MiCA and the Rise of Regulated Euro Stablecoins in Europe: Challenges & Opportunities

The European digital asset landscape is undergoing a profound transformation as the Markets in Crypto-Assets Regulation (MiCA) comes into full effect. With MiCA, the European Union has introduced a comprehensive regulatory framework designed to harmonize the treatment of crypto-assets, including euro-pegged stablecoins, across all member states. This regulatory clarity is catalyzing a new era for MiCA euro stablecoin issuers and market participants, presenting both significant opportunities and complex challenges.

MiCA’s Regulatory Framework: A Double-Edged Sword

MiCA’s arrival in December 2024 has set a new standard for regulated stablecoins in Europe. The regulation mandates that stablecoin issuers maintain reserves primarily in low-risk, liquid euro assets, with at least 60% held in instruments such as government bonds and cash equivalents. This measure is designed to ensure both stability and consumer protection in an industry previously marred by volatility and opaque practices.

However, the cost of compliance is significant. Issuers must obtain e-money licenses, implement robust risk management systems, and undergo regular audits. For established financial institutions, this is a manageable hurdle. For startups and DeFi innovators, however, the legal and administrative burden can be daunting. As CryptoFrontline notes, these requirements may slow innovation and raise barriers to entry for smaller players.

Institutional Adoption Accelerates: The EUROD Case Study

The regulatory certainty provided by MiCA is already attracting major financial institutions into the stablecoin arena. A notable example is the launch of EUROD, a fully MiCA-compliant euro stablecoin issued by French financial group ODDO in partnership with Spanish crypto platform Bit2Me. Backed 1: 1 by euro reserves and designed for payments, trading, and lending, EUROD exemplifies how traditional finance is converging with blockchain technology under the new regulatory regime.

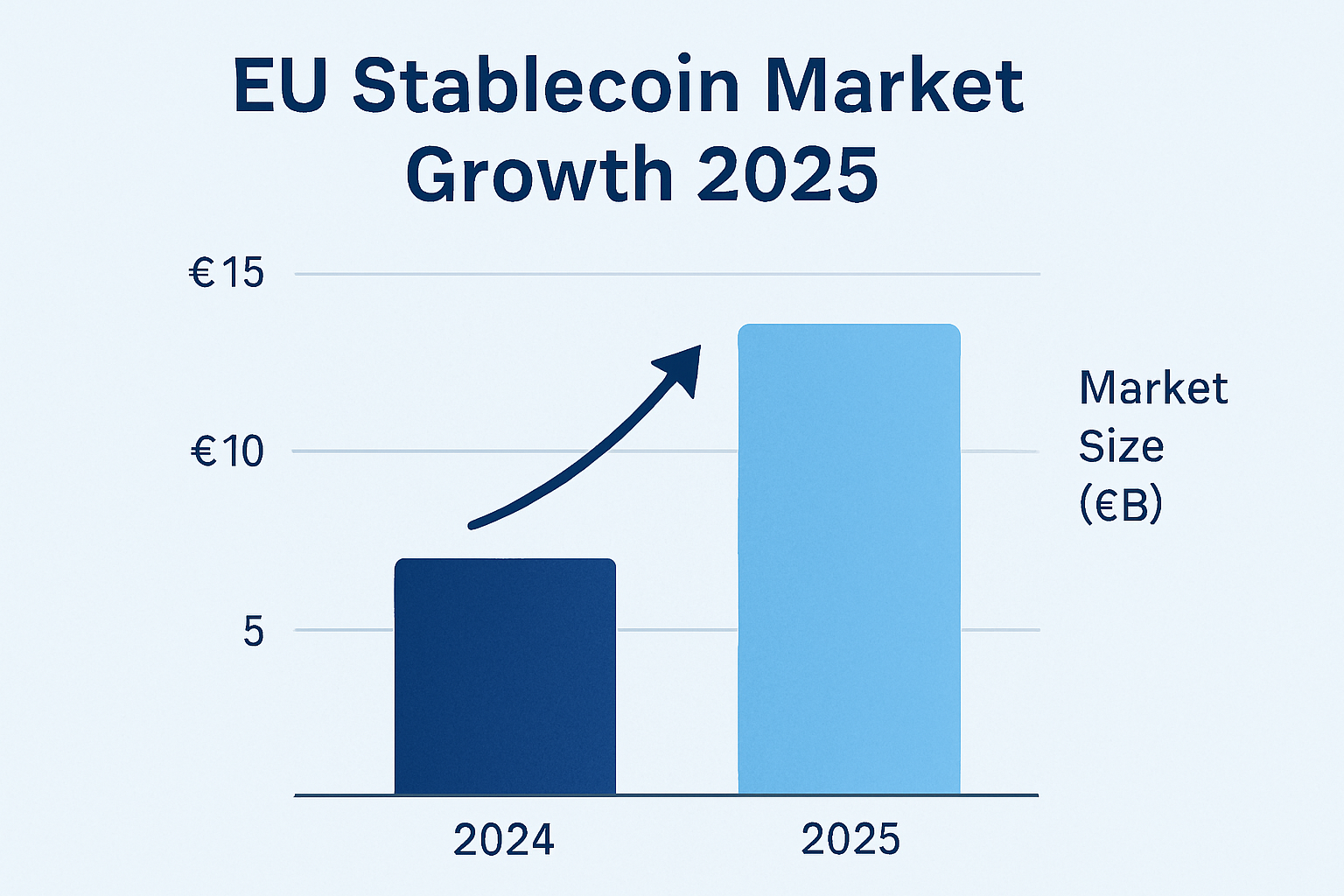

This trend aligns with the European Commission’s ambition to promote euro-backed digital assets as an alternative to USD-dominated stablecoins. The growing interoperability between EU and non-EU tokens also signals a broader shift in global digital currency markets (Cinco Días). With the EU stablecoin market projected to reach €450 billion in 2025 (AInvest), there is clear momentum behind regulated euro stablecoins.

