JPYC Stablecoin Liquidity Pools: Earning 1000 JPY Fees in 70 Days vs Japanese Bank Yields

As Japan’s monetary policy shifts with the Bank of Japan’s key short-term interest rate at 0.75%, savers face a pivotal choice: stick with major banks like MUFG or Mizuho offering a modest 0.3% annual rate on ordinary deposits, or dive into JPYC stablecoin liquidity pools promising 1,000 JPY in fees over 70 days. This Japanese yen stablecoin, trading at $0.006916, delivers DeFi yields that outpace traditional options, backed by yen bank deposits and government bonds for 1: 1 parity.

JPYC’s arrival on Ethereum, Avalanche, and Polygon marks a strategic pivot for non-USD stablecoins. Fully collateralized and regulated, it sidesteps the pitfalls of earlier prepaid models, positioning itself as Asia’s truly global yen-pegged asset. With Japanese bond yields climbing past 3% on the long end, the timing aligns perfectly for liquidity providers seeking yen stablecoin DeFi opportunities.

JPYC’s Solid Foundation in a Rising Rate Environment

The JPYC stablecoin stands out with its 100% backing by domestic savings and Japanese government bonds (JGBs), ensuring convertibility and stability amid the Bank of Japan’s most aggressive hikes in decades. Launched by JPYC Inc. , it operates across multiple blockchains, enabling seamless access to liquidity pools on Polygon for optimized JPYC Polygon yields. Recent market data shows JPY Coin v1 (JPYC) at $0.006916, up and $0.000140 ( and 0.0212%) in 24 hours, with a high of $0.006923 and low of $0.006773.

This resilience contrasts with global turbulence from yen carry trade unwinds, where USD, US bonds, and even BTC felt the pressure. Yet JPYC maintains its peg, appealing to traders diversifying beyond USD stables. For those eyeing Japan’s first regulated yen-backed stablecoin, the blend of security and yield potential redefines non-USD stablecoins.

JPYC and others like Common Stability represent parallel tracks, not rivals, carving distinct paths in yen stablecoin DeFi.

Bank Deposits Hit 0.3%: A New High, But Is It Enough?

Major Japanese banks raised ordinary deposit rates to 0.3% effective February 2,2026, the highest since 1993. This follows the BOJ’s December 2025 hike to 0.75%, signaling normalization after years of near-zero policy. For a 1 million JPY deposit, that’s roughly 3,000 JPY annually, safe but underwhelming against surging 30-year JGB yields and potential liquidity drains impacting global markets.

Strategic insight: While banks provide principal protection, their yields lag inflation and offer no exposure to DeFi growth. Liquidity providers in JPYC pools, however, tap into trading fees and incentives, potentially netting far superior returns without selling yen exposure.

