How MiCA-Compliant Euro Stablecoins Will Compete With USD-Based Stablecoins in DeFi

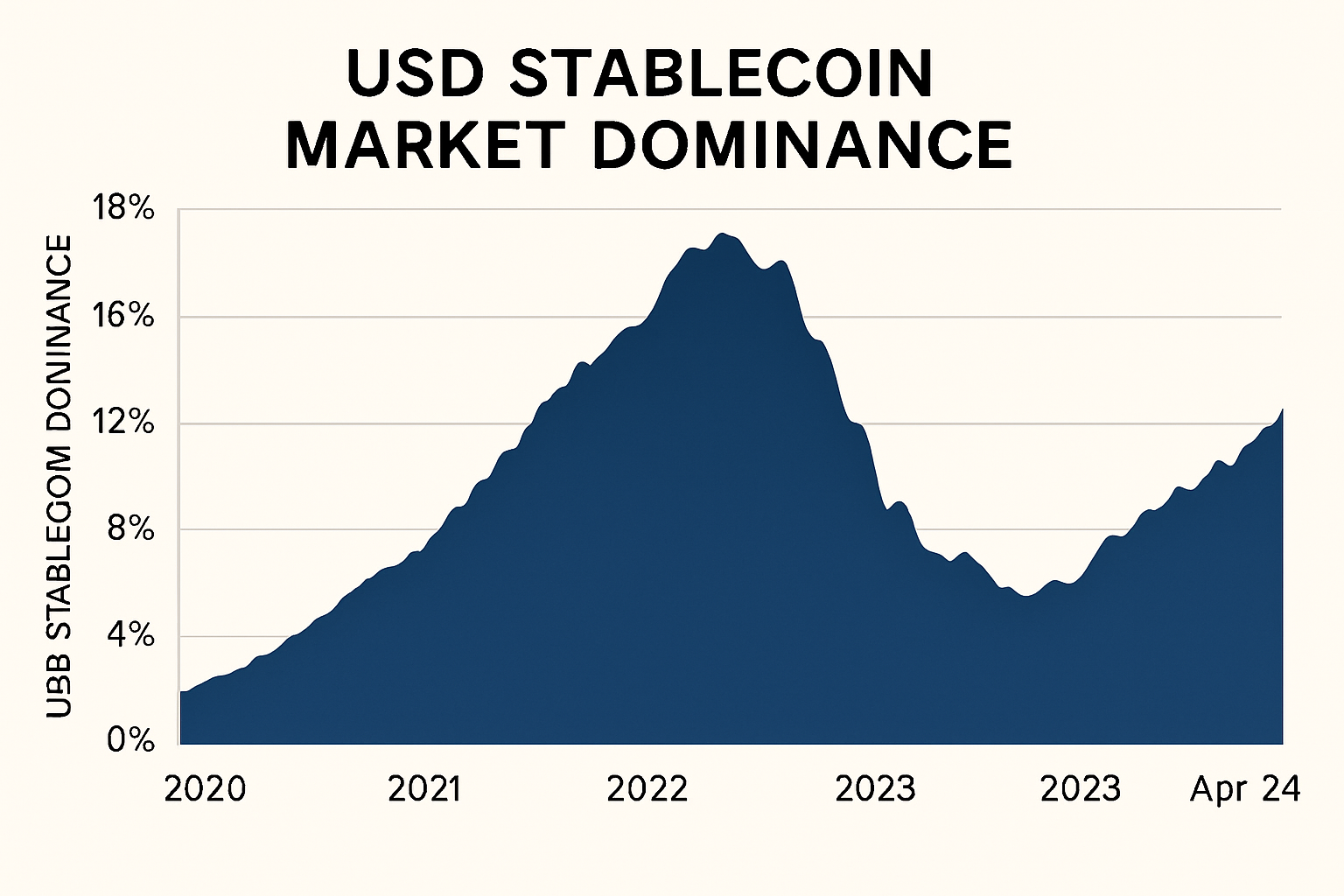

Europe’s digital asset landscape is undergoing a seismic shift as nine of the continent’s largest banks, including ING, UniCredit, CaixaBank, and SEB, prepare to launch a MiCA-compliant euro stablecoin. This collaborative effort, set against the backdrop of the EU’s Markets in Crypto-Assets (MiCA) regulation taking full effect in June 2024, marks a pivotal moment for non-USD stablecoins in decentralized finance (DeFi). While USD-backed tokens still command roughly 99% of the global stablecoin market capitalization, with euro-backed stablecoins representing just €350 million as of September 2025, European financial powerhouses are determined to challenge this dominance by leveraging regulatory clarity and institutional trust.

Regulatory Clarity: The MiCA Advantage

Unlike their USD counterparts, which often operate in regulatory grey zones, the new wave of MiCA-compliant euro stablecoins are governed by one of the world’s most robust crypto frameworks. MiCA mandates that so-called e-money tokens (EMTs) be issued only by licensed entities and fully backed by liquid reserves. This structure offers legal certainty not just for issuers but also for DeFi platforms and institutional investors who require transparent risk management. Circle’s EURC and Société Générale’s EURCV have already obtained EU electronic money licenses, setting a precedent for compliance-driven growth.

This regulatory rigor is no mere box-ticking exercise. It provides euro stablecoins with a strategic edge when courting banks, asset managers, and regulated DeFi protocols seeking alternatives to the sometimes unpredictable oversight facing USD-based competitors. For more on how MiCA is shaping Europe’s regulated stablecoin scene, see our deep dive on MiCA and Euro Stablecoins.

Institutional Muscle: European Banks Enter the Arena

The involvement of nine leading European banks in launching a pan-EU stablecoin is more than symbolic, it signals an intent to bring scale and credibility to the euro stablecoin vs USD stablecoin debate within DeFi. These institutions are leveraging their established payment infrastructure, compliance expertise, and client networks to ensure rapid adoption across both retail and institutional channels.

