How EUROD and EURCV Are Changing Euro Stablecoins: Bank-Issued, Fully Backed & DeFi-Enabled

Euro-backed stablecoins are entering a new era, with major European banks stepping into onchain finance. The launch of EUROD stablecoin by ODDO BHF and EURCV Societe Generale (EUR CoinVertible) by SG-FORGE signals a shift: euro stablecoins are no longer just crypto-native experiments, but regulated, fully backed assets issued and managed by established financial institutions. This development is reshaping how the euro functions in both traditional and decentralized finance.

EUROD and EURCV: Bank-Issued, Fully Backed, MiCA Compliant

Both EUROD and EURCV are bank-issued stablecoins, fully collateralized with euro reserves and designed for compliance with the European Union’s Markets in Crypto-Assets (MiCA) regulation. This means they offer a level of transparency and regulatory oversight that most legacy euro stablecoins simply can’t match.

ODDO BHF’s EUROD is aimed at both retail and institutional users. It’s not just a payment token: it’s a bridge between the euro’s legacy infrastructure and the programmable world of blockchain. The bank has published a MiCA white paper detailing EUROD’s characteristics and risk profile, a move that sets a new standard for transparency in the sector.

EURCV Societe Generale is equally ambitious. Issued by SG-FORGE, EURCV is fully backed by cash reserves and redeemable 1: 1 for euros. It’s available on major public blockchains including Ethereum, Solana, XRPL, and Stellar. As of today, EURCV trades at $1.16, with a 24-hour range between $1.16 and $1.17 and a modest 0.87% gain.

[price_widget: Real-time EURCV price and volume]

