How Japan’s Stablecoin System Connects Banks, Merchants, and Users On-Chain

Japan’s stablecoin system is rapidly evolving into one of the world’s most tightly regulated and technologically advanced frameworks. As competitive pressures mount across Asia, Japanese banks and fintechs are moving from pilot projects to live deployments, connecting the dots between traditional finance and on-chain digital assets. This transformation is not just about launching yen-pegged tokens; it’s about orchestrating a seamless, compliant network that brings together banks, merchants, and users in real time.

Regulated Issuance: Licensed Banks and Trust Companies Take Center Stage

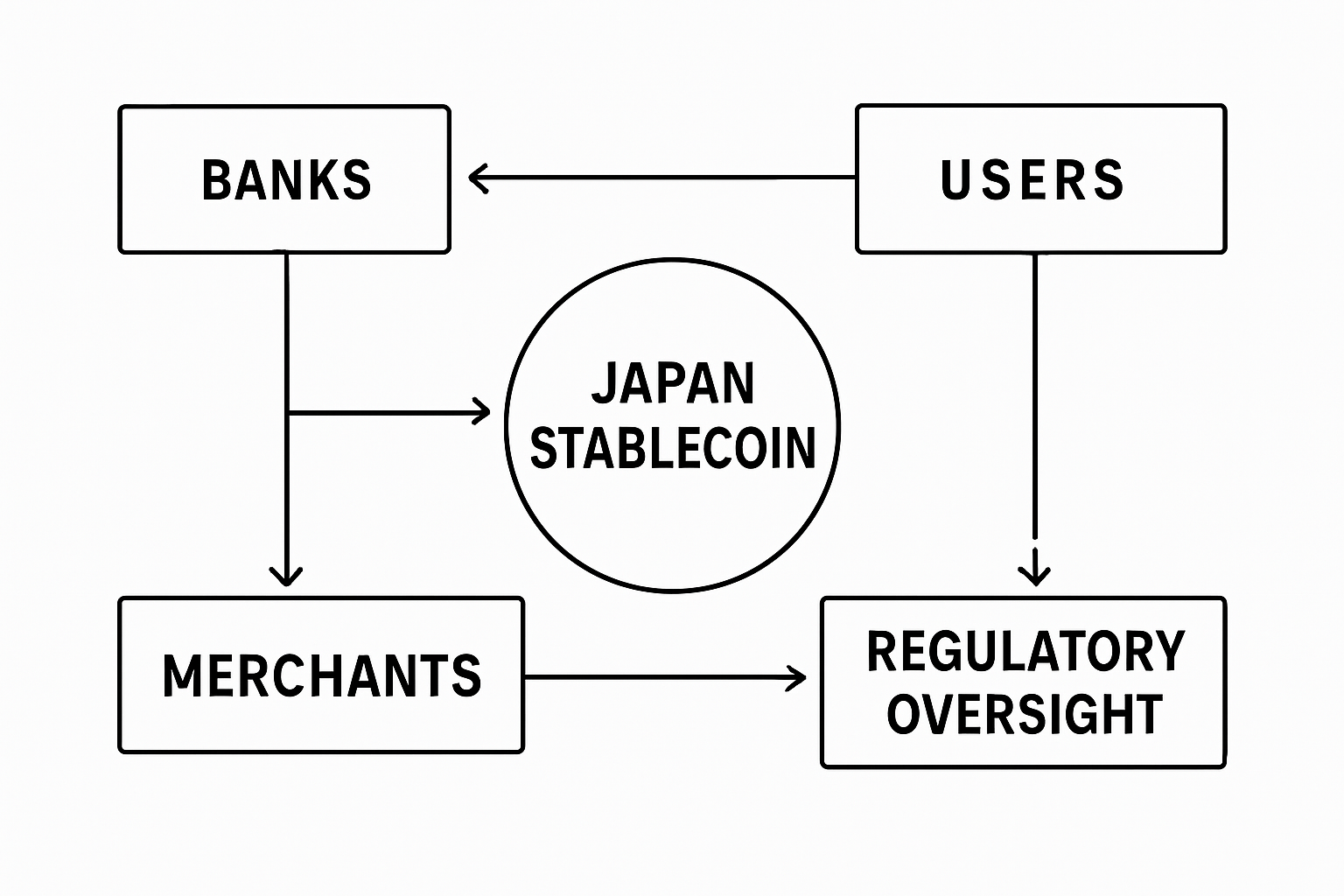

The foundation of Japan’s stablecoin infrastructure lies in its strict regulatory approach. Following amendments to the Payment Services Act, only licensed banks, trust companies, and select fund transfer service providers may issue digital money-type stablecoins. These issuers must fully back their tokens with fiat deposits, ensuring each yen-backed stablecoin is redeemable on demand. Rigorous KYC/AML checks are mandatory at every step – a critical measure designed to protect users and uphold financial integrity.

This model stands in sharp contrast to more lightly regulated stablecoin markets. By anchoring issuance within the banking sector, Japan aims to foster both innovation and systemic stability. Notably, major institutions like Mitsubishi UFJ Financial Group (MUFG) are leading the charge with platforms such as Progmat Coin, designed for multi-chain interoperability while maintaining regulatory guardrails.

