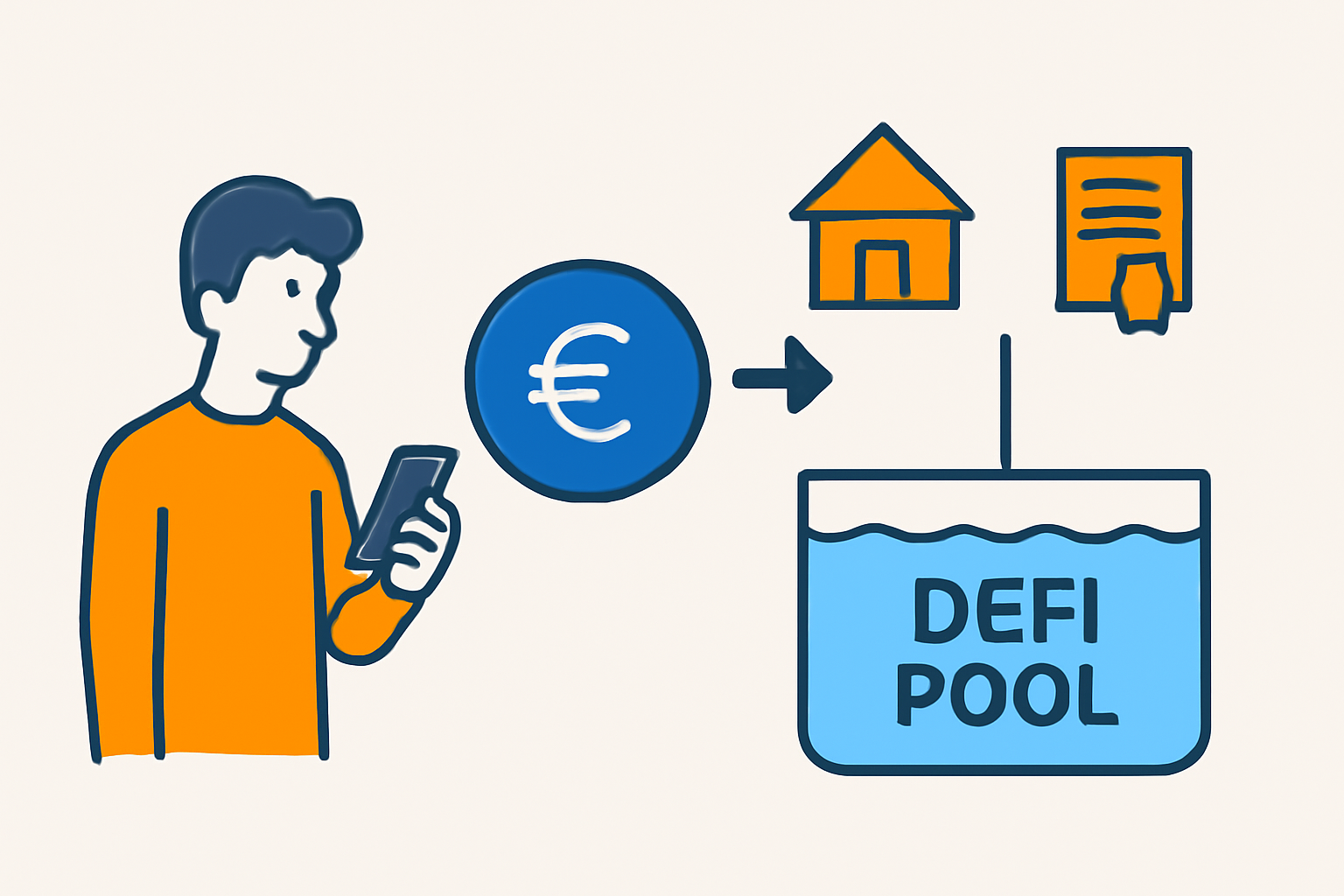

Pioneering Use Cases: From On-Chain Loans to Digital Payments

The most dynamic action is happening at the intersection of RWAs and DeFi lending platforms. Take Centrifuge as an example – it enables businesses to tokenize invoices or property titles as NFTs that can be used as loan collateral on-chain. This process relies on robust, liquid euro stablecoins to settle transactions efficiently while avoiding FX risk for European borrowers and lenders.

The result? A pathway toward real yield opportunities, where users earn returns from real-world economic activity rather than speculative crypto trading alone. As more compliant euro-backed tokens hit the market – including those launched by regulated banks like Société Générale – expect further growth in tokenized asset classes ranging from commercial debt to renewable energy projects.

What’s holding euro stablecoins back from mass adoption in DeFi isn’t technology, but network effects and liquidity. The current combined market cap of €350 million for EUR-backed stablecoins is a fraction of the $230 billion global stablecoin market. This gap highlights an opportunity: as more regulated issuers like Schuman Financial and Quantoz come online, and with projects such as Equilibrium Group focused on tokenizing euro-denominated assets, the infrastructure necessary for scale is rapidly improving.

Regulatory clarity through frameworks like MiCA is already attracting institutional attention. Banks and fintechs now have a clear path to launch compliant euro stablecoins or integrate them into their payment flows, which opens the doors for RWAs to become mainstream collateral in decentralized lending and trading.