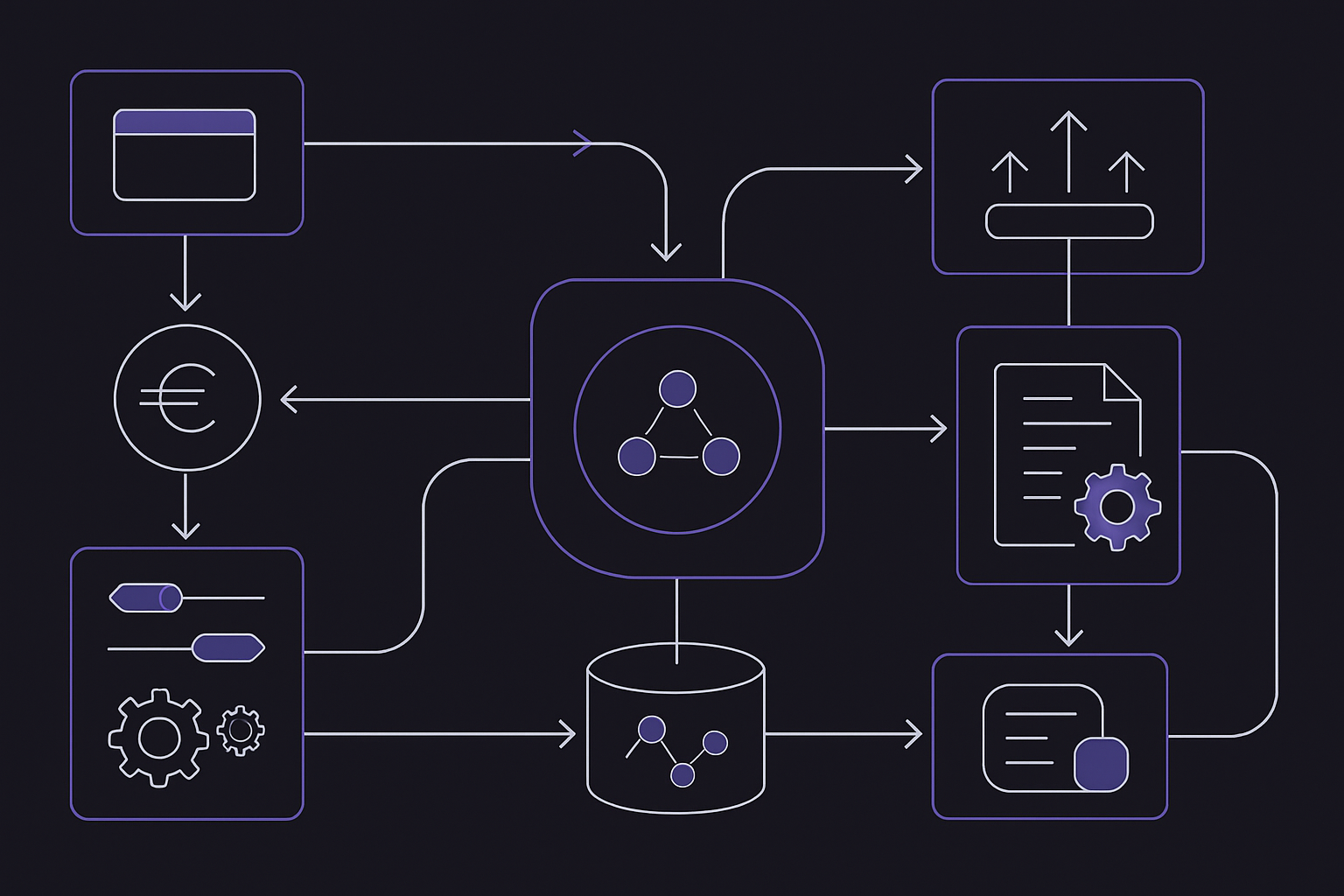

DeFi Integration: Lending, Yield, and Tokenized Assets

The real story is not just regulatory compliance. It’s about utility. Both EUROD and EURCV are being integrated directly into DeFi platforms. In September 2025, SG-FORGE deployed EURCV on Uniswap and Morpho, unlocking euro-based lending, borrowing, and spot trading. This isn’t hypothetical: users can now put their euros to work in DeFi, earning onchain yield or providing liquidity in a transparent, regulated environment.

EUROD follows a similar path. With its upcoming listing on Bit2Me and planned compatibility with multiple blockchains, ODDO BHF is positioning its stablecoin for broad adoption across payments, DeFi protocols, and tokenized asset trading. The focus is on real-world utility – not just speculation.

[technical_chart: EURCV price action and DeFi integration impact]

Why Bank-Issued Euro Stablecoins Matter Now

For years, euro stablecoins lagged behind their USD counterparts in both adoption and trust. Most were issued by startups with limited transparency or regulatory clarity. That’s changed in 2025. The arrival of MiCA-compliant, bank-issued euro stablecoins gives European users a credible alternative to USD stablecoins – and finally brings the euro into the heart of onchain finance.

This is a game-changer for anyone seeking to diversify out of dollar exposure or participate in euro-denominated DeFi. With full collateralization, clear redemption mechanisms, and robust regulatory oversight, both EUROD and EURCV set a new benchmark for what a trusted euro stablecoin should look like.

EUROD Euro Stablecoin (EUROD) Price Prediction 2026-2031

Forecast based on current market adoption, MiCA regulation, and growth in euro-backed stablecoins (as of October 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.00 | $1.07 | $1.15 | +0.9% | First full year of trading; price closely tracks euro; slight premium possible on high demand |

| 2027 | $1.00 | $1.09 | $1.18 | +1.9% | Increased DeFi integration; regulatory clarity strengthens confidence; adoption grows among institutions |

| 2028 | $1.00 | $1.11 | $1.22 | +1.8% | Eurozone monetary stability; more listings on European exchanges; broader retail usage |

| 2029 | $1.00 | $1.13 | $1.26 | +1.8% | Competing euro stablecoins (EURCV, others) drive innovation; minor volatility from market competition |

| 2030 | $1.00 | $1.15 | $1.30 | +1.7% | Tokenization of real-world assets accelerates demand; possible euro volatility impacts peg |

| 2031 | $1.00 | $1.16 | $1.35 | +0.9% | Mature market; stable premium for on-chain euro liquidity; DeFi and TradFi convergence |

Price Prediction Summary

EUROD is expected to maintain a value closely aligned with the euro, given its full collateralization and MiCA compliance. However, increasing DeFi adoption, institutional participation, and euro-denominated digital asset demand may create a consistent, modest premium over the underlying euro value, especially in times of high crypto market liquidity demand or euro market volatility. The minimum price should remain anchored at $1.00 due to redeemability, while average and maximum prices may reflect market-driven premiums.