Key Opportunities for Euro Stablecoins Under MiCA

-

Enhanced Institutional Participation: MiCA’s regulatory clarity has encouraged traditional financial institutions to enter the stablecoin market. For example, ODDO (a major French financial group) partnered with Bit2Me to launch EUROD, a MiCA-compliant euro stablecoin, supporting payments, trading, and lending within the EU blockchain ecosystem.

-

Unified EU Market Access: MiCA creates a harmonized licensing regime, allowing euro stablecoin issuers to operate across all EU member states with a single authorization. This reduces regulatory fragmentation and streamlines cross-border operations.

-

Projected Market Growth: The regulatory certainty provided by MiCA is driving significant expansion, with the EU stablecoin market expected to reach €450 billion in 2025. This growth attracts more issuers and institutional investors to the euro stablecoin sector.

-

Increased Consumer Trust & Protection: MiCA mandates that stablecoin issuers maintain reserves primarily in low-risk, liquid assets, with at least 60% held in safe instruments. This enhances stability and consumer confidence in euro-backed stablecoins.

-

Fostering Innovation in Payments: By providing a clear legal framework, MiCA supports the development of new payment solutions and DeFi applications using euro stablecoins, facilitating faster and more efficient transactions across the EU.

Challenges: Compliance Costs and Market Fragmentation

While MiCA’s harmonized rules are driving institutional adoption and investor confidence, they also introduce new challenges that could shape the competitive landscape. The volume cap on non-euro stablecoins, limiting daily transactions to €200 million when used as a means of exchange, is designed to nudge the market toward euro-pegged alternatives. Yet this could cause fragmentation if global issuers do not align with MiCA standards or if liquidity migrates to less regulated venues (DL News).

Moreover, operational adjustments are already underway across major exchanges. For example, OKX delisted Tether (USDT) for EU users to preempt compliance issues, while Circle’s USDC adapted to meet MiCA’s reserve requirements (Benzinga). These shifts underscore the far-reaching impact of MiCA on both market structure and user experience.

Opportunities for DeFi and Beyond

Despite these hurdles, MiCA opens up new possibilities for European DeFi platforms seeking to integrate regulated euro stablecoins. With clear licensing pathways and robust consumer protections, projects can now build on a foundation of legal certainty. This could accelerate real-world adoption of decentralized finance tools for payments, lending, and cross-border settlements using compliant euro-backed tokens.

As the regulatory dust settles, a new generation of euro stablecoins is emerging, designed specifically to meet MiCA’s stringent requirements. These assets are not only gaining traction among institutional investors but are also being woven into the fabric of Europe’s digital finance ecosystem. The ability to offer fully compliant, transparent, and liquid euro-backed tokens is rapidly becoming a competitive advantage for both centralized and decentralized platforms.

Still, the path forward is not without obstacles. The cost and complexity of ongoing compliance may limit participation to well-capitalized entities, potentially stifling the diversity and innovation that have historically defined the crypto sector. Smaller startups must either adapt quickly or risk being sidelined in favor of incumbents with deeper resources and established regulatory relationships.

Market Outlook: Navigating the New Normal

The projected growth of the EU stablecoin market to €450 billion in 2025 is a testament to the pent-up demand for regulated digital euro assets. As more issuers achieve compliance and as exchanges adapt their offerings, euro stablecoins are poised to become a cornerstone of European digital finance. This transformation is particularly relevant for cross-border payments, trade finance, and the burgeoning European DeFi sector, all areas where regulatory clarity can drive mainstream adoption.

It’s also worth noting that while MiCA’s harmonized approach reduces regulatory arbitrage within the EU, it introduces new frictions at the global level. Non-EU stablecoin issuers must now weigh the costs of compliance against the risks of exclusion from one of the world’s largest economic blocs. Some may choose to exit the EU market altogether, while others could pursue partnerships or licensing arrangements to maintain access. This dynamic is likely to reshape the competitive landscape for years to come.

Key Takeaways for Investors and Builders

- MiCA euro stablecoin issuers must prioritize transparency, robust reserves, and compliance infrastructure to thrive under the new regime.

- The shift toward regulated stablecoins in Europe offers both safety for users and new business models for innovators willing to navigate the regulatory maze.

- Market fragmentation remains a risk as non-euro stablecoins face transaction caps, but this could accelerate euro adoption across DeFi and payment networks.

Ultimately, MiCA’s arrival marks a turning point for digital assets in Europe. By balancing investor protection with market innovation, it sets the stage for euro-backed stablecoins to play a pivotal role in the continent’s financial future. While challenges around compliance and market adaptation persist, the opportunities for growth, diversification, and integration with traditional finance have never been greater. As regulatory frameworks evolve globally, Europe’s experience with MiCA will likely serve as a blueprint for other regions seeking to harness the benefits of regulated stablecoins while mitigating systemic risks.