What’s Next: Scaling Euro RWAs in DeFi

The next phase will see deeper integration of euro stablecoins with both traditional finance infrastructure and emerging DeFi protocols. Expect to see:

[list: The top 5 trends driving growth for RWA euro stablecoin platforms in 2025]

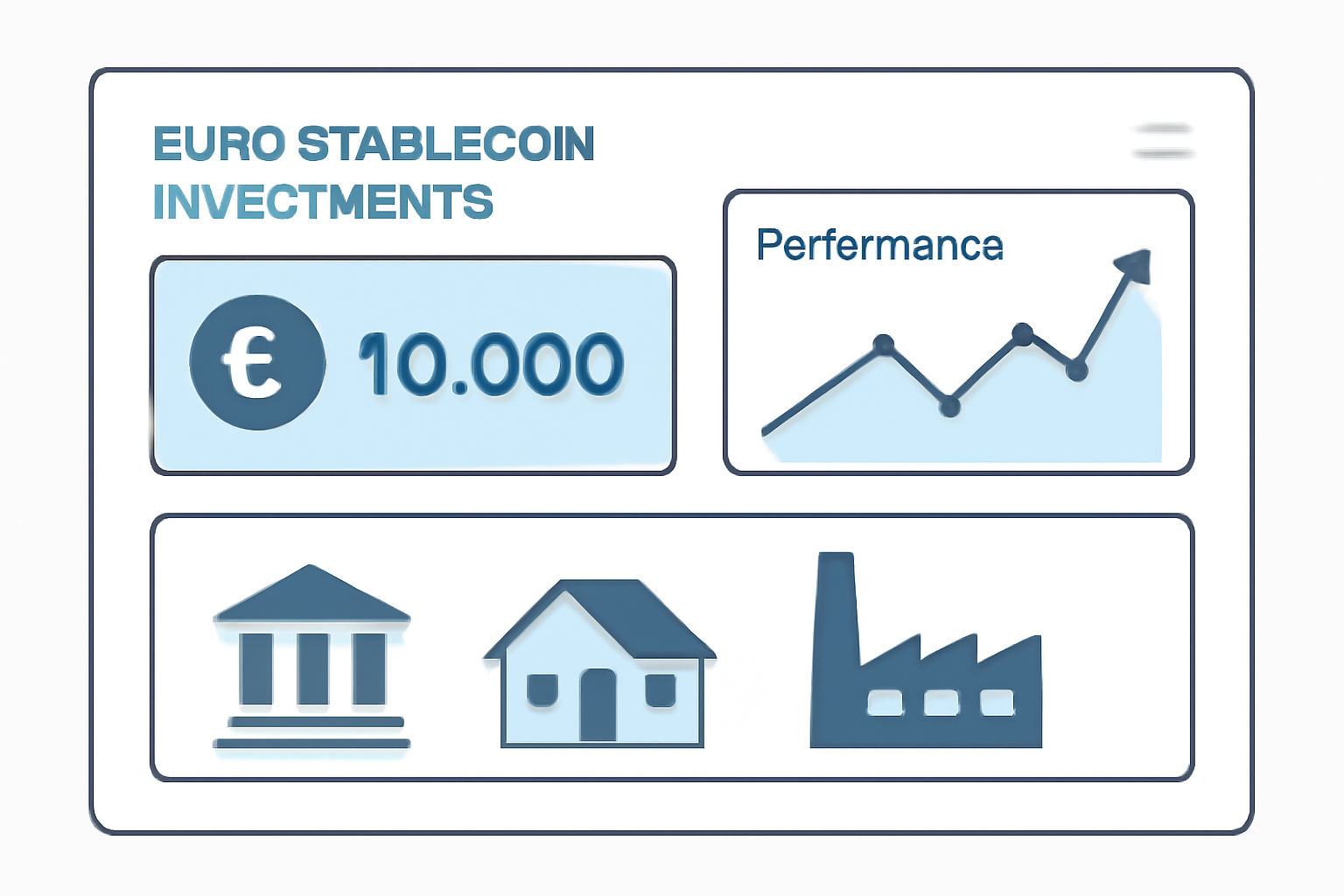

Europe’s share of the global tokenization market is projected to rise, targeting a 25.6% CAGR by 2030 with revenues reaching $3.11 billion (source). As these projections materialize, liquidity pools denominated in euros will become more attractive, especially for asset managers seeking diversification away from USD-centric risk.

For crypto investors and builders, this means it’s time to look beyond USD-pegged assets when designing or participating in new DeFi strategies. The combination of regulatory clarity, new compliant tokens, and expanding use cases will drive a steady shift toward EUR-backed DeFi products.

Actionable Takeaways for Investors

- Monitor liquidity: Track growth in EURC/EURS pools on major DEXs – rising volumes signal improving usability for RWA transactions.

- Assess compliance: Prioritize platforms that are MiCA-compliant or partner with regulated custodians to minimize legal risk.

- Diversify exposure: Consider allocating part of your DeFi portfolio to EUR-denominated yield products powered by real-world collateral.

If you want exposure to Europe’s digital asset evolution, start following the projects building bridges between RWAs and EUR-backed DeFi – this is where both innovation and regulatory legitimacy are converging.