Euro Stablecoins Hit $1 Billion Market Cap in 2026: Growth Drivers After MiCA Boost

In the crisp dawn of 2026, euro stablecoins stand at a pivotal crossroads, their market capitalization swelling to approximately $680 million as of February. This surge, a stark doubling from levels just a year prior, whispers of a seismic shift fueled by the European Union’s Markets in Crypto-Assets (MiCA) regulation. No longer mere footnotes in the USD-dominated stablecoin saga, these euro-pegged tokens are carving out a niche, promising diversification for investors weary of dollar hegemony.

MiCA’s full embrace on December 30,2024, acted as the spark. By imposing rigorous standards for reserves, transparency, and licensing, the framework weeded out shadows while inviting sunlight. Issuers like Circle with EURC and even newer entrants have flourished under this clarity, their transaction volumes exploding nearly ninefold to $3.83 billion monthly. Yet, this is no blind boom; it’s a calculated ascent, where regulatory guardrails meet burgeoning demand from DeFi protocols and cross-border payments seeking euro-native liquidity.

MiCA’s Enduring Ripple Effects

The regulation’s genius lies in its balance: stringent enough to deter fly-by-nights, flexible enough to nurture innovation. Post-MiCA, euro stablecoins have not just grown in cap but in utility. Platforms integrating EUR-pegged assets report smoother settlements within the Eurozone, sidestepping forex friction that plagues USD alternatives. Consider the quiet revolution in tokenized payments; banks and fintechs now eye these stables as bridges to blockchain efficiency without abandoning fiat comforts.

MiCA has provided a clear regulatory framework, encouraging institutional adoption and fostering innovation in the euro stablecoin sector.

This isn’t hype; data bears it out. From a modest base, the sector’s resilience shines amid global volatility, underscoring MiCA’s role in elevating MiCA euro stablecoins from experiment to essential.

S and P Global’s Ambitious Horizon

S and amp;P Global Ratings peers into the crystal ball, forecasting euro stablecoins ballooning to €1.1 trillion by 2030 – a staggering leap from today’s $680 million perch. This isn’t mere extrapolation; it’s rooted in tokenization trends, where real-world assets like bonds and real estate morph into on-chain euro equivalents. Picture vast troves of euro liquidity fueling DeFi yields, RWAs, and even the digital euro’s shadowy companion.

