CNH₮0 Launches on Conflux Network: Key Features for CNY Stablecoin Users

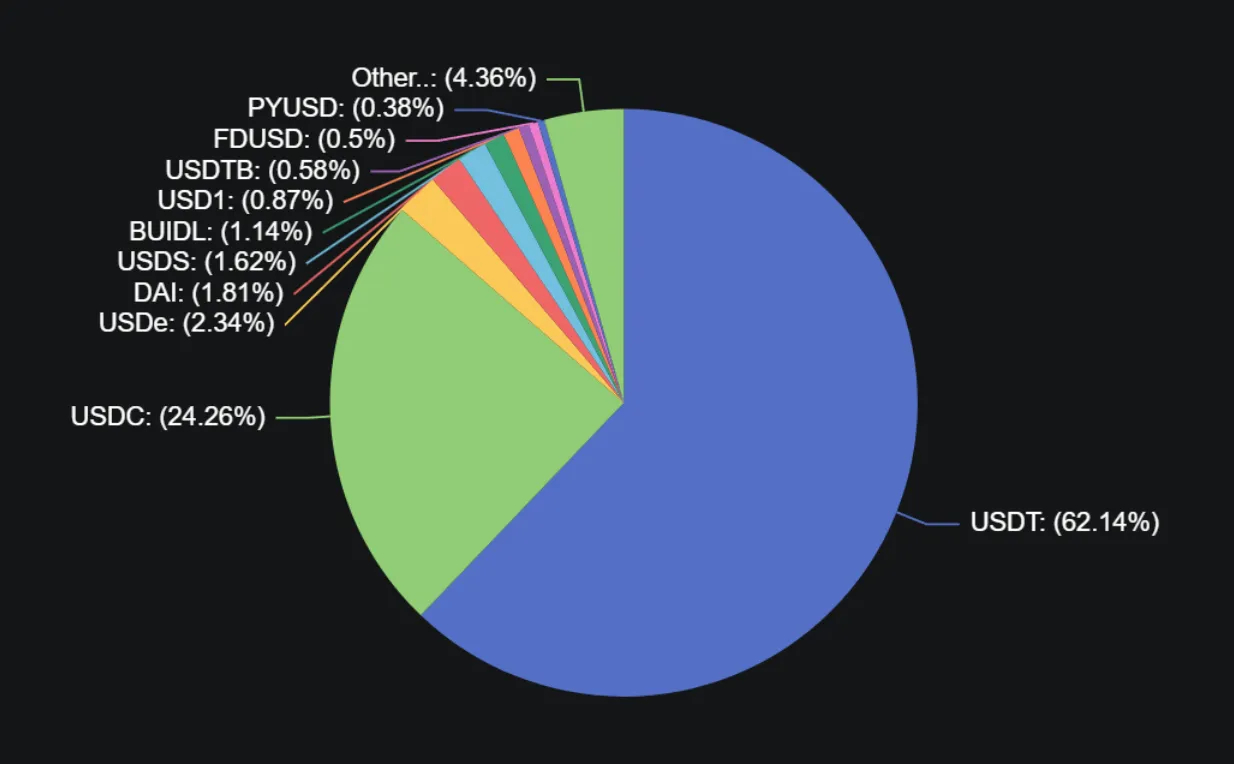

Hold onto your seats, crypto trailblazers! Tether’s launch of CNH₮0 on Conflux Network is shaking up the world of CNY stablecoins, delivering offshore yuan power directly to your DeFi toolkit. This isn’t just another stablecoin drop; it’s a gateway to frictionless cross-border liquidity that bridges US-China assets like never before. As a swing trader who’s ridden countless blockchain waves, I see this as a prime momentum play for diversifying beyond USD dominance.