This bank-led initiative could accelerate integration with mainstream financial services, think instant settlement for cross-border payments or on-chain FX swaps denominated in euros, all while maintaining full regulatory oversight. As Europe’s banking giants eye rollout by 2026, they’re positioning their digital euro token as not just another liquidity option but as an anchor for Europe’s digital sovereignty in an ecosystem still dominated by dollar liquidity.

Pushing Into DeFi: Integration Strategies and Early Momentum

To compete head-on with entrenched USD tokens like USDC or USDT on platforms such as Uniswap or Aave, euro-denominated stablecoins must embed themselves deeply within DeFi infrastructure. Early signs are promising: Société Générale-FORGE has partnered with Bitpanda to make EURCV accessible to nearly 7 million retail users, a move that could turbocharge network effects if mirrored across other protocols.

- Liquidity incentives: Market makers are being incentivized to create deep pools for euro pairs on leading DEXs.

- Regulated lending markets: Licensed DeFi platforms can now offer collateralized lending using MiCA-compliant tokens, lowering counterparty risk.

- User familiarity: European retail users may soon find it easier (and safer) to earn yield or transfer funds using a regulated euro token directly from their banking apps.

The strategic integration between traditional finance (TradFi) and DeFi is accelerating as these new instruments roll out. For investors focused on diversification beyond dollar exposure, and those wary of US regulatory unpredictability, these developments present compelling new avenues for portfolio construction. If you’re considering how non-USD assets can reshape your crypto allocation strategy, check out our analysis on euro-pegged stablecoins in diversified portfolios.

While the groundwork is promising, the journey for MiCA-compliant euro stablecoins to dethrone USD-based incumbents in DeFi will be measured by adoption, liquidity depth, and seamless integration with existing protocols. The €350 million market cap of euro stablecoins as of September 2025 is dwarfed by the trillions in USD-backed tokens, but the regulatory momentum and institutional backing are shifting sentiment. As these bank-issued tokens hit public mainnets, their ability to offer transparent reserves and regulatory protection could appeal to risk-conscious users and institutions alike.