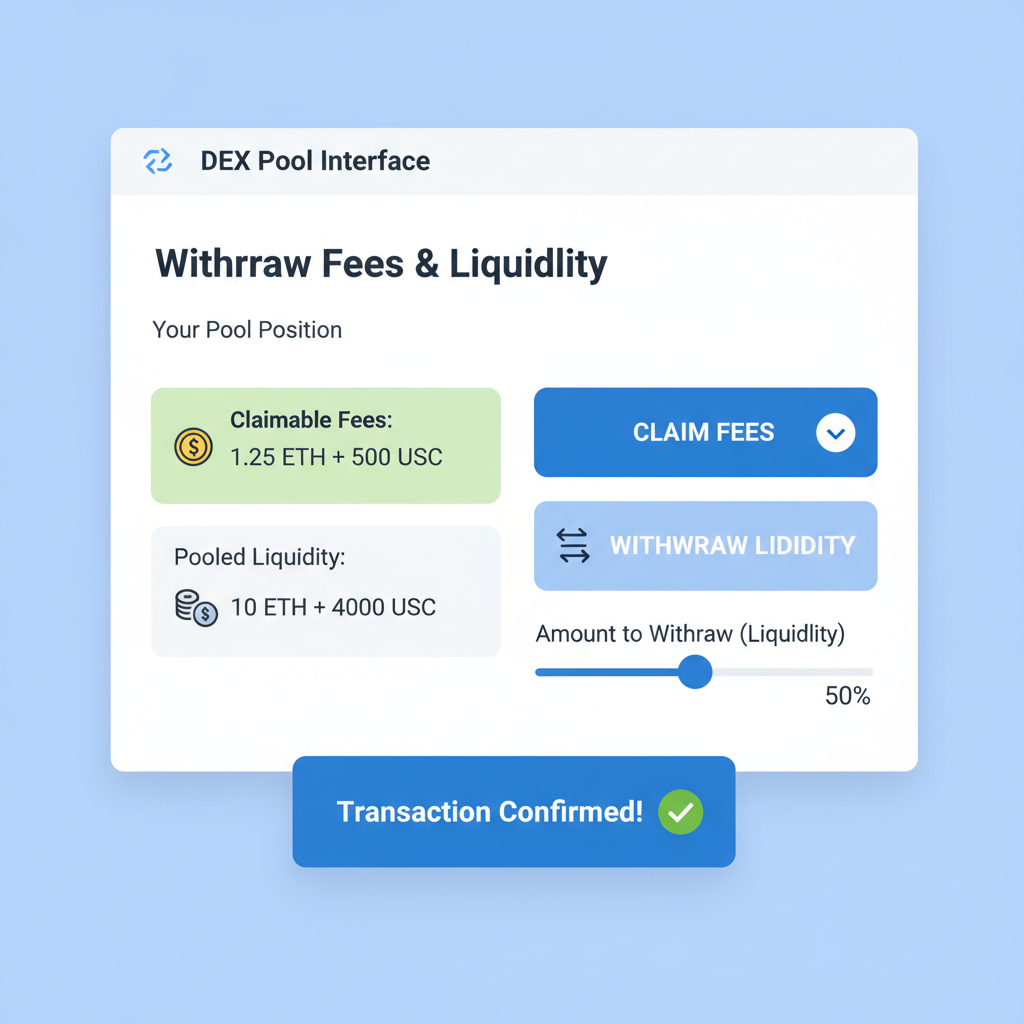

DeFi Yields in Action: 1,000 JPY Fees from JPYC Pools

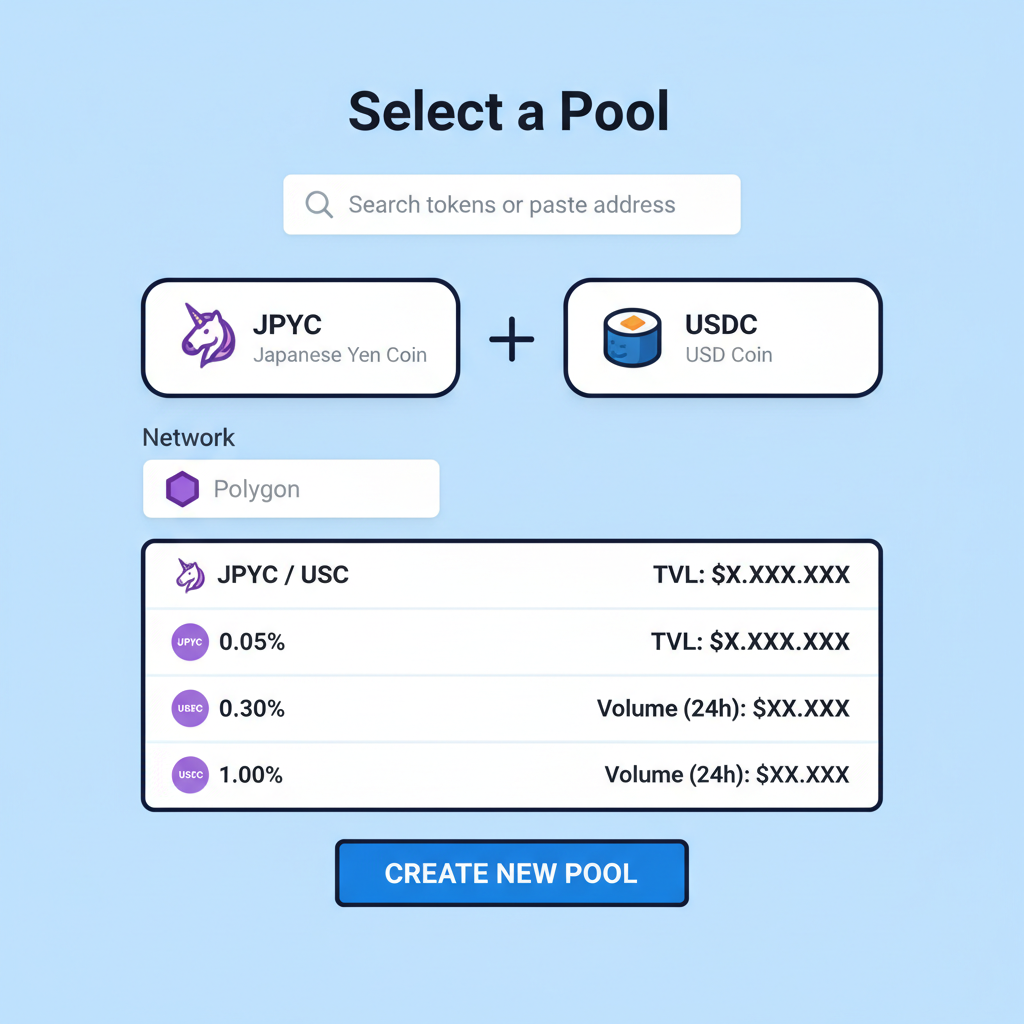

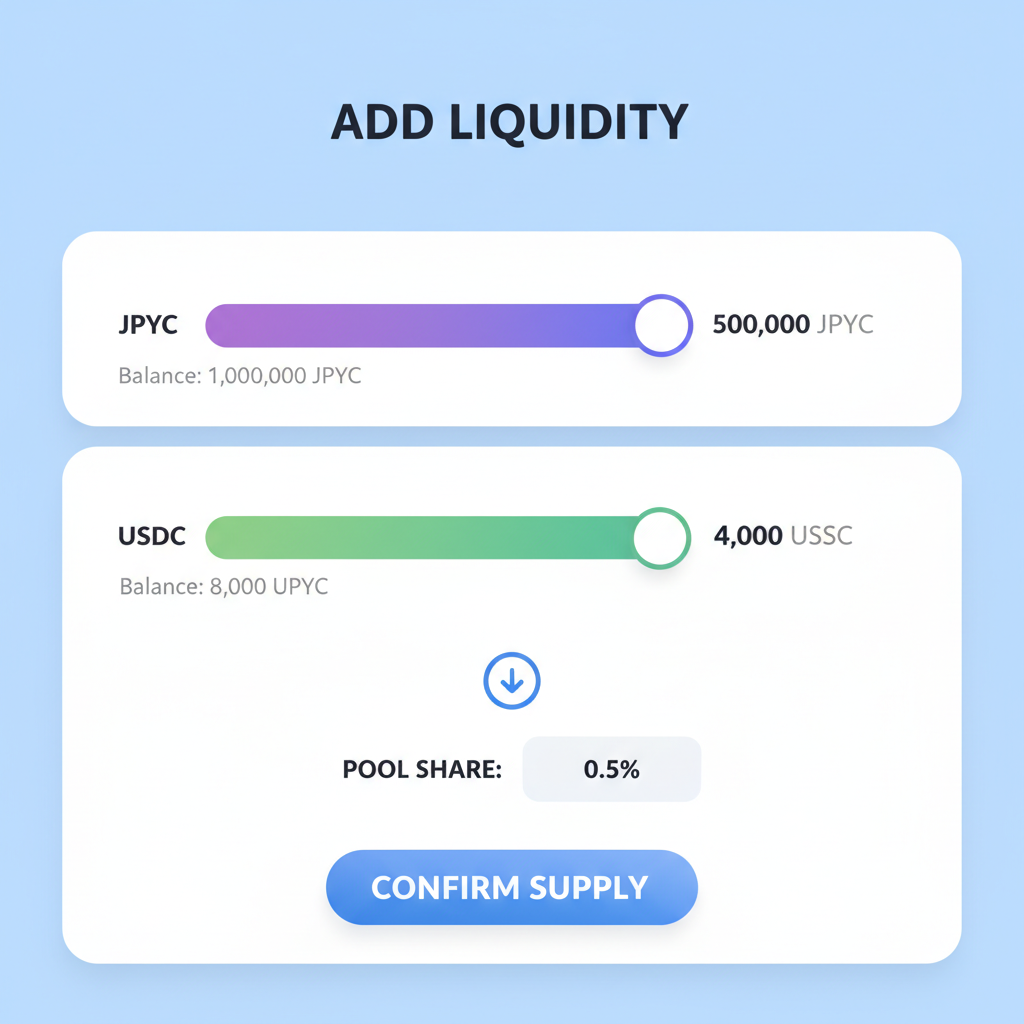

Participating in JPYC stablecoin liquidity pools means supplying JPYC paired with assets like USDC on platforms such as Uniswap or SushiSwap on Polygon. Fees accrue from swaps, amplified by incentives. The headline 1,000 JPY in 70 days equates to an annualized yield exceeding 50% on modest positions, dwarfing bank rates. For context, a 100,000 JPY-equivalent pool (about 14.46 million JPYC at $0.006916) could generate those fees amid current volumes.

