How Japan’s Stablecoin System Connects Banks, Merchants, and Users On-Chain

Japan’s stablecoin system is rapidly emerging as a model of regulated, on-chain finance that bridges the gap between traditional banks, merchants, and everyday users. Unlike the global dominance of USD-pegged stablecoins, Japan’s yen stablecoin infrastructure is uniquely shaped by stringent oversight and deep integration with the country’s established financial sector. This architecture is not only about technical innovation but also about regulatory harmony and practical adoption at scale.

From Fiat Deposit to Blockchain: The Regulated On-Ramp

The journey begins with fiat yen deposits at a regulated financial institution. Under Japan’s Payment Services Act, only licensed banks, trust companies, or registered money transfer agents are authorized to issue digital-money type stablecoins. This ensures that every user onboarding starts with robust Know Your Customer (KYC) checks and anti-money laundering (AML) compliance. The process isn’t just a formality – it is the foundation for trust and systemic stability in an ecosystem where digital assets must be as reliable as their fiat counterparts.

How Yen Stablecoins Flow in Japan’s Regulated System

-

Fiat Yen Deposit and KYC at Regulated Financial Institution: Users begin by depositing Japanese yen at a licensed bank, trust company, or registered fund transfer provider—such as Mitsubishi UFJ Financial Group (MUFG), Tokyo Kiraboshi Financial Group, or Hokkoku Bank. Comprehensive Know Your Customer (KYC) and anti-money laundering checks are performed to ensure regulatory compliance.

-

Issuance of Yen-Pegged Stablecoins on Permissioned Blockchain: After successful deposit and verification, the institution issues yen-backed stablecoins (e.g., via Progmat Coin or Japan Open Chain). These stablecoins are minted on permissioned, regulation-compliant blockchains, ensuring 1:1 backing with fiat reserves held by the issuer.

-

On-Chain Transfer and User-to-User Transactions with Regulatory Oversight: Users can transfer stablecoins between wallets (such as MetaMask), make payments, or settle transactions. All on-chain activity is monitored for compliance with Japanese regulations, leveraging blockchain transparency and oversight mechanisms.