Key Differences: MiCA Euro Stablecoins vs. USD Stablecoins

-

Regulatory Compliance: MiCA-compliant euro stablecoins, such as EURC (by Circle) and EURCV (by Société Générale), are issued under the EU’s Markets in Crypto-Assets (MiCA) regulation, ensuring strict licensing, reserve, and transparency requirements. In contrast, most USD stablecoins (e.g., USDT, USDC) operate under varying regulatory regimes, with less uniform oversight in the US and globally.

-

Issuer Profile: MiCA-compliant euro stablecoins are increasingly issued by licensed European banks and financial institutions (e.g., ING, UniCredit, Société Générale), providing institutional credibility. USD stablecoins are typically issued by specialized fintech firms, such as Circle (USDC) and Tether (USDT), rather than traditional banks.

-

Market Dominance and Liquidity: USD stablecoins overwhelmingly dominate DeFi, accounting for approximately 99% of total stablecoin market capitalization, while euro-backed stablecoins have a market cap of around €350 million as of September 2025. This disparity impacts liquidity, trading pairs, and DeFi protocol integrations.

-

Legal Certainty and User Protection: MiCA mandates clear legal status, consumer protections, and full reserve backing for euro stablecoins, reducing counterparty risk for DeFi users. USD stablecoins offer varying degrees of legal clarity and reserve transparency, depending on issuer and jurisdiction.

-

Integration with DeFi Platforms: MiCA-compliant euro stablecoins are rapidly expanding integrations, exemplified by EURCV’s partnership with Bitpanda to reach millions of users. However, USD stablecoins remain the default for most DeFi protocols, offering broader utility and established liquidity pools.

-

Monetary Sovereignty and Policy Alignment: Euro stablecoins support European monetary autonomy and align with the European Central Bank’s goal to reduce reliance on USD-denominated assets in the region’s digital economy. USD stablecoins, while globally accepted, can raise concerns over external monetary influence in EU DeFi markets.

Liquidity remains a critical battleground. Market makers and DeFi platforms are experimenting with incentives such as reduced trading fees, higher yields on euro-denominated pools, and cross-chain bridges to facilitate capital flow between Ethereum, Polygon, and emerging L2s. These efforts are already showing traction: EURCV’s integration with Bitpanda provides a template for other banks and fintechs seeking compliant access to DeFi rails. The next phase will likely see more euro stablecoin pairs listed on major DEXs, improved fiat on-ramps for EU users, and innovative lending markets built around regulated collateral.

Community sentiment is also evolving. European crypto users who have long defaulted to dollar-pegged assets now have a homegrown alternative that aligns with local regulatory expectations and monetary policy interests. The ECB’s vocal push for digital monetary autonomy injects further urgency into the narrative, especially as geopolitical tensions highlight the risks of over-reliance on USD liquidity in global crypto markets.

What Could Tip the Scales?The Path Forward for Euro Stablecoins in DeFi

For MiCA-compliant euro stablecoins to move beyond niche status, several catalysts must align:

- Banks must deliver user-friendly interfaces that make minting, redeeming, and using euro tokens as simple as traditional online banking.

- DeFi protocols need robust incentives: such as higher APYs or exclusive governance rights, for early adopters of regulated euro assets.

- Cross-border payment solutions leveraging instant settlement can showcase real-world utility beyond speculation or yield farming.

- Clear interoperability standards will allow seamless movement of euro stablecoins across blockchains without compromising compliance.

The real test will come as institutional money flows into regulated DeFi products built around these new assets. If European banks can leverage their trusted brands while delivering true on-chain utility, rather than simply replicating legacy payment rails, MiCA-compliant euro stablecoins could become foundational to Europe’s digital finance strategy.

The coming years will reveal whether the combination of regulatory clarity, institutional muscle, and user-centric design can chip away at dollar dominance in decentralized markets. For now, all eyes are on Europe’s banking giants as they roll out their digital currency experiments under the watchful eye of MiCA, and set a precedent that other regions may soon follow.