Key Factors Affecting EUROD Euro Stablecoin Price

- MiCA regulatory enforcement and future updates

- Adoption by DeFi protocols and traditional financial institutions

- Competition from other euro stablecoins (EURCV, etc.)

- Market demand for euro-denominated digital assets

- Eurozone monetary policy and macroeconomic stability

- Liquidity on major exchanges and cross-chain integrations

- Potential black swan events affecting stablecoins or the euro

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These launches are not just technical upgrades; they are a strategic response to rising demand for onchain euro liquidity. As more European banks join the movement, expect increased competition, improved features, and broader access to euro-backed stablecoins across both retail and institutional channels. The significance is clear: the euro is finally getting a digital-native presence that matches its status as a global reserve currency.

What sets this new generation of euro stablecoins apart is their multi-chain approach. EURCV’s deployment on Ethereum, Solana, XRPL, and Stellar means users are no longer locked into a single ecosystem. This flexibility is critical for DeFi protocols seeking deep, euro-denominated liquidity and for traditional financial institutions exploring tokenized asset settlement.

Key Features Driving Adoption

Top 5 Features of EUROD and EURCV for DeFi Users

-

MiCA Regulatory Compliance: Both EUROD (by ODDO BHF) and EURCV (by SG-FORGE) are issued under the European Union’s Markets in Crypto-Assets (MiCA) regulation, ensuring robust legal protection and transparency for DeFi users.

-

Fully Euro-Backed and Redeemable: EUROD and EURCV are each fully backed by euro reserves and can be redeemed 1:1 for euros, providing stability and minimizing counterparty risk for DeFi participants.

-

Seamless DeFi Integration: EURCV is deployed on major DeFi platforms like Uniswap and Morpho, enabling lending, borrowing, and spot trading. EUROD is designed for similar integrations, supporting tokenized asset trading and digital payments.

-

Multi-Chain Accessibility: EURCV is available on public blockchains including Ethereum, Solana, XRPL, and Stellar, offering DeFi users broad network compatibility and flexibility.

-

Institutional-Grade Security: Issued by established financial institutions (ODDO BHF and SG-FORGE), both stablecoins benefit from rigorous oversight, secure custody, and transparent operations, appealing to both retail and institutional DeFi users.

Transparency is another major differentiator. Both ODDO BHF and SG-FORGE publish detailed reports on reserves and risk management, offering the kind of visibility regulators and institutional clients demand. This aligns with the new MiCA standards and sets a precedent for future bank-issued stablecoins in Europe.

For traders and investors, price stability is paramount. With EURCV currently trading at $1.16, it’s maintaining its peg within a tight range. This price consistency, paired with onchain redemption guarantees, makes these assets practical for everything from cross-border payments to sophisticated DeFi strategies.

The Road Ahead: What to Watch For

The next 12 months will be crucial as these euro-backed stablecoins expand their reach. Expect to see:

- More bank-issued stablecoins joining the market, accelerating euro DeFi adoption

- Integration with major exchanges and wallets for seamless retail access

- Growth in onchain euro lending, staking, and tokenized bonds

- Regulatory clarity fostering new enterprise use cases

The momentum is already attracting attention from other European banks looking to collaborate or launch their own projects. For a look at how this trend is shaping up across the continent, see our coverage of nine major European banks joining forces for a 2026 euro stablecoin launch.

The bottom line: EUROD and EURCV are reshaping the landscape for non-USD stablecoins. With institutional-grade backing, regulatory clarity, multi-chain support, and real DeFi integration, they offer European users a credible path into digital finance, no USD exposure required. As adoption grows, expect these assets to become foundational building blocks in both traditional banking and the rapidly evolving DeFi ecosystem.