How JPYC is Transforming Yen Stablecoins in Japan’s Regulated Crypto Market

Japan’s regulated crypto market is on the cusp of a transformation, and at the heart of this shift is JPYC, the country’s first fully regulated yen-pegged stablecoin. As regulatory clarity emerges in Japan, the launch of JPYC in autumn 2025 marks more than just another stablecoin debut. It signals a new era for digital assets in Asia, where compliance, innovation, and macroeconomic impact converge.

JPYC: The First Regulated Yen Stablecoin

JPYC is not simply a token pegged to the Japanese yen. It’s a fintech milestone, born from Tokyo-based innovation and molded by Japan’s revised Payment Services Act. This regulatory framework, updated in June 2023, opened the door for licensed banks, trust companies, and money transfer firms to issue stablecoins under strict oversight. JPYC seized this opportunity, securing approval from Japan’s Financial Services Agency (FSA), and positioning itself as a benchmark for future yen-backed digital assets.

The stablecoin will be available across three major blockchains, Ethereum, Avalanche, and Polygon, ensuring interoperability for both retail users and institutional players. Each JPYC token is fully backed by domestic bank deposits and Japanese government bonds (JGBs), which not only guarantees its 1: 1 peg but also integrates traditional finance with blockchain technology in an unprecedented way.

