EUROD: The First MiCA-Compliant Euro Stablecoin by ODDO BHF – What Crypto Investors Need to Know

EUROD, the euro-backed stablecoin from ODDO BHF, is making headlines as the first MiCA-compliant digital euro to launch under Europe’s new regulatory regime. For crypto investors seeking regulated alternatives to USD-pegged tokens, EUROD represents a significant step forward for both the European DeFi ecosystem and institutional adoption of blockchain-based assets.

Why EUROD Matters: A New Era for Regulated Euro Stablecoins

On October 15,2025, French banking powerhouse ODDO BHF – stewarding over €150 billion in assets – officially entered the digital asset space with EUROD. This move comes at a pivotal moment as the EU’s Markets in Crypto-Assets (MiCA) regulation takes effect, setting strict standards for transparency, reserve management, and investor protection. Unlike legacy euro stablecoins that operated in regulatory limbo or offshore jurisdictions, EUROD is fully compliant with MiCA, offering a robust legal framework for European investors.

The stablecoin is issued on the Polygon blockchain, leveraging its high throughput and low-cost infrastructure to facilitate instant euro-denominated transactions. Each EUROD token is backed 1: 1 by euros held in reserves managed by ODDO BHF Asset Management – a critical assurance for risk-conscious participants.

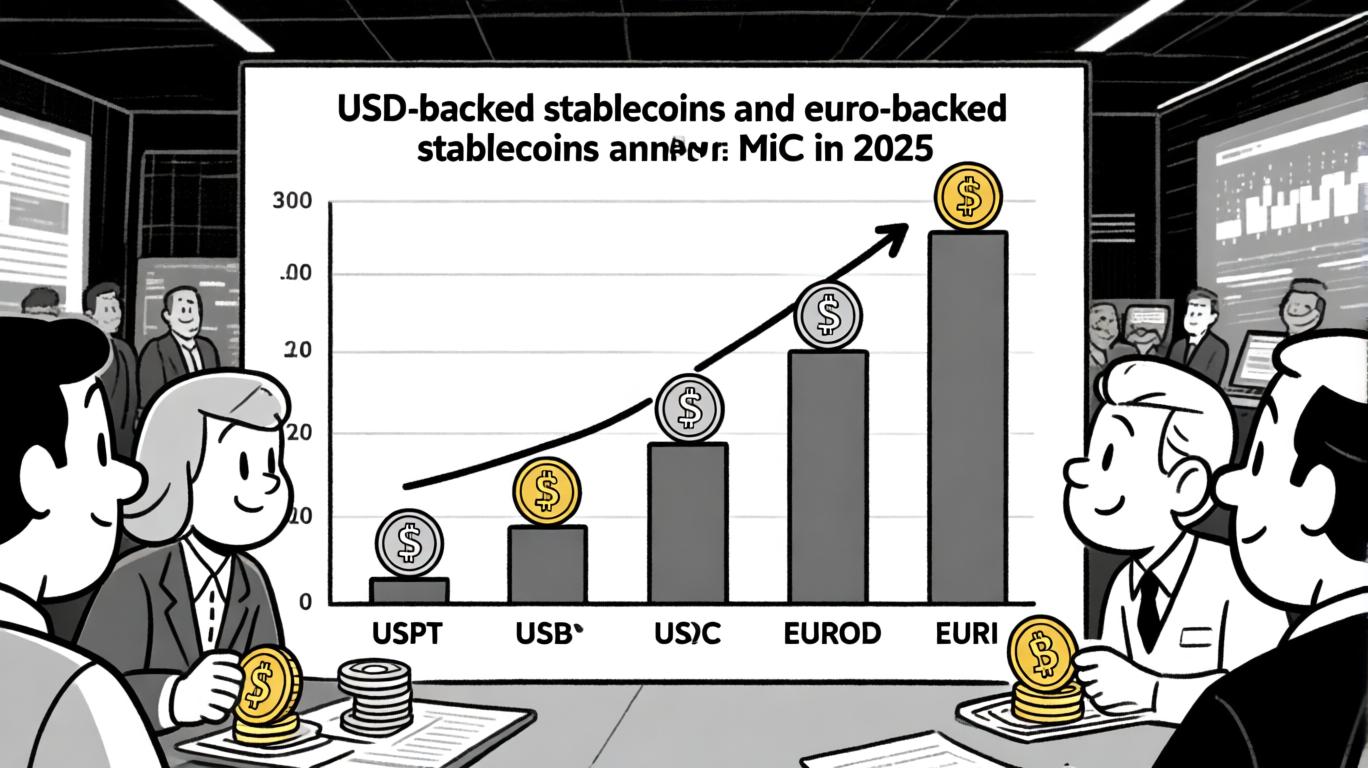

How Does EUROD Compare? Key Features at a Glance

EUROD vs. Other Euro Stablecoins: Key Features & MiCA Compliance

-

EUROD by ODDO BHF: Launched in October 2025 by French banking giant ODDO BHF, EUROD is a fully euro-backed stablecoin issued on the Polygon blockchain. It is fully compliant with the EU’s MiCA regulation, with reserves managed by ODDO BHF Asset Management and regular attestations. Listed on Bit2Me, it offers institutional-grade transparency, regulatory clarity, and instant euro-denominated transactions.

-

EURT (Tether Euro): Issued by Tether, EURT is a euro-pegged stablecoin operating on multiple blockchains, including Ethereum and Tron. While EURT claims full euro backing, it is not currently MiCA-compliant and is managed by a non-EU entity, making its regulatory status less clear for European investors.

-

EUROC (Circle Euro Coin): Issued by Circle, the company behind USDC, EUROC is a euro-backed stablecoin available on Ethereum and Avalanche. Circle is actively working toward MiCA compliance, but as of October 2025, EUROC is not yet fully MiCA-compliant. EUROC offers transparency through monthly attestations and is supported by major exchanges.

-

Stasis EURS: Launched by Stasis, EURS is one of the oldest euro-pegged stablecoins, operating on Ethereum and other blockchains. It provides regular reserve attestations and is widely used in DeFi. However, EURS is not yet officially MiCA-compliant, though Stasis has announced plans to align with upcoming EU regulations.