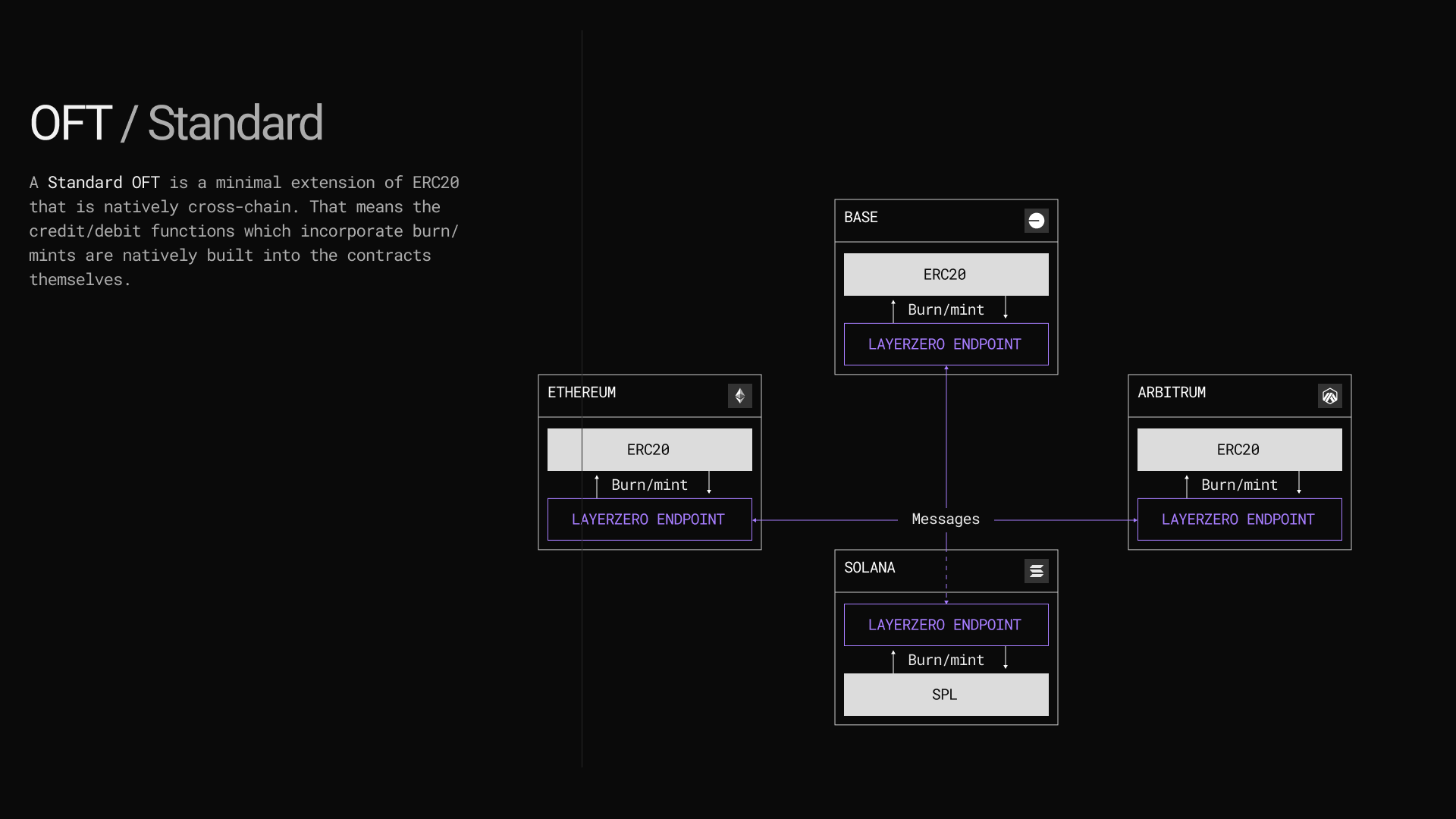

In November 2025, Tether unleashed CNH₮0, their offshore Chinese yuan-pegged stablecoin, exclusively on Conflux. Pegged 1: 1 to CNH, it taps into Tether’s robust reserves and Ethereum redemption system, ensuring rock-solid stability. What sets it apart? LayerZero’s Omnichain Fungible Token (OFT) standard powers native, seamless transfers across chains without wrapped tokens or liquidity pools getting in the way. No more fragmentation headaches for offshore yuan stablecoin enthusiasts.

Conflux 3.0: The Scalable Backbone for CNH₮0 Dominance

Conflux isn’t messing around. Their recent upgrade to version 3.0 cranks up scalability with real-time settlements and full EVM compatibility, making it a beast for stablecoin ops. Think lightning-fast transactions at a fraction of Ethereum gas fees, perfect for high-volume CNY stablecoin Conflux Network action. This positions Conflux as the go-to layer for programmable global money, linking USD₮0 and CNH₮0 in a dual-stablecoin powerhouse.

I’ve been charting Conflux’s momentum, and this launch aligns perfectly with its price cycles. For traders eyeing Tether CNH stablecoin, CNH₮0 slots right into DeFi protocols, payments, and trades. Conflux’s team nailed it: they’re pioneering liquidity expansion beyond USD stablecoins, and early adopters will reap the rewards.

