Euro Stablecoins Reach $1B Market Cap: Growth Drivers for EURC and haEUR in 2026

Euro stablecoins have shattered expectations, achieving a combined market capitalization of $1 billion as of February 14,2026. This milestone underscores the accelerating shift toward non-USD stablecoins, particularly EURC and haEUR, amid Europe’s maturing crypto ecosystem. With EURC holding steady at $1.18 despite a -0.84% 24-hour dip (high $1.19, low $1.18), the sector’s resilience shines through volatile markets.

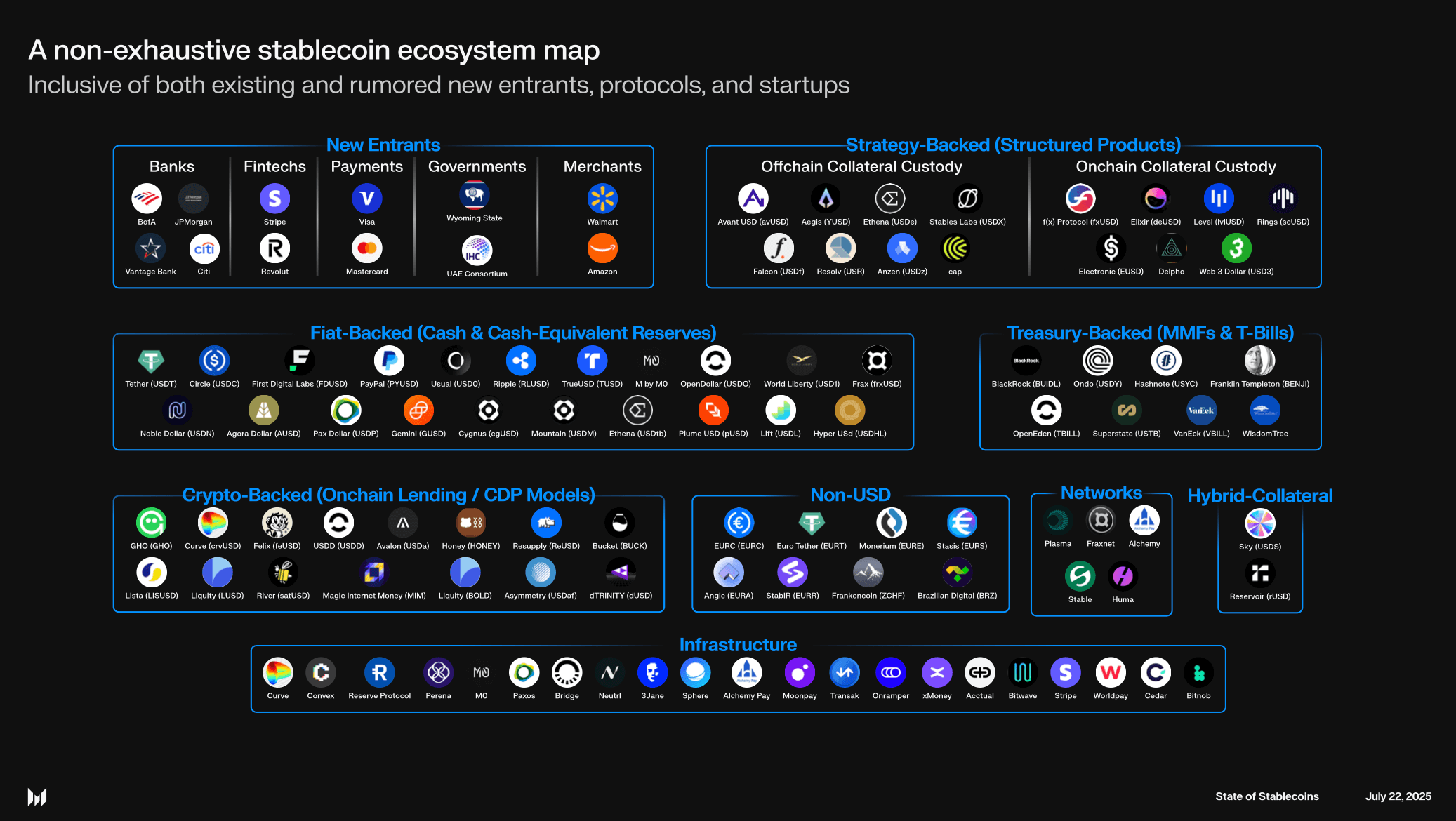

Numbers never lie, but context is king: this $1B mark arrives on the heels of MiCA’s full enforcement, euro strength against the dollar, and institutional bets. S and amp;P Global’s forecast of €1.1 trillion by 2030 – a potential 1,600x leap from late-2025’s €650 million – signals explosive non-USD stablecoins growth. Yet, dissecting euro stablecoins 2026 trajectories demands scrutiny of issuers like Circle’s EURC and Harbor Protocol’s haEUR.