-

Anchored in MiCA Compliance: Unlike most competitors, EUROD stands out as the first major euro stablecoin to launch with full MiCA compliance, offering European crypto investors a regulated, transparent, and institutionally backed digital euro option. This regulatory clarity is expected to set a new standard for stablecoins in the EU market.

The introduction of EUROD immediately sets it apart from earlier euro-pegged stablecoins like EURT (Tether) or EURS (Stasis). Here’s what makes it notable:

- MiCA Compliance: Full adherence to EU regulatory standards ensures greater transparency and accountability than most competitors.

- Institutional Backing: Issued by a 175-year-old regulated bank with deep experience in asset management.

- On-Chain Efficiency: Built on Polygon for fast, scalable transactions suitable for both retail and institutional use cases.

- Liquidity and Accessibility: Listed on Bit2Me, an authorized Spanish exchange supported by major European financial institutions.

- Reserve Transparency: Regular audits and public attestations of 1: 1 collateralization with euros held in segregated accounts.

This combination positions EUROD as a benchmark for future regulated stablecoins in Europe. For more detail on how MiCA shapes this landscape, see our analysis of MiCA and euro stablecoins.

The Strategic Role of Polygon: Bridging TradFi and Web3

A critical technical choice behind EUROD is its deployment on the Polygon network. Polygon’s Layer-2 architecture dramatically reduces transaction fees compared to Ethereum mainnet while maintaining robust security through its proof-of-stake consensus. This makes it attractive not only for retail payments but also for institutional settlement flows that demand speed without sacrificing compliance or auditability.

This integration reflects a broader trend where established financial institutions are leveraging Web3 infrastructure to deliver real-world assets digitally. By marrying traditional custody standards with blockchain efficiency, ODDO BHF aims to attract both crypto-native users seeking stability and traditional finance players demanding regulatory clarity. For those interested in the technical underpinnings or considering integrating EUROD into their DeFi strategies, understanding Polygon’s role is essential.

The Market Impact: Liquidity Meets Regulation

The listing of EUROD on Bit2Me – one of Southern Europe’s leading crypto exchanges – immediately enhances its liquidity profile. Bit2Me is authorized under MiCA and backed by major players like Telefonica and Unicaja Banco, ensuring institutional-grade safeguards are in place. This means that traders can access euro-denominated liquidity pools without exposure to USD volatility or offshoring risks often associated with non-EU stablecoins.