Read more at FinanceFeeds

On-Chain Minting and User Wallet Integration: Seamless Digital Onboarding

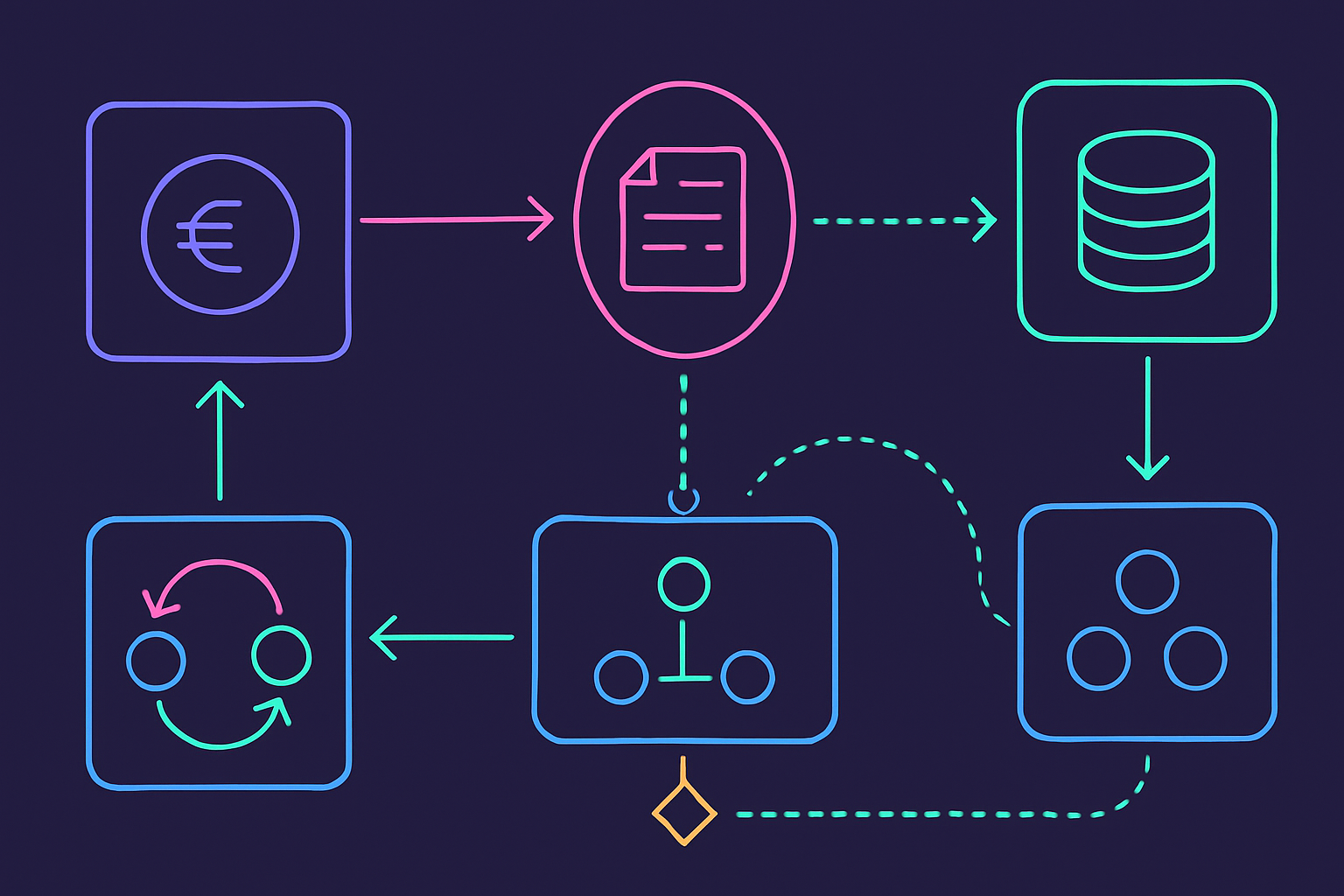

Once fiat deposits are confirmed with the issuing bank or trust company, stablecoins are minted directly on public or permissioned blockchains. This process is not limited to proprietary ledgers; recent initiatives like the Japan Open Chain enable Ethereum compatibility, so users can interact via widely adopted wallets such as MetaMask.

The result? Instant digital onboarding for end-users, who receive their yen stablecoins in personal wallets after passing compliance checks. The technology ensures transparency – every issuance event is recorded on-chain – while retaining oversight through wallet whitelisting or transaction monitoring tools.