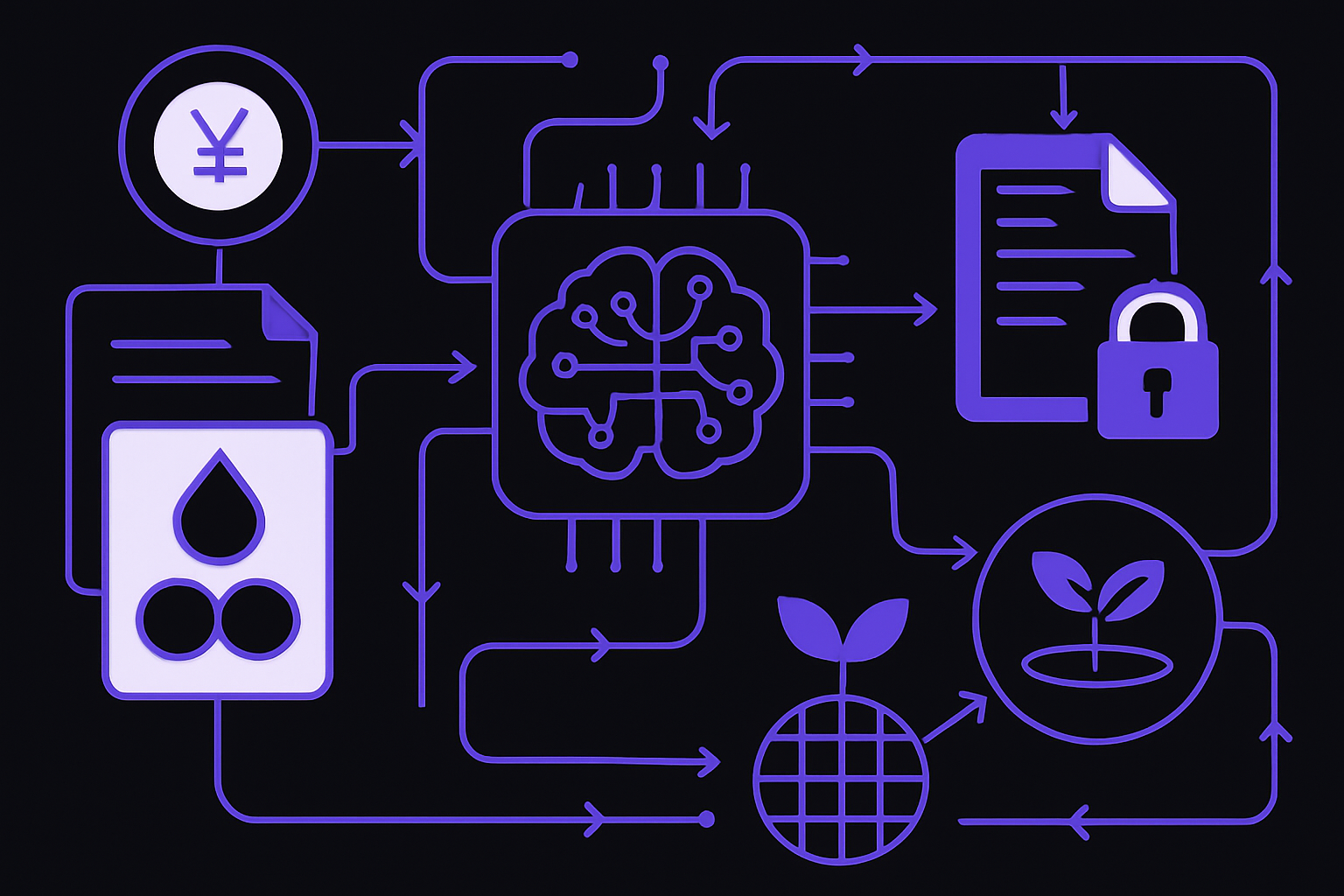

How JPYC Works: Mechanisms Behind Stability

At its core, JPYC offers Japanese users a digital asset that mirrors the value of one yen exactly, no more, no less. Unlike many USD-based stablecoins that rely heavily on transaction fees or opaque reserves, JPYC’s business model is refreshingly transparent. Revenue comes from interest accrued on its JGB holdings; as circulation grows, so does profitability without eroding user balances through fees.

This approach has two notable effects: it reduces foreign exchange risk for local users while providing an attractive alternative for cross-border transactions involving yen. By anchoring each token to tangible assets within Japan’s financial system, and under direct regulatory scrutiny, JPYC sets itself apart as a trusted digital instrument for payments, remittances, and even DeFi applications.

Key Benefits of Using JPYC Yen-Backed Stablecoin

-

Regulatory Compliance and Security: JPYC is Japan’s first yen-pegged stablecoin approved under the revised Payment Services Act, ensuring strict oversight by the Financial Services Agency (FSA) and robust consumer protections.

-

Full Yen Backing with Domestic Assets: Each JPYC token is backed 1:1 by Japanese yen held in domestic savings and Japanese government bonds (JGBs), providing transparent and reliable value stability.

-

Multi-Chain Accessibility: JPYC will be issued on Ethereum, Avalanche, and Polygon blockchains, enabling broad interoperability and easy integration with leading DeFi platforms.

-

No Transaction Fees for Users: Unlike many stablecoins, JPYC does not charge transaction fees; instead, it generates revenue from interest on JGB holdings, making transfers more cost-effective for users.

-

Facilitates Fast Domestic and Cross-Border Payments: JPYC’s digital nature allows for near-instant, 24/7 transfers, streamlining both domestic and international transactions compared to traditional banking systems.

-

Supports Japan’s Digital Finance Strategy: JPYC aligns with Japan’s push for blockchain-based payments and fintech innovation, helping position the country as a leader in regulated digital assets.

-

Potential Impact on Japan’s Bond Market: As JPYC adoption grows, increased demand for JGBs could reshape the bond market, integrating blockchain with traditional finance and supporting national economic goals.

Regulatory Clarity Fuels Market Confidence

The significance of regulation cannot be overstated in Japan’s crypto landscape. Previous attempts at launching yen-backed tokens were stymied by legal ambiguity or insufficient safeguards, a reality that left investors wary and innovators cautious. The revised Payment Services Act changed all that by outlining clear requirements for reserve management, auditing standards, and redemption rights.

With these guardrails in place, and with FSA approval secured, JPYC embodies what many see as the gold standard for non-USD stablecoins globally. Its forthcoming launch has already sparked conversations among banks and fintech providers about integrating blockchain-based payment rails into mainstream finance.

If you’re curious about how JPYC compares to other regulated stablecoins or want to understand its unique features and risks in detail, read our deep dive here: JPYC: Japan’s First Regulated Yen Stablecoin, Features, Risks and Opportunities.