LayerZero OFT Magic: Cross-Chain Freedom Unleashed

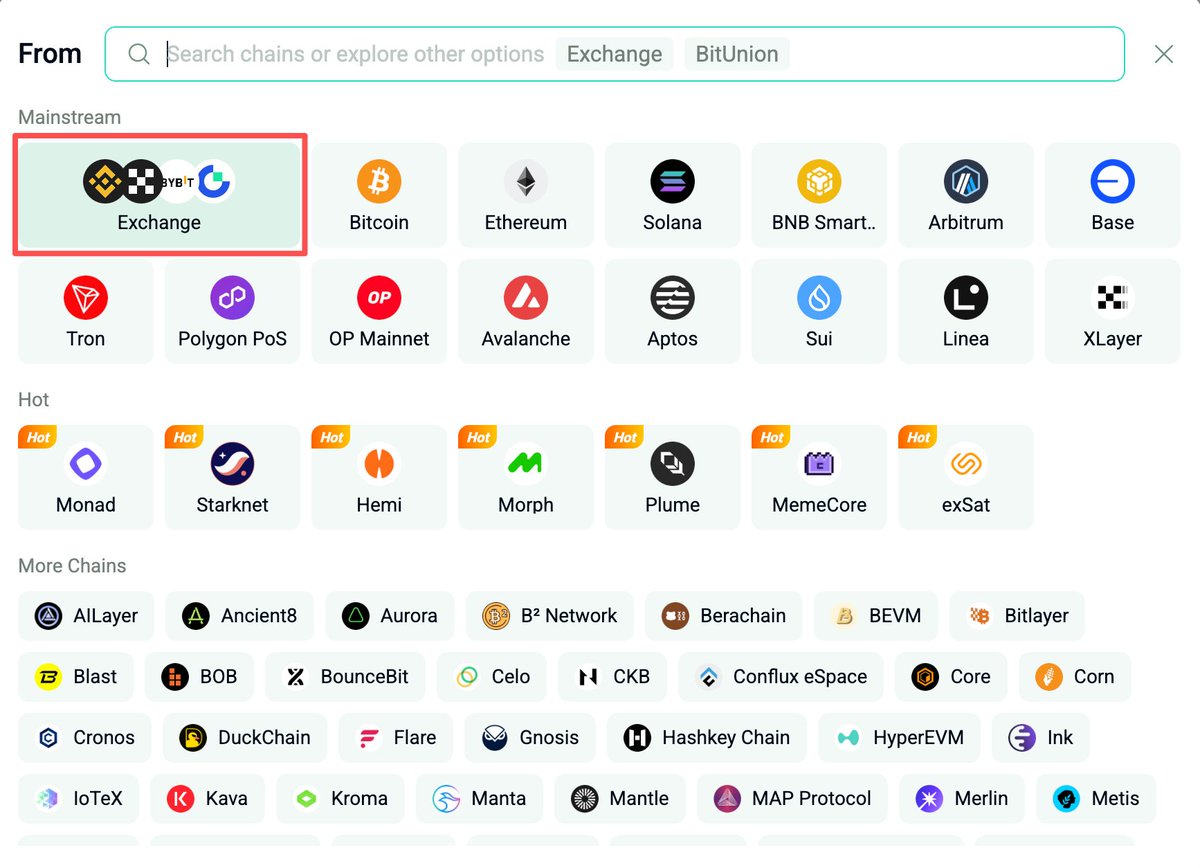

At the heart of CNH₮0’s appeal lies LayerZero’s OFT tech. This bad boy enables direct, chain-agnostic movement of CNH-backed value. Want to shift from Conflux to Ethereum or beyond? Done in one click, no bridges or intermediaries. Institutions love it for cross-border payments; retail traders dig the DeFi liquidity boost. It’s transforming non-USD stablecoins CNY into versatile assets that respect no borders.

Key Features of CNH₮0 on Conflux Network

| Feature | Benefit | |

|---|---|---|

| 🔗 | OFT Standard | Seamless multi-chain transfers |

| ⚙️ | EVM Compatible | Easy smart contract integration |

| ⚡ | Real-time Settlement | Ultra-fast transactions |

| 💰 | CNH Pegged | Offshore yuan stability |

| 🛡️ | Ethereum Redemption | Direct Tether backing |

Picture this: you’re swing trading CNH/USD pairs on-chain, and CNH₮0 lets you hedge volatility without leaving the blockchain. That’s the motivational edge we’ve craved in non-USD stables.

