EUROD Stablecoin: ODDO BHF’s MiCA-Compliant Euro Digital Asset Explained

On October 15,2025, the European financial landscape took a decisive step forward as ODDO BHF, a Paris-based banking institution with over €150 billion in assets, unveiled its first euro-backed stablecoin: EUROD. This launch is more than a technical milestone. It is a statement on the future of digital finance in Europe, blending the rigor of traditional banking with the possibilities of blockchain technology. As regulatory clarity emerges under the European Union’s MiCA (Markets in Crypto-Assets) framework, EUROD positions itself at the intersection of compliance, security, and innovation.

EUROD Stablecoin: A Strategic Move for European Digital Assets

The debut of EUROD is not just about another stablecoin entering the market. ODDO BHF’s move signals a broader trend: established financial institutions are now actively shaping the digital asset ecosystem. EUROD is fully backed by euros held by ODDO BHF, ensuring a 1: 1 peg and offering investors a digital asset that mirrors the stability of its fiat counterpart. The stablecoin is issued on the Polygon blockchain, leveraging its scalability and low fees to facilitate real-time euro transfers and efficient settlement for businesses, payment processors, and retail users alike.

What sets EUROD apart is its compliance with MiCA regulations. The MiCA regime, which came into effect in 2024, imposes strict standards for stablecoin issuers, including requirements for transparency, risk management, and regular reporting. By adhering to these rules, ODDO BHF offers users a level of regulatory assurance rarely seen in the stablecoin space. This compliance is crucial for institutional adoption, as it reduces counterparty risk and aligns with the due diligence processes of regulated entities.

“EUROD is designed to bridge the gap between traditional finance and blockchain-based applications, offering a secure, compliant, and efficient digital euro for the evolving needs of Europe’s digital economy. ”: ODDO BHF spokesperson

Key Partnerships and Infrastructure: Security Meets Liquidity

Launching a MiCA-compliant stablecoin is only part of the equation. ODDO BHF has partnered with Fireblocks for institutional-grade custody solutions and Flowdesk to ensure robust market liquidity. These collaborations underscore the bank’s commitment to security, operational resilience, and market depth. By integrating with Fireblocks, EUROD benefits from advanced multi-party computation (MPC) technology, safeguarding user assets against potential cyber threats. Flowdesk’s role as a liquidity provider ensures that EUROD remains easily tradable and accessible across multiple platforms, starting with its listing on Bit2Me, a leading Madrid-based crypto exchange.

The choice of Polygon as the underlying blockchain is strategic. Polygon’s reputation for low transaction costs and high throughput makes it an ideal platform for stablecoins that aim to serve both retail and institutional users. This technical infrastructure supports ODDO BHF’s ambition to promote greater euro liquidity within decentralized finance (DeFi) ecosystems and to boost Europe’s financial autonomy in the global digital asset race.