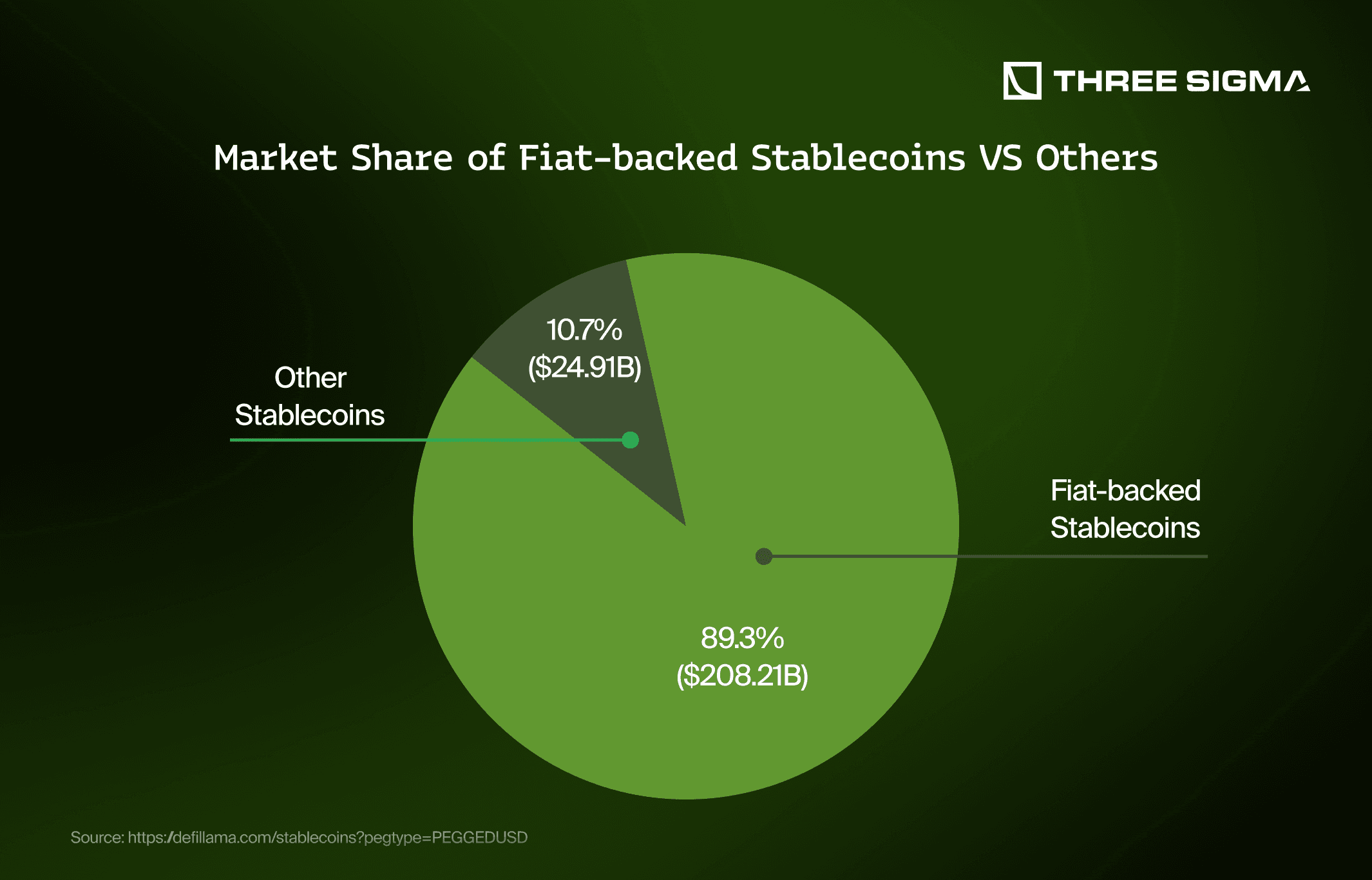

Drivers? Tokenized payment systems poised to slash costs in a fragmented Europe, plus institutional inflows chasing regulated yields. Yet nuance tempers optimism: Europe trails in adoption, with USD stables still king at 99% dominance. S and amp;P’s upper bound envisions a 1600x surge, but realism demands addressing hurdles like interoperability and the ECB’s watchful gaze.

Euro Stablecoins Market Cap Prediction 2027-2032

Projections in USD based on S&P Global forecasts, MiCA-driven growth, and market analysis as of 2026 (baseline: $680M in 2026)

| Year | Minimum Market Cap (USD) | Average Market Cap (USD) | Maximum Market Cap (USD) |

|---|---|---|---|

| 2027 | $100B | $216B | $300B |

| 2028 | $200B | $540B | $900B |

| 2029 | $300B | $864B | $1.62T |

| 2030 | $420B | $1.19T | $2.43T |

| 2031 | $525B | $1.49T | $3.24T |

| 2032 | $630B | $1.78T | $4.25T |

Price Prediction Summary

Euro stablecoins are forecasted to experience hyper-growth post-MiCA implementation, with average market cap surging from $216B in 2027 to $1.78T by 2032. Bearish scenarios account for regulatory delays and competition from USD stablecoins, while bullish cases factor in rapid RWA tokenization and bank-led adoption.

Key Factors Affecting Euro Coin Price

- MiCA regulation providing clear framework and boosting institutional confidence

- Launch of MiCA-compliant stablecoin by 11 European banks in H2 2026

- Tokenization of real-world assets (RWAs) and payment systems

- Increasing transaction volumes (e.g., 9x surge post-MiCA)

- Competition from USD-pegged stablecoins and potential CBDC (digital euro)

- Broader crypto market cycles and EUR/USD exchange rate fluctuations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Banks Forge Ahead with Consortium Play

Whispers of institutional heft grow louder: a consortium of 11 European banks, including heavyweights like Unicredit and Progmati, gears up for a MiCA-compliant euro stablecoin launch in H2 2026. This move signals more than momentum; it’s a declaration that traditional finance sees euro stables as the future of programmable money. No longer content spectating, these players aim to blend legacy rails with blockchain speed, targeting wholesale payments and treasury ops.