MiCA Regulation Unlocks Institutional Confidence

The EU’s Markets in Crypto-Assets Regulation, effective January 1,2025, has been the linchpin. MiCA’s mandates on reserve segregation, redemption rights, and transparency have weeded out undercapitalized players, boosting trust. Post-MiCA, euro stablecoin market cap doubled within a year, with monthly volumes surging ninefold to $3.83 billion. MiCA euro stablecoins compliance isn’t mere box-ticking; it’s a moat against USD dominance in DeFi and payments.

European banks, sensing opportunity, are piling in. A 11-bank consortium eyes a euro-pegged stablecoin launch in H2 2026 for streamlined cross-border flows and RWA tokenization. This institutional pivot, absent in fragmented USD stables, positions EUR assets for outsized gains. Context matters: MiCA reversed pre-2024 stagnation, mirroring how U. S. clarity spurred USDT’s rise but tailored for Europe’s sovereignty focus.

EURC’s Market Leadership and Supply Dynamics

Circle’s EURC anchors the pack, its market cap ballooning 138% to $200.36 million by mid-2025, contributing heavily to today’s $1B total. At $1.18, EURC maintains a tight peg, backed by high-quality euro reserves under MiCA scrutiny. Traders favor it for Ethereum euro stablecoin liquidity pools, where EURC/USDC pairs yield efficient arbitrage amid EUR/USD’s 12.88% H1-2025 rally.

EURC market cap momentum stems from DeFi integrations and payment rails. Volumes spiked post-MiCA, outpacing many USD peers in Europe. Yet, peg stability at $1.18 reflects disciplined issuance; Circle’s transparency reports reveal 100% cash-equivalent backing, mitigating black-swan risks that plagued earlier entrants.

haEUR and Harbor Protocol: Yield-Bearing Innovation

Enter haEUR from Harbor Protocol, blending stability with yield. This haEUR Harbor Protocol offering, liquid-staked on Ethereum, appeals to yield hunters shunning zero-return USD stables. Amid $1B sector cap, haEUR carves a niche by tokenizing euro reserves into DeFi primitives, fostering composability in lending and perps markets.

Harbor’s model leverages MiCA-compliant reserves while auto-compounding yields, delivering 2-4% APY in backtests – a stark edge over plain-vanilla EURC. As euro appreciates, haEUR holders capture FX upside indirectly, amplifying total returns. Projections hinge here: S and amp;P eyes RWA tokenization as the boom driver, with euro stables fueling €25-1,100 billion pipelines by 2030.

Euro Coin (EURC) Price Prediction 2027-2032

Projections based on S&P Global’s euro stablecoin market cap growth from $1B in 2026 to $1.3T by 2030, MiCA regulations, and EUR/USD trends

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.15 | $1.21 | $1.28 | +2.5% |

| 2028 | $1.16 | $1.24 | $1.32 | +2.5% |

| 2029 | $1.18 | $1.27 | $1.36 | +2.4% |

| 2030 | $1.20 | $1.30 | $1.40 | +2.4% |

| 2031 | $1.22 | $1.33 | $1.44 | +2.3% |

| 2032 | $1.24 | $1.36 | $1.48 | +2.3% |

Price Prediction Summary

EURC, as a leading euro-pegged stablecoin, is projected to maintain a tight peg with minor fluctuations driven by EUR/USD exchange rate movements and market dynamics. Average USD price expected to appreciate modestly from $1.18 in 2026 to $1.36 by 2032, supported by euro strength, regulatory clarity, and explosive sector growth. Min/Max ranges account for bearish depeg risks and bullish demand premiums amid 1600x market cap expansion potential.