Risks balance the reward: impermanent loss from volatility, smart contract vulnerabilities, and chain-specific gas fees. Yet with JPYC’s backing and multi-chain deployment, it’s a calculated bet for yen-pegged stablecoin earnings. Polygon pools shine for low costs, boosting net JPYC liquidity pool returns.

JPYC Stablecoin Price Prediction 2027-2032

Annual USD price forecasts based on JPY exchange rates, adoption trends, and macroeconomic factors

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.0065 | $0.0070 | $0.0075 | +1.2% |

| 2028 | $0.0068 | $0.0073 | $0.0078 | +4.3% |

| 2029 | $0.0071 | $0.0076 | $0.0081 | +4.1% |

| 2030 | $0.0074 | $0.0079 | $0.0084 | +3.9% |

| 2031 | $0.0077 | $0.0082 | $0.0087 | +3.8% |

| 2022 | $0.0080 | $0.0085 | $0.0090 | +3.7% |

Price Prediction Summary

Over the 2027-2032 period, JPYC’s USD price is projected to gradually increase from around $0.0070 to $0.0085, driven primarily by anticipated strengthening of the Japanese Yen against the USD amid BOJ’s rate normalization and rising yields. The stablecoin is expected to maintain its 1:1 peg with minimal deviations, supported by full collateralization and growing DeFi adoption offering yields superior to traditional banks.

Key Factors Affecting JPYC Stablecoin Price

- Bank of Japan interest rate policy and JPY appreciation potential

- USD/JPY exchange rate fluctuations

- Superior yields from JPYC liquidity pools vs. Japanese bank deposits (0.3%)

- Regulatory support for yen stablecoins in Japan

- Increasing adoption in DeFi on Ethereum, Avalanche, and Polygon

- Competition from emerging yen stablecoins and global stablecoin market dynamics

- Broader crypto market cycles and liquidity conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Traders blending technicals and fundamentals see JPYC as a hedge against further BOJ hikes, with liquidity pools offering asymmetric upside. This isn’t blind speculation; it’s risk-managed exposure to Japan’s evolving stablecoin landscape.

Layering in options strategies elevates this further. As a derivatives specialist, I view JPYC liquidity positions as prime candidates for covered calls or protective puts, generating premium income atop pool fees. Imagine selling calls on your JPYC-USDC LP tokens during low volatility; the theta decay compounds your edge, turning a simple pool into a multifaceted yield machine.

Yield Showdown: JPYC Pools vs. Bank Deposits

To quantify the gap, consider real-world projections. Banks cap you at 0.3% annually, or about 8.22 JPY daily on a 1 million JPY deposit. JPYC pools, fueled by DeFi trading volumes, deliver 1,000 JPY over 70 days roughly 14.29 JPY daily on equivalent capital. That’s a stark divergence, especially as JGB yields tempt but lock funds long-term.

JPYC Liquidity Pools vs. Major Japanese Bank Deposits (0.3% Annual): 100k–1M JPY Comparison

| Investment Amount (JPY) | JPYC LP Earnings (70 days, JPY) | JPYC Est. APY (%) | Bank Earnings (70 days, JPY) | Bank Annual Rate (%) | Risks (JPYC vs. Bank) |

|---|---|---|---|---|---|

| 100,000 | 1,000 | ~5.3 | 58 | 0.3 | JPYC: High – Impermanent loss 📉, smart contract 🔐, depeg risk ⚠️ | Bank: Very low – Deposit insurance 🛡️ (up to 10M JPY) |

| 500,000 | 5,000 | ~5.3 | 288 | 0.3 | JPYC: High – Impermanent loss 📉, smart contract 🔐, depeg risk ⚠️ | Bank: Very low – Deposit insurance 🛡️ (up to 10M JPY) |

| 1,000,000 | 10,000 | ~5.3 | 575 | 0.3 | JPYC: High – Impermanent loss 📉, smart contract 🔐, depeg risk ⚠️ | Bank: Very low – Deposit insurance 🛡️ (up to 10M JPY) |

This table underscores why savvy allocators pivot to JPYC liquidity pools. Banks suit the ultra-conservative, but for those tolerating DeFi’s measured risks, the arithmetic favors blockchain. Polygon deployment minimizes gas drag, preserving more fees as yen-pegged stablecoin earnings.