Such alliances could turbocharge EUR stablecoin market cap, injecting billions in reserves and trust. Imagine seamless euro transfers across borders, tokenized deposits yielding returns – all under MiCA’s umbrella. Challenges persist, from digital euro competition to scaling tech, but the trajectory points upward, redefining euro stablecoins 2026 as a cornerstone of global crypto diversification.

Dive deeper into the bank consortium’s blueprint, where partnerships promise to reshape Europe’s crypto landscape.

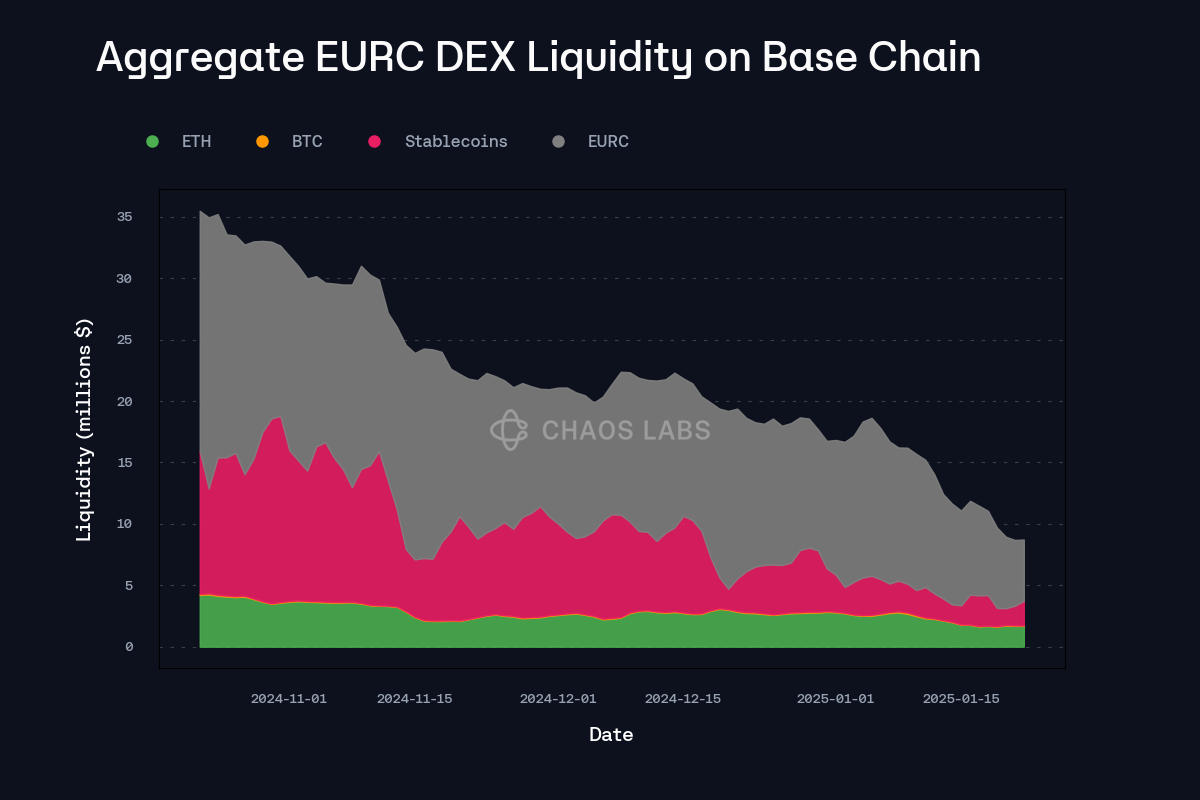

Circle’s EURC exemplifies this momentum, its reserves backed by euro cash and equivalents under MiCA’s watchful eye. Transaction surges – up nearly ninefold to $3.83 billion monthly – underscore real-world traction, from DeFi lending pools to remittance corridors favoring euro liquidity. Competitors like EURCV trail but gain ground, their variable yields attracting yield-hungry Europeans navigating negative rates elsewhere. These aren’t just tokens; they’re evolving instruments blending stability with programmability.