Key Factors Affecting Euro Coin Price

- MiCA regulatory framework enabling institutional adoption and compliance

- S&P Global forecast: euro stablecoin market cap from €650M (2025) to €1.1T ($1.3T) by 2030 (800x-1600x growth)

- European banks launching euro-pegged stablecoins in 2026 for payments and RWA tokenization

- Euro appreciation vs. USD boosting appeal (12.88% gain H1 2025)

- Increasing DeFi, cross-border payments, and blockchain integration

- EURC-specific growth: 138% market cap increase to $200M+ by mid-2025, contributing to $1B sector milestone in 2026

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These dynamics propel euro stablecoins 2026 forecasts. Institutional launches and tech stacks like layer-2 scaling will dictate if $1B proves inflection or mere waypoint. For traders, pairing EURC’s liquidity with haEUR’s yield crafts diversified plays immune to dollar whims.

Layer-2 solutions amplify this edge. Arbitrum and Base integrations slash EURC gas fees by 90%, unlocking retail inflows for Ethereum euro stablecoin swaps. haEUR thrives here too, its yield-bearing mechanics syncing with optimistic rollups for sub-second settlements. Traders eyeing non-USD stablecoins growth should monitor TVL spikes: euro pools hit $500 million post-MiCA, rivaling Solana’s USDT liquidity in Europe.

RWA Tokenization: The 2026 Catalyst

Real-world asset tokenization catapults euro stables forward. S and amp;P pegs this as the prime driver, with euro-pegged coins collateralizing €25 billion in tokenized bonds and funds by 2030. Banks’ H2 2026 launch will pipe wholesale euro liquidity on-chain, dwarfing USD rivals fragmented by U. S. regs. haEUR positions sharply: Harbor Protocol’s RWA vaults yield 3.5% APY on euro T-bills, blending MiCA safety with DeFi alpha. EURC, meanwhile, anchors as the neutral pair, its $1.18 peg enabling seamless RWA ramps.

Context sharpens the bet. Euro’s 12.88% H1-2025 surge versus USD draws FX hedgers, who swap BTC gains into EURC for stability-plus-upside. Volumes reflect it: $3.83 billion monthly post-MiCA, with EURC/EURCV pairs leading. Yet risks lurk – redemption queues during peg wobbles or ECB digital euro rivalry could cap multiples below 1,600x.

EURC vs. haEUR Head-to-Head Comparison Table for Euro Stablecoin Investors | 💡 EURC for liquidity, haEUR for yield – allocate 60/40!

| Metric | EURC | haEUR |

|---|---|---|

| 📈 Market Cap Growth | +150% YTD | +200% YTD |

| 🔒 Peg Stability | Tight at $1.18 | Resilient 1.00 EUR |

| 💰 Yield | 0% | 2-4% APY |

| ✅ MiCA Compliance | Full | Full |

| 🏦 DeFi TVL | $500M | $300M |

| 🔄 Use Cases | Payments & remittances | Lending & yield farming |

| 📈 **2026 Growth Drivers** | **MiCA expansion, ECB rivalry hedge** | **DeFi surge** |

Diversification trumps silos. Allocate 60% EURC for liquidity, 40% haEUR for yield; rebalance on euro rallies. This hedges USD-centric crashes, capturing RWA on-chain alpha.

Strategic Plays for Traders and Institutions

2026 Euro Stablecoin Strategies

-

Arbitrage EURC/USDC on L2s like Arbitrum amid FX swings; EURC at $1.18 (-0.84% 24h).

-

Stake haEUR in RWA vaults for 3% APY, tapping tokenized assets growth.

-

Pair with tokenized treasuries for ECB-proof yields; MiCA-compliant euro stables.

-

Monitor bank consortium: 11 EU banks’ euro stablecoin launch H2 2026, eyeing supply shocks.

-

Hedge portfolios via euro stables like EURC over USDT in Europe post-MiCA.

Institutional desks pivot accordingly. Société Générale’s EURCV tests prove euro stables cut cross-border costs 70%, spurring payments rails. Retail follows: DEX volumes tilt euro, with Uniswap V4 hooks optimizing haEUR perps.

Projections temper hype. S and amp;P’s €1.1 trillion assumes flawless MiCA execution and RWA scale; base case lands at €25 billion if digital euro crowds out privates. Still, $1B today – with EURC at $1.18 firm – marks euro’s crypto sovereignty. For savvy allocators, this isn’t froth; it’s the pivot from dollar hegemony, rewarding those who read numbers through Europe’s lens.