Merchant Acceptance and Real-Time Settlement: Streamlining Commerce

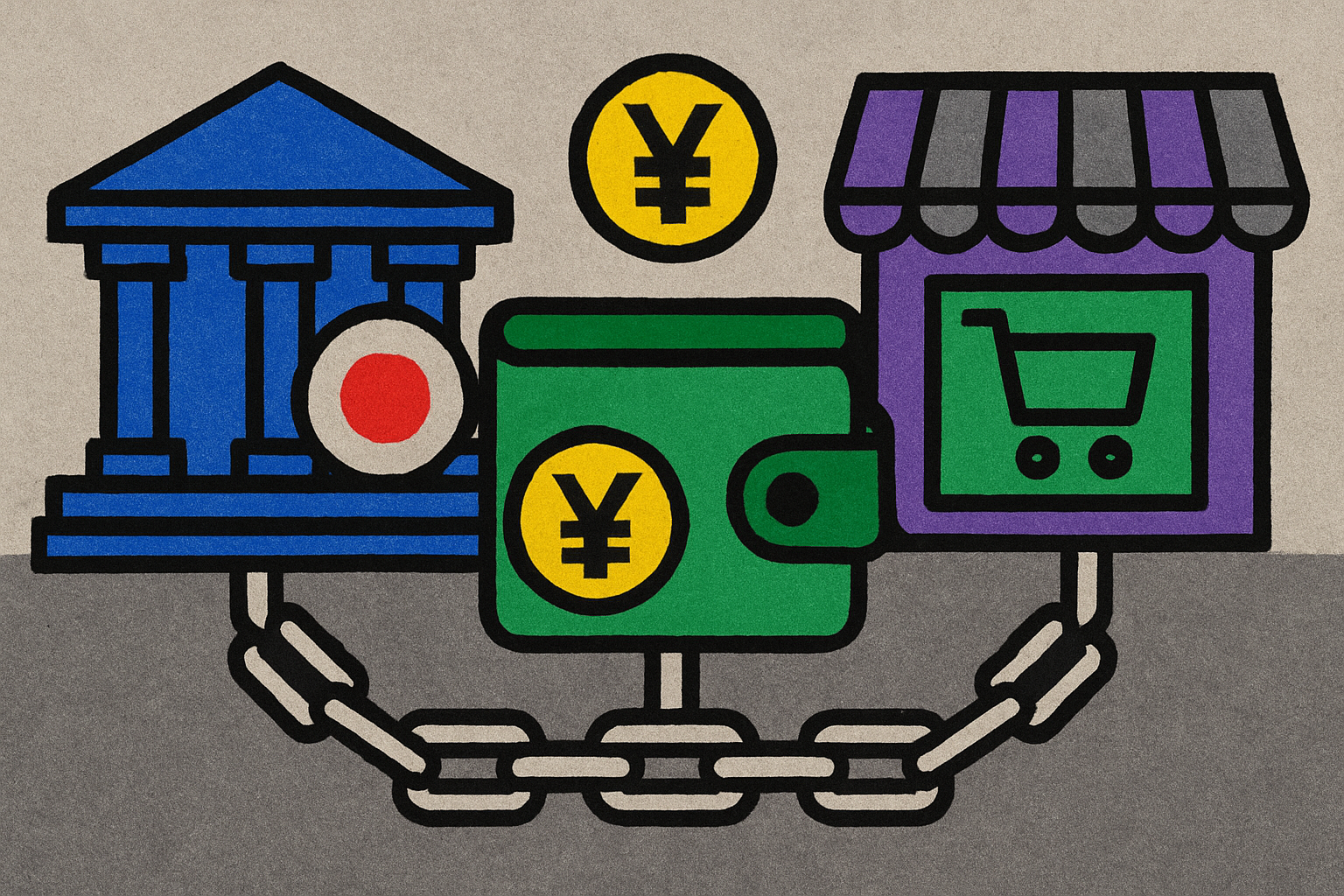

The next link in Japan’s regulated stablecoin chain is merchant adoption. Merchants can now integrate with dedicated payment gateways or accept regulated yen stablecoins directly into their wallets. This unlocks several advantages:

How Japan’s Regulated Stablecoin System Connects Banks, Merchants, and Users

-

Regulated Issuance by Licensed Banks and Trust Companies: Japanese banks and trust institutions, such as Mitsubishi UFJ Financial Group (MUFG) and Hokkoku Bank, issue yen-pegged stablecoins under the amended Payment Services Act. These stablecoins are fully backed by fiat deposits and comply with stringent KYC/AML standards, ensuring regulatory oversight and trust.

-

On-Chain Minting and User Wallet Integration: After fiat is deposited, stablecoins are minted on public or permissioned blockchains like Ethereum or the Japan Open Chain. Users can receive and store these stablecoins in digital wallets such as MetaMask, enabling seamless on-chain transactions while maintaining compliance.

-

Merchant Acceptance and Real-Time Settlement: Merchants integrate with stablecoin payment gateways or directly accept regulated yen stablecoins. This allows for instant settlement, lower transaction fees (e.g., Tochika’s 0.5% merchant fee), and streamlined reconciliation, improving cash flow and reducing operational burdens.

-

Redemption and Compliance Monitoring: Users and merchants can redeem stablecoins for fiat through the issuing bank or trust company. Continuous transaction monitoring ensures anti-money laundering (AML) compliance and provides transparent audit trails, safeguarding the integrity of the payment ecosystem.

- Instant settlement: Transactions clear on-chain within seconds – no waiting for traditional batch processing.

- Lower fees: Merchant fees often drop below 1%, as seen with Tochika’s 0.5% rate in Ishikawa Prefecture.

- Simplified reconciliation: Every payment leaves an immutable audit trail on blockchain networks.

This infrastructure is already live at regional scale – Hokkoku Bank’s Tochika platform lets users top up balances via app and pay participating merchants instantly.

Explore Tochika’s implementation here

The Regulatory Backbone: Continuous Compliance and Redemption Flows

No system is complete without robust off-ramps and compliance monitoring. In Japan’s model, users and merchants can redeem their stablecoins for fiat through the original issuer. All transactions remain subject to ongoing AML screening and audit requirements set by regulators.

This closed-loop structure not only reassures participants but also provides regulators with full visibility over flows between banks, merchants, and end-users, cementing Japan’s position as a pioneer in compliant digital asset ecosystems.