Why EUROD Matters: Use Cases and Advantages Over USD-Pegged Stablecoins

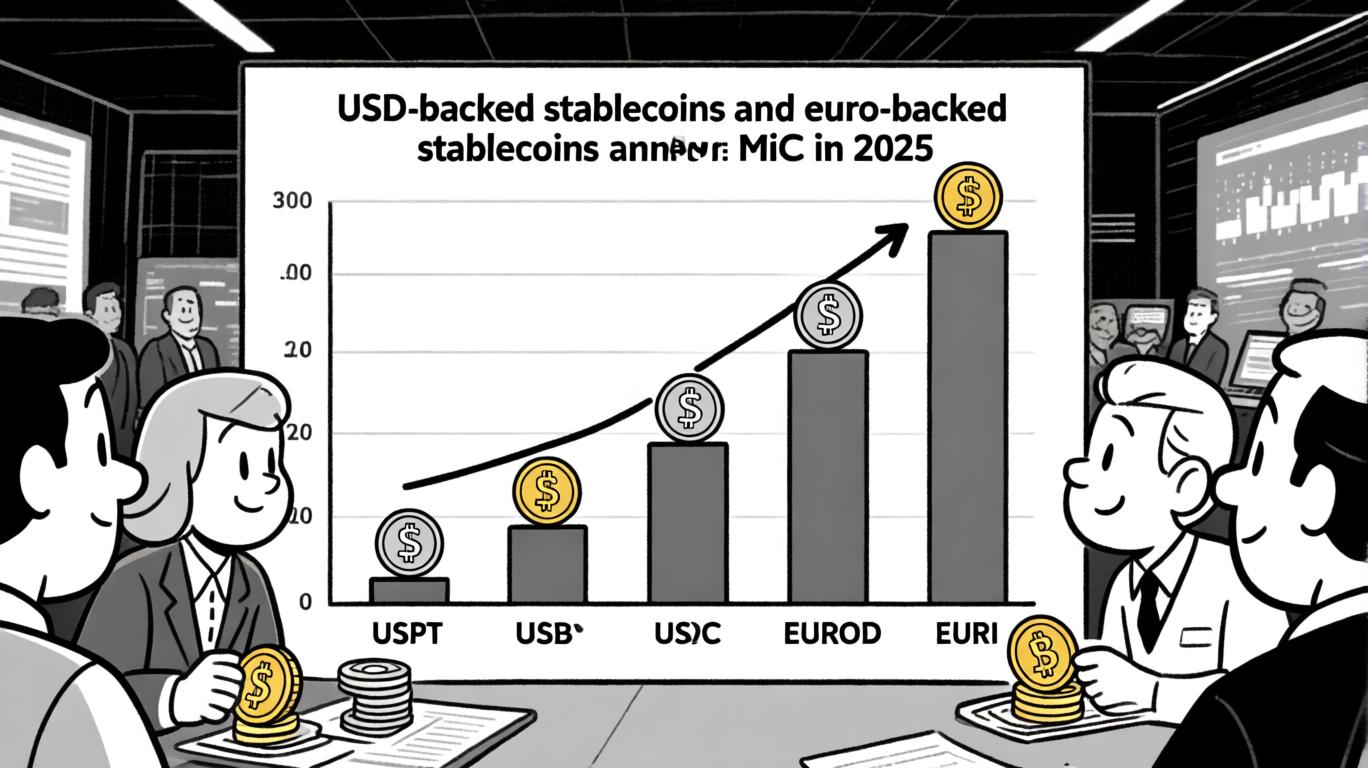

For years, USD-pegged stablecoins have dominated the crypto markets, but their dominance comes with limitations for European users. EUROD provides a native euro-denominated solution that eliminates FX risk for European businesses and investors operating in digital assets. It also opens up new possibilities for cross-border payments, remittances, and on-chain settlement in euros, areas where USD-based stablecoins fall short due to regulatory or currency mismatch concerns.

Top 5 Benefits of EUROD vs USD-Pegged Stablecoins

-

MiCA Regulatory Compliance: EUROD is fully compliant with the European Union’s Markets in Crypto-Assets (MiCA) regulation, ensuring strict standards for risk management, transparency, and reporting—offering users a higher level of legal certainty compared to many USD-pegged alternatives.

-

Direct Euro Exposure for European Users: EUROD provides seamless access to a euro-denominated digital asset, reducing foreign exchange risk and costs for European businesses and individuals who would otherwise rely on USD-pegged stablecoins.

-

Enhanced Financial Autonomy for Europe: By promoting euro liquidity in decentralized ecosystems, EUROD supports Europe’s strategic goal of financial sovereignty, decreasing reliance on US dollar-based stablecoins and strengthening the euro’s digital presence.

-

Instant, Low-Cost Transactions on Polygon: Issued on the Polygon blockchain, EUROD enables real-time euro transfers with low transaction fees—advantages not always matched by USD stablecoins operating on less scalable networks.

-

Trusted Banking Backing and Secure Custody: EUROD is issued by ODDO BHF, a 175-year-old French bank with over €150 billion in assets, and leverages Fireblocks for secure digital asset custody—providing a level of institutional trust and security rarely matched by USD-pegged stablecoin issuers.

The introduction of EUROD is particularly timely as Europe seeks to strengthen its role in global digital finance. By providing a compliant, low-volatility digital euro, ODDO BHF empowers users to transact, invest, and settle in their native currency without exposure to dollar fluctuations or regulatory uncertainty. As MiCA sets the standard for stablecoin regulation worldwide, EUROD’s launch could serve as a template for future non-USD stablecoins striving for legitimacy and adoption.

EUROD’s arrival also addresses growing demand for euro-denominated liquidity in decentralized finance protocols and digital asset markets. With many DeFi platforms still reliant on USD stablecoins, the presence of a regulated European alternative can unlock new pools of capital and facilitate euro-denominated lending, borrowing, and trading. This is a strategic step for market participants seeking to diversify beyond the dollar-centric paradigm and align with regional monetary policy.

By leveraging the Polygon blockchain, ODDO BHF ensures that EUROD transactions are not only fast and cost-effective but also environmentally conscious, thanks to Polygon’s energy-efficient consensus mechanism. This aligns with Europe’s broader sustainability goals and responds to institutional investors’ growing focus on ESG (Environmental, Social, and Governance) criteria in digital assets.

Market Impact and Regulatory Significance: EUROD Sets a New Benchmark

EUROD’s launch is a pivotal moment for European stablecoins, setting a new benchmark for compliance, transparency, and institutional-grade security. Its MiCA alignment means that investors and businesses can confidently engage with a digital euro that is subject to rigorous oversight and regular audits. This is especially significant as the EU positions itself as a global leader in digital asset regulation, with MiCA expected to influence policy frameworks far beyond Europe’s borders.

ODDO BHF’s entry into the stablecoin space is likely to spur further competition among European banks and fintechs, accelerating innovation and expanding the utility of euro-backed digital assets. As more institutions follow suit, we can anticipate a more robust and diversified ecosystem for non-USD stablecoins, one that supports Europe’s ambition for digital sovereignty and financial independence.

For crypto investors, traders, and businesses, the immediate benefit is access to a compliant and liquid euro stablecoin for on-chain settlements, DeFi participation, and cross-border payments. For regulators and policymakers, EUROD serves as a real-world example of how traditional finance can coexist with decentralized systems while upholding stringent risk controls.

Looking Ahead: What’s Next for EUROD and Euro Stablecoins?

The real test for EUROD will be in its adoption across both centralized exchanges and decentralized protocols. Its listing on Bit2Me is just the beginning; broader integration with payment processors, enterprise platforms, and DeFi applications will determine its long-term impact. As regulatory clarity continues to evolve under MiCA, expect to see further institutional participation in the euro stablecoin sector, and potentially new entrants inspired by ODDO BHF’s blueprint.

Ultimately, EUROD’s launch marks a turning point for European digital assets. By combining the trust of a 175-year-old financial institution with the efficiency of blockchain technology and the rigor of MiCA compliance, ODDO BHF has set a high bar for future euro stablecoins. This is a development that crypto market participants, and anyone interested in the future of money, should watch closely.