JPYCompound: Building the DeFi Liquidity Layer for Yen Stablecoins

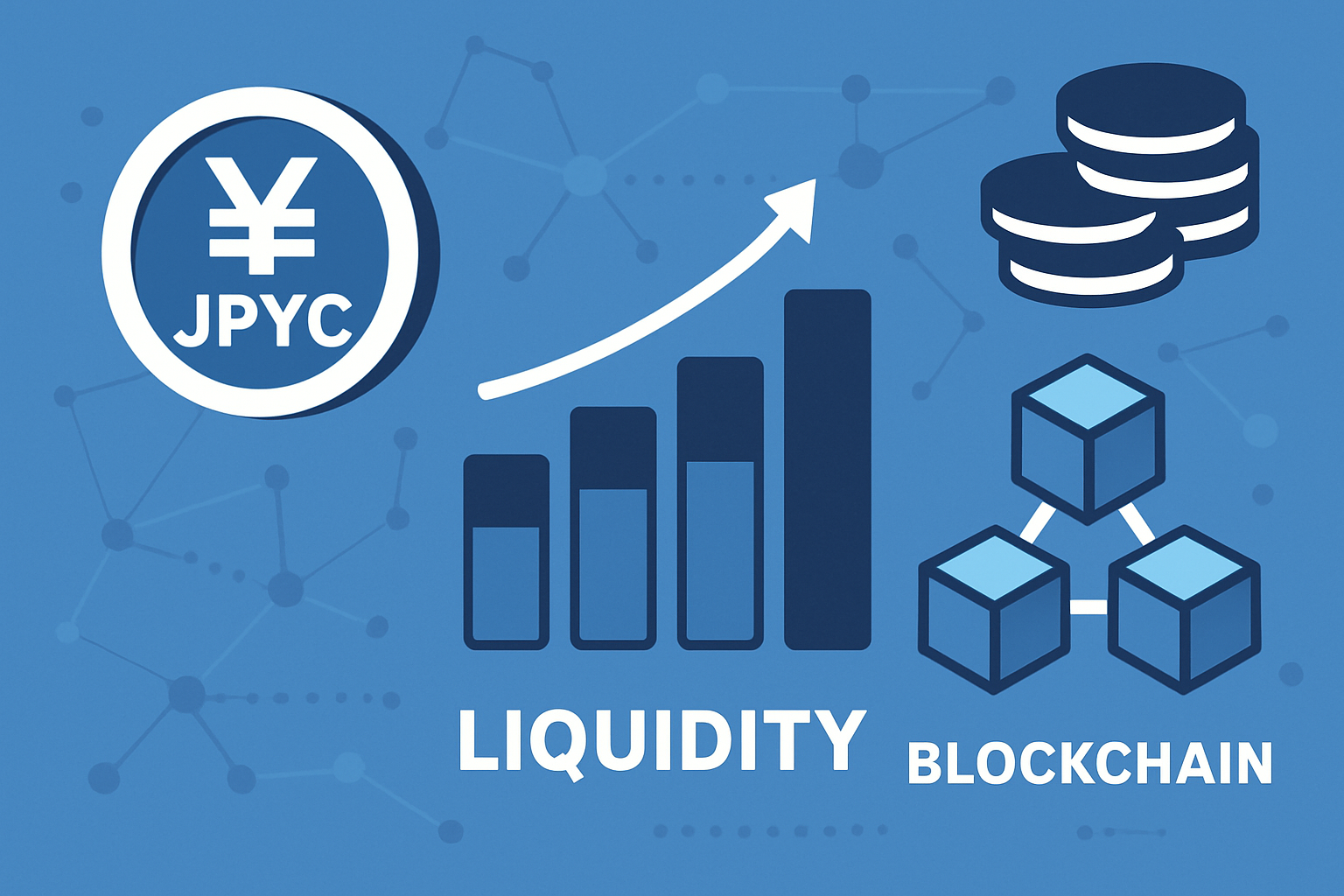

Japan’s digital finance landscape is undergoing a seismic shift as JPYCompound emerges as the first dedicated DeFi liquidity layer for yen stablecoins. This development comes on the heels of Japan’s Financial Services Agency (FSA) approving JPYC, the nation’s first fully regulated, yen-backed stablecoin. With JPYC set to launch in autumn 2025 and targeting an ambitious 1 trillion yen ($6.78 billion) issuance over three years, the groundwork for a robust, yen-denominated decentralized finance ecosystem is being laid. For Japanese investors and institutions, this marks a pivotal move away from reliance on USD-pegged stablecoins, potentially reducing both currency conversion costs and exposure to dollar volatility.