Strategic Wins for CNY Stablecoin Users

For CNH₮0 Conflux users, the perks stack high. First, diversification: pair it with USD₮0 for balanced exposure in a yuan-strengthening cycle. Second, real-world utility: remittances, trade finance, and settlements get turbocharged. Conflux’s China-friendly vibe, thanks to its regulatory nods, makes it a safe bet amid global crypto scrutiny.

Dive deeper into how offshore yuan-pegged tokens are reshaping on-chain FX here. As someone certified in technical analysis, I predict momentum building as liquidity pools deepen. Ride this wave smartly, but always respect the risks.

CNH₮0 isn’t solo; it’s twinned with USD₮0, creating a liquidity corridor that’s already buzzing in Conflux’s ecosystem. DeFi yields on CNH pairs? Incoming. Cross-chain arbitrage ops? Wide open. This launch screams opportunity for those bold enough to pivot from USD-centric plays.

But let’s drill down into what this means for your portfolio. As Conflux’s ecosystem heats up, CNH₮0 Conflux users gain access to DeFi protocols hungry for non-USD pairs. Lending platforms, DEXs, and yield farms are integrating it fast, offering competitive APYs that USD stables can’t match in a diversifying market. Swing traders like me thrive here: spot CNH strength against volatile fiat swings, enter positions with low fees, and exit cross-chain without slippage nightmares.

Unlocking DeFi and Real-World Power Playswith CNH₮0

The real fire? CNH₮0’s role in bridging TradFi and DeFi. Offshore yuan settlements for Asian trade corridors become instant and programmable. Imagine exporters settling invoices in seconds, not days, dodging forex fees. For crypto natives, it’s fuel for sophisticated strategies: collateralize CNH₮0 for leveraged USD₮0 borrows or arbitrage CNH/USD spreads across chains. Conflux’s EVM compatibility means your favorite Ethereum tools port over effortlessly, amplifying CNY stablecoin Conflux Network adoption.

CNH₮0 Wins for Swing Traders

-

Low-Fee Cross-Chain Transfers: Leverage LayerZero’s OFT standard for seamless, cost-effective moves across chains without wrapped tokens.

-

DeFi Yield on CNH Pairs: Unlock high yields in Conflux DeFi protocols using CNH₮0 as a core liquidity asset.

-

Hedge USD Dominance: Diversify with CNH exposure alongside USD₮0 for balanced global liquidity plays.

-

Real-Time Settlements: Enter/exit positions instantly via Conflux 3.0’s scalable, EVM-compatible real-time finality.

-

Regulatory-Friendly China Access: Gain compliant offshore CNH exposure on China-approved Conflux Network.

I’ve tested similar setups in FX markets, and this feels like momentum ignition. Pair CNH₮0 with Conflux’s native CFX for boosted liquidity mining rewards. Early data shows trading volumes spiking, signaling the next leg up. Don’t sleep on this; position now while pools are shallow.

Navigating Risks in the Yuan Wave

Every wave has chop. Peg stability is Tether’s strong suit, backed by CNH reserves and Ethereum redemptions, but offshore yuan faces geopolitical ripples. Conflux mitigates with its China-approved status, yet monitor PBOC signals closely. Gas fees? Negligible. Smart contract risks? Audit trails are solid via LayerZero. My advice: allocate 5-10% of your stables portfolio here, use stop-losses on CFX exposure, and rebalance quarterly. Respect the risks, but the upside in non-USD stablecoins CNY is massive.

Conflux is thrilled to pioneer the expansion of liquidity beyond USD stablecoins.

That quote from the Conflux team captures the vibe. As Tether CNH stablecoin evolves, expect integrations with wallets like MetaMask and exchanges like Binance expanding support. This isn’t hype; it’s infrastructure shift.

For momentum chasers, watch for liquidity milestones: when CNH₮0 TVL hits $100M, expect price catalysts on CFX. Combine with technicals like RSI divergences on weekly charts for entry signals. This launch cements Conflux as the hub for offshore yuan stablecoin action, pulling in institutions wary of pure Ethereum costs.

Stepping back, CNH₮0 on Conflux redefines non-USD stables. It empowers you to ride yuan cycles with blockchain precision, diversify smartly, and tap Asia’s economic engine. Whether you’re hedging trades or building long-term stacks, this is your cue to act. Chart it, trade it, own the momentum. The waves are cresting; grab your board.