-

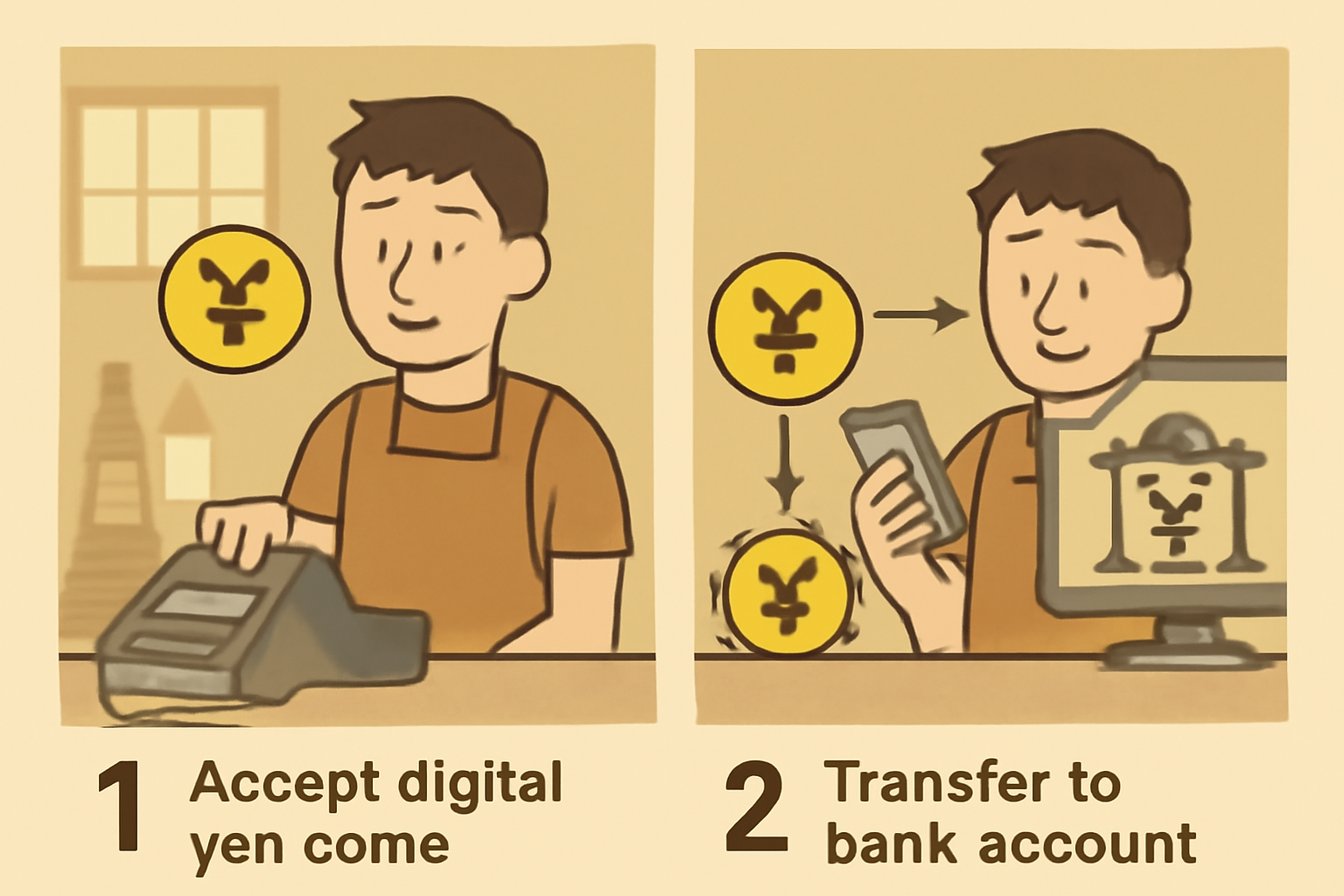

Merchant Redemption and Conversion to Fiat via Bank or Payment Service Provider: Merchants accepting stablecoins (e.g., through the Tochituka app or integrated POS systems) can redeem their digital assets for fiat yen. Redemption is processed by the issuing bank or payment service provider, ensuring seamless conversion and liquidity management within the regulated framework.

Once KYC is completed and funds are deposited, these institutions mint yen-pegged stablecoins on permissioned blockchains. Platforms like MUFG’s Progmat Coin and the Ethereum-compatible Japan Open Chain have become critical infrastructure for this issuance layer. These blockchains are not open to anyone – they are permissioned environments where only approved entities can participate in minting or burning tokens. This guarantees that every token in circulation is always backed 1: 1 by underlying assets such as bank deposits or Japanese government bonds (source).

On-Chain Transfers: User-to-User Payments With Regulatory Oversight

On-chain transfer and user-to-user transactions represent a significant evolution from traditional banking rails. Once issued, yen stablecoins can be sent peer-to-peer across wallets with near-instant settlement times. Yet unlike unregulated crypto networks, every transaction on these blockchains remains subject to regulatory monitoring. Tools for traceability and compliance are embedded into the chain itself – a necessity given Japan’s focus on transparency and risk management.

This approach opens new possibilities for both retail users and businesses: families sending remittances within Japan, freelancers receiving instant payments from clients, or even regional projects like Hokkoku Bank’s Tochika digital currency enabling local commerce (source). The common thread is that liquidity never leaves the safety net of bank-backed collateralization.

The Merchant’s Perspective: Redemption and Integration With Banking Systems

The final critical link in this system is merchant redemption and conversion to fiat via a bank or payment service provider. Merchants accepting yen stablecoins can redeem them for actual fiat at any time through their banking partners or authorized payment processors. For example, merchants participating in the Tochika network benefit from fast settlements directly into their bank accounts – often with lower fees than legacy card networks.

This seamless integration of digital payments with traditional finance creates a virtuous cycle of adoption. Merchants gain operational efficiency while users enjoy frictionless spending options tied directly to their existing accounts. Regulatory clarity ensures all parties remain compliant without sacrificing usability.

What sets Japan’s stablecoin system apart is the deliberate choreography between compliance, liquidity management, and real-world utility. The process is not merely a technical upgrade; it is a structural reimagining of how value circulates in a digital-first economy while retaining the core principles of trust and regulatory alignment.

Liquidity, Compliance, and the Future: A Pattern for Global Adoption?

By anchoring every step, from fiat yen deposit and KYC at regulated financial institutions to merchant redemption via bank partners: in established compliance frameworks, Japan’s model sidesteps many of the pitfalls seen in less regulated stablecoin markets. Liquidity remains tightly coupled to underlying assets, minimizing systemic risk. At the same time, merchant-facing innovations like Tochika’s 0.5% commission structure demonstrate that on-chain payments can be both cost-effective and scalable for local economies.

The integration of platforms such as Progmat Coin and Japan Open Chain reveals another critical pattern: interoperability with global public blockchains is possible without compromising domestic oversight. This is especially evident in cross-border initiatives like Project Pax, where major Japanese banks collaborate to streamline international business settlements using yen-backed stablecoins. These projects are not isolated pilots but early signals of how regulated stablecoins could transform global payment corridors (source).

This architecture isn’t just about technology, it’s about orchestrating incentives across all participants in the ecosystem. Users gain confidence from robust KYC and asset backing. Merchants benefit from faster settlements and lower fees. Banks maintain their central role as trusted intermediaries while leveraging blockchain efficiencies.

For crypto investors and businesses considering alternatives to USD-based stablecoins, Japan’s approach offers a blueprint for balancing innovation with institutional reliability. As more Asian banks feel competitive pressure to adopt similar models (source), expect these patterns, regulated issuance, permissioned transfers, seamless merchant redemption, to become defining features of next-generation stablecoin infrastructure.

The bottom line? By connecting banks, merchants, and users through an on-chain framework grounded in regulatory best practices, Japan’s stablecoin system demonstrates how digital money can be both transformative and trustworthy, a case study that global markets are watching closely as the future of finance unfolds.