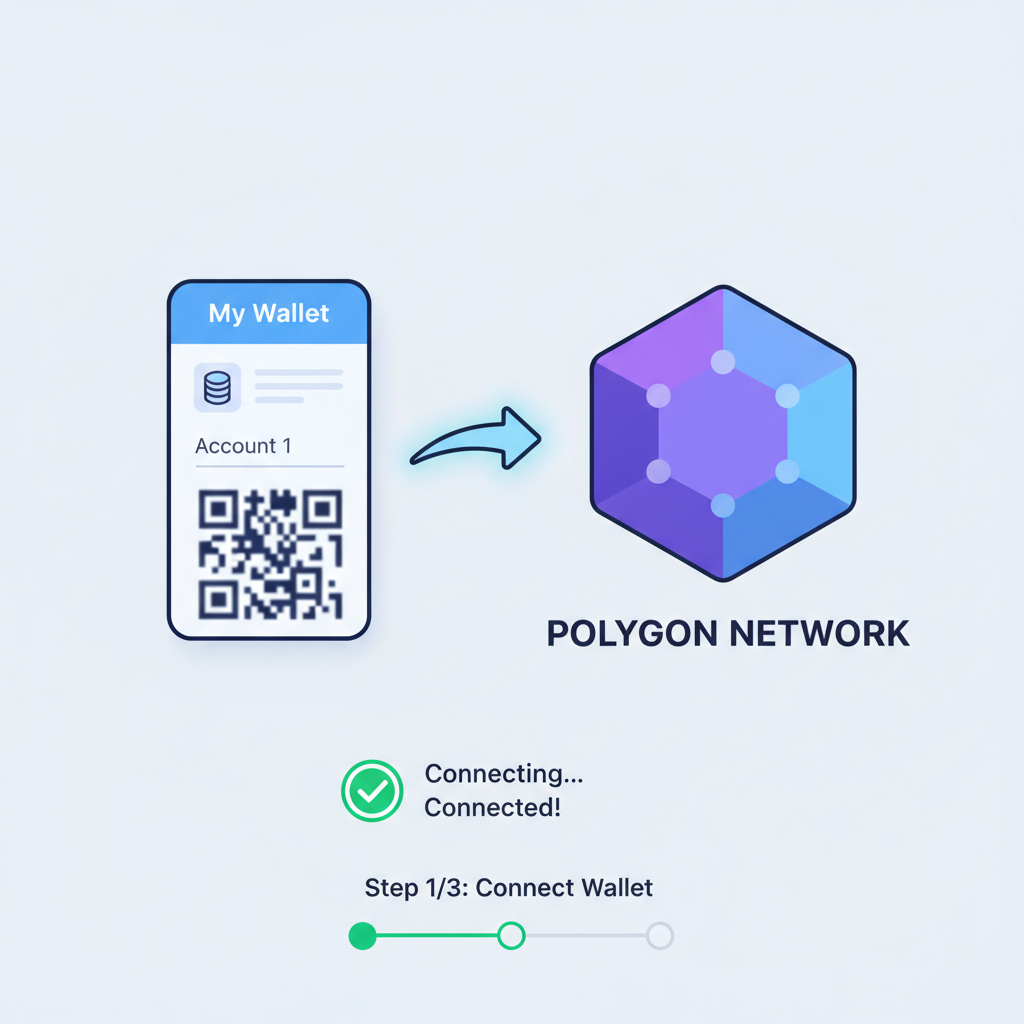

Getting Started: Step-by-Step to JPYC Pool Rewards

Bridging from theory to execution demands precision. Here’s how to claim those superior yields without unnecessary exposure.

Once positioned, monitor via dashboards like DeFiLlama or pool-specific trackers. Adjust for volume spikes post-BOJ announcements, harvesting fees weekly to compound. This methodical approach aligns with my trading floor ethos: position sizing first, then let convexity work.

Yet balance tempers enthusiasm. Impermanent loss erodes if JPYC deviates from its $0.006916 peg, though backing minimizes this. Smart contract audits and multi-chain options mitigate hacks, but never allocate beyond 10-20% of yen portfolio. For deeper dives into Japan’s yen-backed stablecoin reshaping DeFi, the infrastructure gains traction amid rising rates.

Looking ahead, JPYC’s multi-chain footprint positions it for interoperability plays, perhaps via JPYCompound’s liquidity layer down the line. As BOJ normalizes to 1% or beyond, yen stablecoin DeFi volumes swell, amplifying pool incentives. Parallel developments like Common Stability broaden the ecosystem, fostering non-USD stablecoins as diversification staples.

Strategic allocators blend both worlds: core in banks for safety, satellites in JPYC for yield. At $0.006916 with and 0.0212% daily momentum, this Japanese yen stablecoin isn’t just competing; it’s redefining returns in a post-zero rate Japan. Options open opportunities indeed seize them with eyes wide open.