For DeFi users and institutional participants, this is more than just another listing. The ability to move funds on-chain in a MiCA-compliant, euro-denominated asset opens new pathways for euro-based lending, borrowing, and settlement. As European regulators increase scrutiny on unregulated stablecoins, market participants are likely to demand the transparency and legal certainty that EUROD provides. This is especially relevant for corporates and treasuries looking to digitize euro liquidity without regulatory ambiguity.

Opportunities and Risks for Crypto Investors

EUROD’s launch introduces a new paradigm for euro stablecoin users, but it also brings unique considerations. While MiCA compliance and institutional backing drastically reduce counterparty and regulatory risks, investors should still evaluate:

- Smart Contract Risk: While Polygon is widely regarded as secure, all blockchain deployments carry technical risk. ODDO BHF’s transparency around audits is a positive, but ongoing diligence is advised.

- Redemption Framework: The 1: 1 backing is only as robust as the redemption process. Investors should review ODDO BHF’s published procedures for converting EUROD to fiat euros, especially during periods of market stress.

- Adoption Curve: Early liquidity may be concentrated on Bit2Me and select DeFi protocols. Monitoring trading volumes and integration with other platforms will be key for active users.

How EUROD Shapes the Future of Euro Stablecoins

EUROD’s compliance-first approach is likely to accelerate the institutionalization of euro-backed stablecoins across Europe. As MiCA enforcement ramps up, we anticipate legacy tokens lacking regulatory approval will face delistings or restricted access within the EU. By contrast, EUROD could become the euro stablecoin of choice for DeFi protocols, payment providers, and even cross-border settlement networks seeking a legally sound digital euro.

Top Use Cases for EUROD in DeFi, Payments & Finance

-

On-Chain Euro Payments & Settlements: EUROD enables instant, low-cost euro-denominated transactions on the Polygon blockchain, making it ideal for cross-border B2B payments, payroll, and remittances within the EU. Its MiCA compliance and 1:1 euro backing by ODDO BHF ensure regulatory trust and transparency.

-

DeFi Protocol Integration: As a regulated euro stablecoin, EUROD can be used on DeFi platforms like Aave and Curve Finance for lending, borrowing, and liquidity provision. This allows users to earn yield or access credit in a compliant, euro-denominated format.

-

Institutional Treasury Management: Institutional investors and corporates can hold and transfer EUROD as a digital cash equivalent, benefiting from real-time settlement, reduced counterparty risk, and full regulatory compliance under MiCA.

-

Crypto Exchange Trading and On/Off-Ramps: EUROD is listed on Bit2Me, a MiCA-authorized exchange, providing a secure, euro-backed stablecoin for trading pairs, fiat on/off-ramps, and liquidity pools for European crypto investors.

-

Bridging Traditional Finance and Web3: EUROD serves as a regulated bridge between traditional banking (via ODDO BHF) and blockchain-based financial services, supporting new euro-denominated products such as tokenized bonds and digital asset settlements.

For investors and builders, this means a more predictable and scalable environment for euro-denominated digital assets. The combination of on-chain programmability, transparent reserves, and regulatory clarity has the potential to unlock new financial products native to Europe’s digital economy. Those tracking the evolution of non-USD stablecoins should closely watch how EUROD’s market share and integrations develop over the coming quarters.

Where to Learn More and Next Steps

As the European stablecoin landscape matures, staying informed is critical. For a deep dive into MiCA’s regulatory architecture and its implications for euro stablecoins like EUROD, explore our comprehensive analysis. Investors considering exposure to EUROD should also review ODDO BHF’s official documentation and Bit2Me’s listing details for up-to-date compliance and risk disclosures.

EUROD’s arrival marks a watershed moment for regulated digital assets in Europe. Whether you’re a DeFi strategist, institutional treasury manager, or crypto enthusiast searching for alternatives to USD-based tokens, ODDO BHF’s stablecoin offers a compelling blend of security, transparency, and on-chain utility. As MiCA-compliant euro stablecoins become the new standard, expect further innovation at the intersection of blockchain and traditional finance.