The practical impact of these tightly regulated flows is already visible in both retail and wholesale settings. For example, Project Pax, a collaboration among Japan’s largest banks, demonstrates how regulated yen stablecoins can be used for cross-border settlements, dramatically reducing friction and cost compared to legacy correspondent banking rails. This is not hypothetical: real-world pilots are underway, with live on-chain transactions connecting Japanese corporates to global partners. See details on Project Pax at Cointelegraph

Redemption and Compliance Monitoring: Closing the Loop On-Chain

Redemption is a critical pillar of the yen stablecoin infrastructure. When users or merchants wish to convert their digital yen back to fiat, they initiate a redemption request through their app or wallet. The issuing bank or trust company burns the redeemed tokens on-chain and credits the user’s linked bank account with the equivalent yen amount.

This process is not only seamless but also highly secure. Every redemption triggers real-time compliance monitoring, transactions are screened for suspicious activity, and full audit trails are maintained for regulatory review. This ensures that Japan’s stablecoin system remains aligned with global standards for anti-money laundering (AML) and counter-terrorist financing (CTF), while still delivering a frictionless user experience.

How Users Redeem Yen Stablecoins for Fiat in Japan

-

Regulated Issuance by Licensed Banks and Trust Companies: Japanese banks and trust institutions, such as Mitsubishi UFJ Financial Group (MUFG) and Hokkoku Bank, issue yen-pegged stablecoins under the amended Payment Services Act. These stablecoins are fully backed by fiat deposits, ensuring robust compliance with KYC/AML requirements and regulatory oversight.

-

On-Chain Minting and User Wallet Integration: After users deposit fiat, stablecoins are minted on public or permissioned blockchains—examples include Japan Open Chain and Progmat Coin (compatible with Ethereum, Cosmos, Avalanche, Polygon). Stablecoins are then distributed to users’ digital wallets, such as MetaMask, enabling seamless on-chain transactions while maintaining regulatory controls.

-

Merchant Acceptance and Real-Time Settlement: Merchants integrate with stablecoin payment gateways or directly accept regulated yen stablecoins. Platforms like the Tochituka app (for Tochika by Hokkoku Bank) enable instant settlement, lower transaction fees (as low as 0.5%), and streamlined reconciliation, supporting both regional and national commerce.

-

Redemption and Compliance Monitoring: Users and merchants can redeem stablecoins for fiat through the issuing bank or trust company. The process involves continuous transaction monitoring and transparent audit trails to ensure ongoing anti-money laundering (AML) compliance, as mandated by Japan’s Payment Services Act and overseen by the Financial Services Agency (FSA).

Japan’s approach stands apart from loosely regulated global peers by embedding compliance into every layer, from onboarding to redemption. This regulatory backbone provides confidence to both institutional players and everyday consumers, accelerating adoption across sectors.

Market Implications: A Blueprint for Global Stablecoin Adoption?

The Japanese model offers a compelling preview of what regulated bank merchant stablecoin adoption could look like worldwide. By orchestrating a closed-loop system anchored by licensed financial institutions, Japan delivers:

- Programmable payments: Smart contracts automate settlement, escrow, and compliance logic.

- Interoperability: Platforms like Progmat Coin allow yen stablecoins to move fluidly across Ethereum, Cosmos, Avalanche, Polygon, and more.

- User protection: Full fiat backing and transparent audit trails mitigate counterparty risk.

This architecture is rapidly gaining attention beyond Japan, as seen in Hong Kong and Singapore, where banks are under similar regulatory pressures to modernize payment rails while maintaining oversight.

Read about regulatory developments at JBFD. org

The Road Ahead: Scaling Beyond Borders

If current trends hold, we can expect Japan’s model to influence international stablecoin standards, especially as cross-border commerce demands faster, cheaper settlement options that do not compromise on compliance. The next frontier will be interoperability between national systems: connecting yen-pegged coins with euro or dollar-backed counterparts for seamless FX settlement on public blockchains.

For now, Japan’s blueprint demonstrates that robust regulation need not stifle innovation; rather, it can enable a scalable ecosystem where banks, merchants, and users transact safely on-chain, setting the stage for mainstream adoption of non-USD stablecoins globally.