Unpacking the Growth Drivers

What propels euro stablecoins 2026 toward trillion-scale ambitions? Beyond MiCA’s clarity, tokenization of real-world assets looms large. Bonds, invoices, even property fractions tokenized in euros could unlock trillions in idle capital, per S and P’s lens. DeFi platforms, long starved for non-USD pairs, now host robust EUR liquidity pools, slashing impermanent loss risks for eurozone traders. Cross-border payments benefit too; imagine Paris fintechs settling with Berlin suppliers in seconds, not days, sans FX volatility.

5 Key Growth Drivers

-

MiCA regulatory clarity boosting trust: Effective December 30, 2024, MiCA doubled market cap to $680 million by February 2026, with monthly volume surging ninefold to $3.83 billion, drawing institutions.

-

Bank consortium launch injecting billions: 11 European banks plan a MiCA-compliant euro stablecoin in H2 2026, unlocking vast institutional capital.

-

RWA tokenization trends: S&P Global eyes €1.1 trillion market by 2030, propelled by euro stablecoins enabling tokenized assets and payments.

-

DeFi integration for native EUR yields: Platforms like Aave and Curve offer euro-denominated yields, attracting users avoiding USD FX risks.

-

Diversification from USD dominance: Euro stablecoins, at 0.006% of eurozone’s $15.5 trillion supply, counter USDT/USDC hegemony amid regulatory shifts.

Institutional appetite sharpens the edge. The 11-bank consortium’s H2 2026 debut promises wholesale-grade stables, potentially dwarfing current issuers. Unicredit and Progmati’s involvement hints at hybrid models: euro stables as CBDC complements, not rivals, threading the ECB’s digital euro ambitions with private innovation.

Yet growth isn’t linear. Europe grapples with USD stablecoin inertia; Tether and USDC command 99% of volumes, their global entrenchment a formidable moat. Adoption lags in retail, where education gaps and UX hurdles persist. The ECB’s digital euro pilot, slated for 2026 trials, casts a long shadow – could it cannibalize private stables? Nuance here: regulated euro tokens might coexist, powering rails the CBDC overlooks.

EURC’s post-MiCA volume explosion offers clues, revealing how compliance ignites demand in unexpected quarters.

Navigating Hurdles Toward $1 Billion and Beyond

From today’s $680 million foothold, breaching $1 billion in 2026 feels within reach, propelled by these tailwinds. S and P’s €1.1 trillion 2030 vision hinges on interoperability bridges linking silos – Ethereum, Solana, and emerging euro chains. Regulatory harmonization beyond MiCA, perhaps via global standards, could accelerate this. Investors eyeing non-USD stablecoins growth find euro assets compelling: lower correlation to Fed whims, hedge against dollar peaks.

Scalability tests await. As volumes swell, Layer-2 solutions tailored for euro throughput emerge, promising sub-cent fees. Security incidents, rare but vivid, demand vigilant audits; MiCA’s mandates help, but issuer discipline defines longevity. For traders, arbitrage windows between EURC spot and futures beckon, while long-term holders bet on euro stables as portfolio anchors in a multipolar crypto world.

Zoom out, and euro stablecoins signal a broader reconfiguration. No longer USD vassals, they empower Eurozone sovereignty in digital finance, fostering EUR stablecoin market cap trajectories that rival legacy systems. Banks’ entry cements this shift, blending TradFi gravitas with blockchain verve. As tokenized ecosystems mature, expect euro stables to underpin everything from supply-chain finance to metaverse economies – all pegged to Europe’s economic heartbeat.

Watch H2 2026 closely; the consortium’s splash could catalyze the $1 billion milestone, validating S and P’s bold stroke. In this arena, patience rewards the prescient, as MiCA-forged euro tokens redefine stability on their terms.