JPYCompound: The Core Lending Layer for Yen Stablecoins

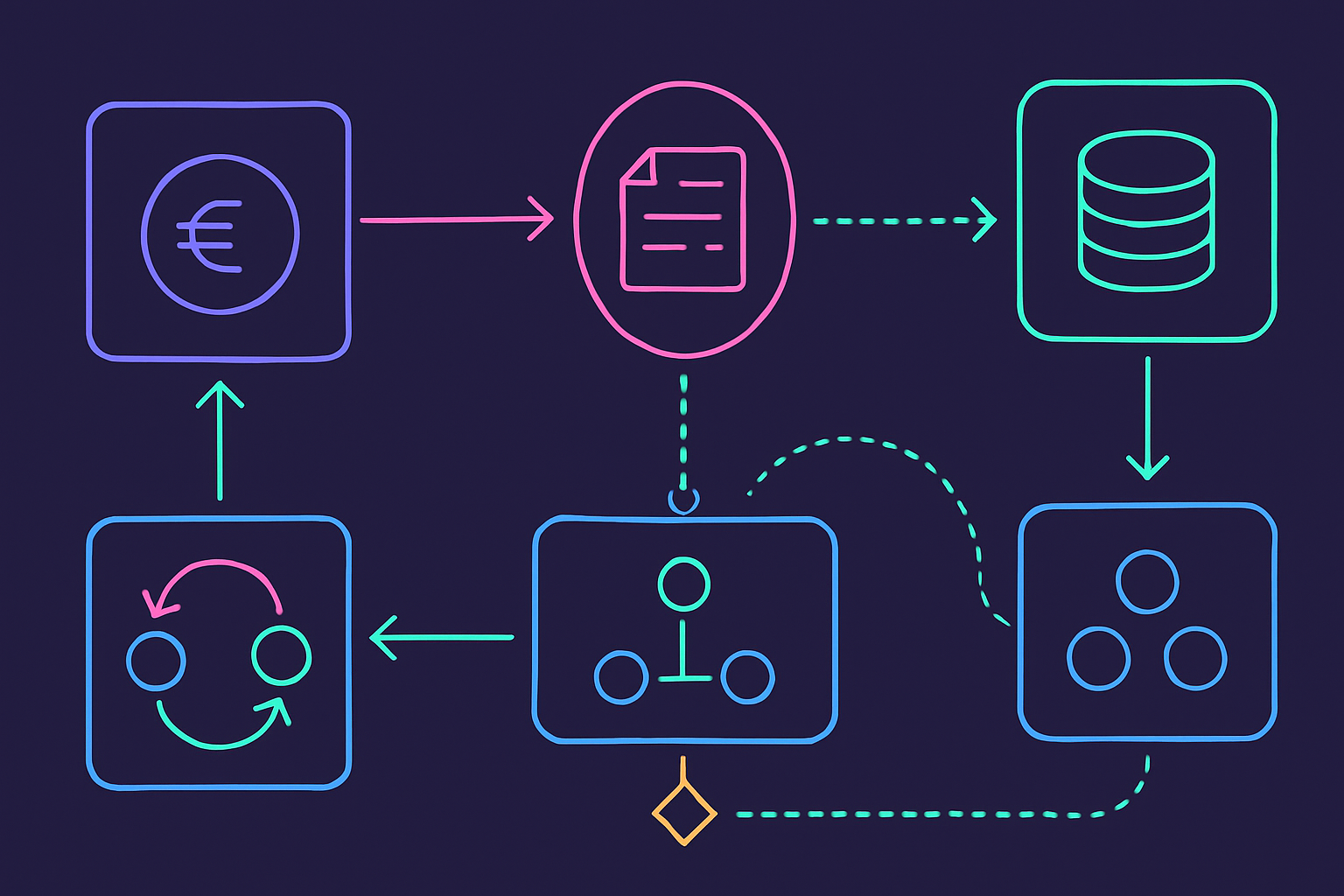

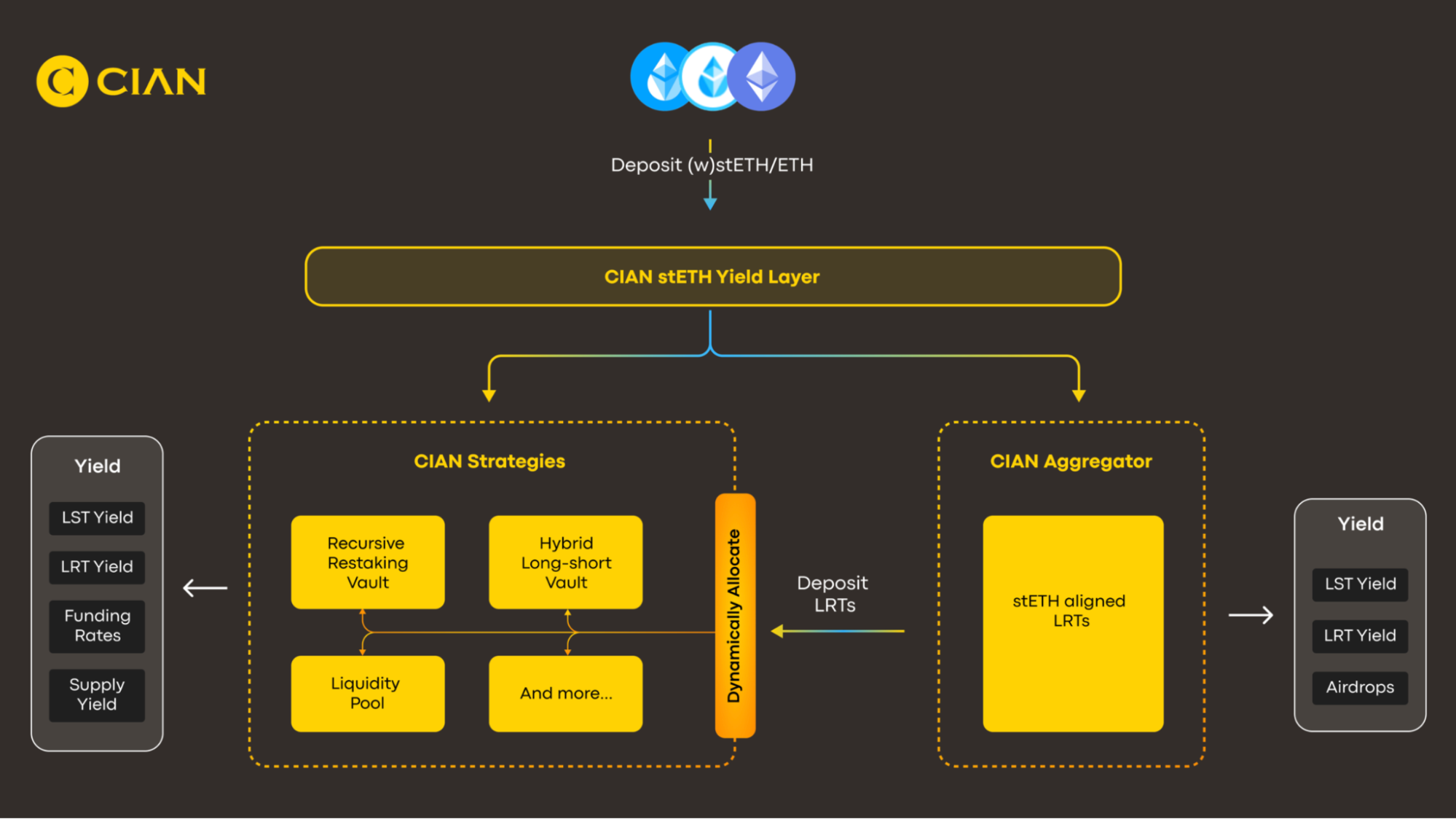

At its core, JPYCompound functions as a decentralized protocol enabling users to deposit, borrow, and leverage yen stablecoins such as JPYC. The protocol is designed to deliver both liquidity and real yield for Japanese DeFi participants. By pooling yen-pegged assets and facilitating lending markets, JPYCompound addresses a critical gap in the current DeFi landscape, which has historically been dominated by USD-based stablecoins like USDT and USDC.

What sets JPYCompound apart is its alignment with Japan’s regulatory framework. JPYC, the flagship yen stablecoin, is fully backed by Japanese government bonds (JGBs) and domestic savings, providing a transparent and compliant foundation for DeFi activity. This regulatory clarity is expected to attract not only retail users but also institutional capital, paving the way for more sophisticated financial products and lending strategies within the Japanese crypto ecosystem.

Multi-Chain Interoperability: Reducing Costs and Expanding Access

One of the most significant innovations underpinning the yen stablecoin DeFi movement is the use of multi-chain issuance. JPYC will be available as an ERC-20 token on Ethereum, Avalanche, and Polygon, each offering unique advantages. For example, Avalanche’s C-Chain delivers transaction finality in roughly two seconds and fees under $0.10, a stark contrast to Ethereum’s higher costs and slower settlement times. This multi-chain approach is designed to maximize interoperability, minimize transaction expenses, and enable seamless movement of yen stablecoins across different DeFi platforms.

For Japanese users, this means faster, cheaper access to DeFi services denominated in their native currency. It also opens the door for cross-chain lending, borrowing, and yield farming strategies that were previously cost-prohibitive or operationally complex when relying on USD stablecoins. As a result, JPYCompound and similar protocols are poised to attract a new wave of liquidity and innovation to the Japanese DeFi sector.