JPYC’s transparent reserve structure and multi-chain deployment have already begun to influence market sentiment, with many Japanese financial institutions considering partnerships or integrations. The fact that JPYC is fully backed by domestic savings and JGBs not only reassures users about its stability but could also set a precedent for future digital yen projects in Japan. The stablecoin’s availability on Ethereum, Avalanche, and Polygon makes it accessible to a wide array of DeFi protocols and fintech apps, potentially sparking a new wave of innovation within the Japanese crypto ecosystem.

Potential Ripple Effects on Japan’s Financial Markets

The launch of JPYC is expected to have far-reaching implications beyond crypto trading. By driving demand for JGBs as reserve assets, JPYC could subtly reshape the dynamics of Japan’s bond market. If adoption mirrors the trajectory seen with USD stablecoins and U. S. Treasuries, we may see stablecoin issuers become significant players in sovereign debt markets, a development closely watched by policymakers and institutional investors alike.

Moreover, JPYC could serve as an on-ramp for global users seeking exposure to yen-denominated assets without navigating traditional banking hurdles. This opens up new possibilities for remittances, trade settlement, and even programmable money use cases tailored to Japan’s economic landscape.

How JPYC Could Transform Payments, Investments, and DeFi in Japan

-

Seamless Digital Yen Payments: JPYC’s regulated, yen-pegged stablecoin enables instant, low-cost payments across Ethereum, Avalanche, and Polygon blockchains. This provides Japanese consumers and businesses with a secure, digital alternative to cash and legacy bank transfers, supporting both domestic and cross-border transactions.

-

Boosting DeFi Adoption in Japan: With JPYC available on major blockchains, Japanese users can access decentralized finance platforms like Aave, Uniswap, and Curve using a yen-backed asset. This reduces foreign exchange risk and regulatory uncertainty, making DeFi more accessible to local investors.

-

Driving Demand for Japanese Government Bonds (JGBs): JPYC is fully backed by domestic savings and JGBs, meaning wider adoption could increase demand for these bonds. This mirrors the impact of US dollar stablecoins on US Treasuries, potentially reshaping Japan’s bond market and integrating blockchain with traditional finance.

-

No-Code Integration for Businesses: Platforms like ASTERIA Warp allow companies to integrate JPYC payments without coding expertise. This opens the door for e-commerce, fintech, and other sectors to adopt digital yen payments quickly and securely.

-

Strengthening Japan’s Regulatory Leadership: JPYC’s launch under the revised Payment Services Act positions Japan as a global leader in regulated stablecoins. The clear legal framework encourages innovation, attracts fintech investment, and sets a benchmark for digital asset regulation in Asia.

What Comes Next for Yen-Backed Stablecoins?

As autumn 2025 approaches and anticipation builds, industry observers are keenly watching how swiftly JPYC will be adopted by exchanges, wallets, and payment providers. Early signals from the developer community suggest strong interest in integrating JPYC into existing DeFi platforms as well as creating new products specifically designed around yen liquidity. The regulatory clarity now present in Japan gives these builders confidence to experiment without fear of sudden policy reversals.

Other Asian economies are likely to study Japan’s approach closely. If successful, the JPYC model, grounded in transparency, full backing by domestic assets, and robust compliance, could inspire similar initiatives across the region. For now, however, all eyes remain on Tokyo.

Key Takeaways for Investors and Innovators

- JPYC is set to become a foundational digital asset for both domestic payments and international transfers involving yen.

- Regulatory clarity under Japan’s revised Payment Services Act has unlocked new pathways for compliant innovation in stablecoins.

- The model of full backing by JGBs aligns blockchain-based assets with traditional finance, potentially influencing bond markets over time.

- Multi-chain support (Ethereum, Avalanche, Polygon) ensures broad access across both retail and institutional channels.

The arrival of a regulated yen-backed stablecoin like JPYC represents more than just technological progress, it is a signal that Asia’s largest economies are ready to shape their own digital currency futures on their own terms. As integration accelerates across payment apps and DeFi protocols this year into next, those watching from abroad would do well to pay attention: what happens with JPYC may soon echo far beyond Japan’s borders.