Key Benefits of Yen Stablecoin DeFi for Japanese Investors

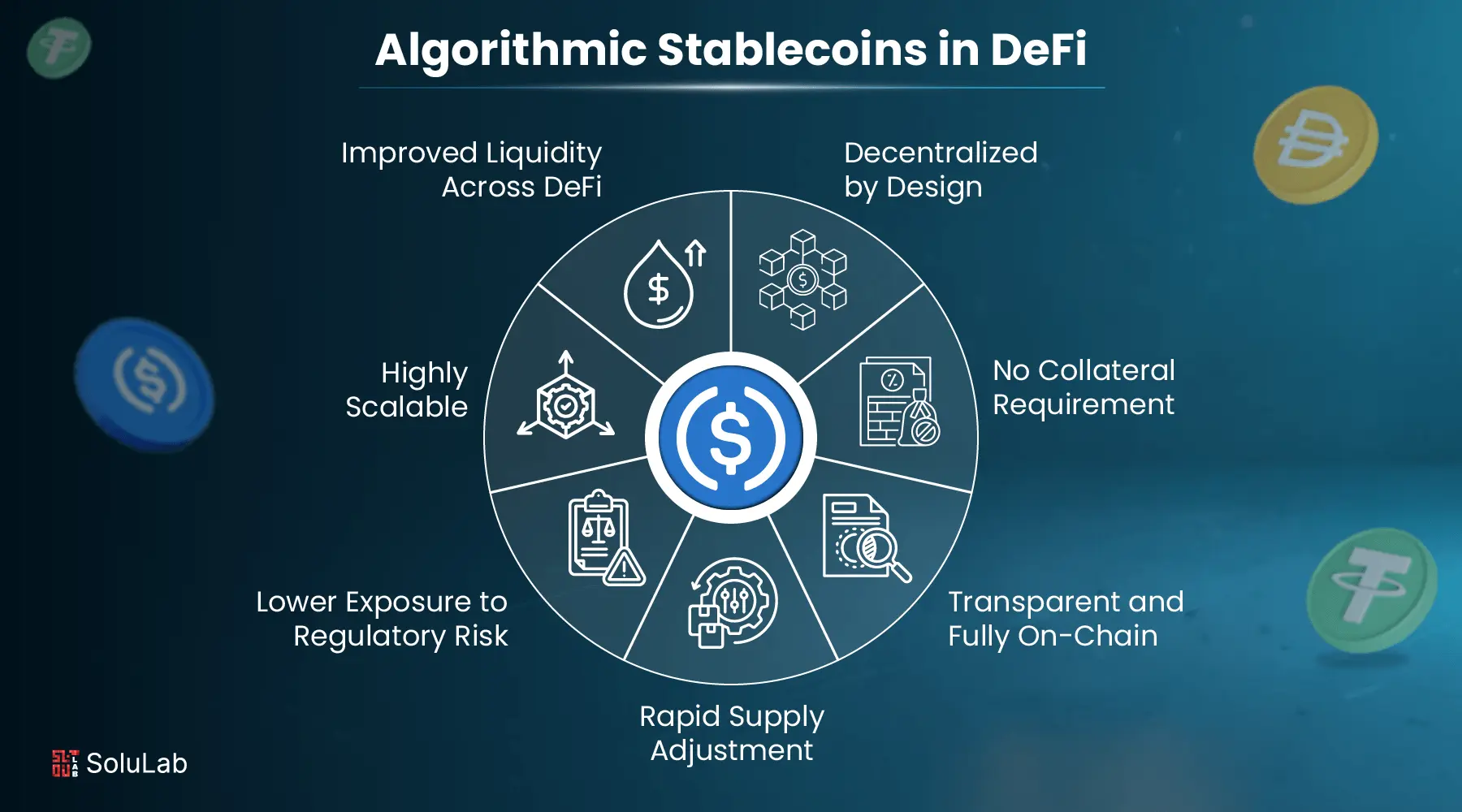

-

Reduced Currency Conversion Costs: JPYC enables Japanese investors to transact directly in yen on DeFi platforms, eliminating the need to convert to USD-pegged stablecoins like USDT or USDC. This minimizes foreign exchange fees and exposure to currency volatility.

-

Enhanced Blockchain Liquidity for Yen: The launch of JPYC, fully backed by Japanese yen and government bonds, provides a native liquidity layer for yen-denominated assets on blockchains such as Ethereum, Avalanche, and Polygon.

-

Faster and Cheaper Transactions: By leveraging networks like Avalanche’s C-Chain, JPYC offers transaction finality in ~2 seconds and fees under $0.10, making DeFi participation more efficient for Japanese users.

-

Access to Real Yield and DeFi Lending: JPYC holders can participate in lending protocols, earning real yield from yen-backed assets and using features like yield redirection for automated loan repayments or portfolio management.

-

Regulatory Assurance and Security: JPYC operates under Japan’s updated Payment Services Act and is approved by the FSA, ensuring compliance, transparency, and investor protection compared to unregulated alternatives.

-

Support for Japan’s Digital Finance Strategy: The integration of JPYC aligns with Japan’s push towards blockchain-based payments and fintech innovation, positioning investors at the forefront of the country’s evolving digital economy.

Implications for Japan’s Bond Market and DeFi Yield Dynamics

The introduction of yen-backed stablecoins like JPYC is expected to have far-reaching effects beyond the crypto sector. By backing JPYC with JGBs, issuers are increasing direct demand for government bonds, potentially impacting yields and liquidity in traditional markets. Furthermore, the programmable nature of these stablecoins enables advanced DeFi features such as instant yield redirection and automated loan repayments, as highlighted by industry experts.

Experts have also speculated about the rise of new lending models such as “LoanChain, ” where Japanese users could lend yen stablecoins to borrowers in higher-interest jurisdictions, capturing global yield differentials. This dynamic could introduce a new layer of complexity and opportunity to both DeFi protocols and Japan’s broader financial system. For a deeper dive into how JPYC may reshape Japan’s bond market, see this analysis on AInvest.