Comparing EURC, EURAU, and EURQ: Which Euro Stablecoin Is Best for DeFi and Payments?

The euro-backed stablecoin market has rapidly evolved into a crucial segment of the digital asset landscape, particularly as European regulatory clarity and the euro’s relative strength have spurred both institutional and DeFi adoption. In 2025, three contenders stand out for anyone seeking the best euro stablecoin for DeFi and payments: EURC (Euro Coin by Circle), EURAU (Euro Tether by Auros), and EURQ (Euro Q by Qredo). Each brings a distinct approach to compliance, blockchain integration, and user focus, making a comparative analysis essential for investors and builders alike.

Why Euro Stablecoins Matter in 2025

The rise of euro stablecoins is not just a matter of currency diversification. With MiCA regulations now in full effect, Europe has become a proving ground for compliant digital money. Euro-pegged tokens offer an alternative to dollar dominance in stablecoins, catering to EU-based businesses, global remittance corridors, and DeFi protocols seeking non-USD liquidity. As highlighted by the European Central Bank, differences in return profiles between US dollar- and euro-linked stablecoins reflect underlying liquidity dynamics and risk appetites, a macro trend shaping capital flows across continents.

Recent data shows that as of September 2025, the euro stablecoin market cap has surged to nearly $500 million, buoyed by regulatory certainty and growing demand for programmable money. This sets the stage for a deeper comparison between EURC, EURAU, and EURQ.

Euro Stablecoin and Major Crypto Price Comparison (6-Month Performance)

Comparing EURC, EURAU, EURQ, and major stablecoins and cryptocurrencies as of September 19, 2025

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Euro Coin (EURC) | $1.17 | $1.12 | +4.5% |

| EURAU Euro Stablecoin (EURAU) | $1.17 | $1.12 | +4.5% |

| EURQ Euro Stablecoin (EURQ) | $1.17 | $1.12 | +4.5% |

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| USD Coin (USDC) | $0.0487 | $0.0487 | +0.0% |

| Dai (DAI) | $0.9996 | $0.9996 | +0.0% |

| Bitcoin (BTC) | $115,904.00 | $86,032.00 | +34.7% |

| Ethereum (ETH) | $4,480.12 | $4,480.12 | +0.0% |

Analysis Summary

Over the past six months, euro-denominated stablecoins (EURC, EURAU, EURQ) have each appreciated by +4.5%, reflecting modest euro strength and regulatory-driven market growth. Major USD stablecoins (USDT, USDC, DAI) have maintained their pegs with negligible price movement. Bitcoin has seen the strongest performance, rising 34.7%, while Ethereum remained flat.

Key Insights

- Euro stablecoins (EURC, EURAU, EURQ) have all moved in lockstep, gaining +4.5% over six months, likely due to euro appreciation and MiCA-driven adoption.

- USD stablecoins (USDT, USDC, DAI) remained stable, as expected, with no significant price change.

- Bitcoin outperformed all assets in the comparison, gaining +34.7% over six months.

- Ethereum’s price remained unchanged over the period, showing no significant movement.

All prices and percentage changes are sourced directly from the provided real-time market data as of September 19, 2025. The table compares current and 6-month historical prices to calculate percentage changes, ensuring accuracy and consistency with the supplied data.

Data Sources:

- Main Asset: https://blocfolio.com/coin/euro-coin

- EURAU Euro Stablecoin: https://blocfolio.com/coin/euro-coin

- EURQ Euro Stablecoin: https://blocfolio.com/coin/euro-coin

- Tether: https://blocfolio.com/coin/euro-coin

- USD Coin: https://blocfolio.com/coin/euro-coin

- Dai: https://blocfolio.com/coin/euro-coin

- Bitcoin: https://www.bitcoinbtcsats.com/price/usd/2025/3/

- Ethereum: https://blocfolio.com/coin/euro-coin

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

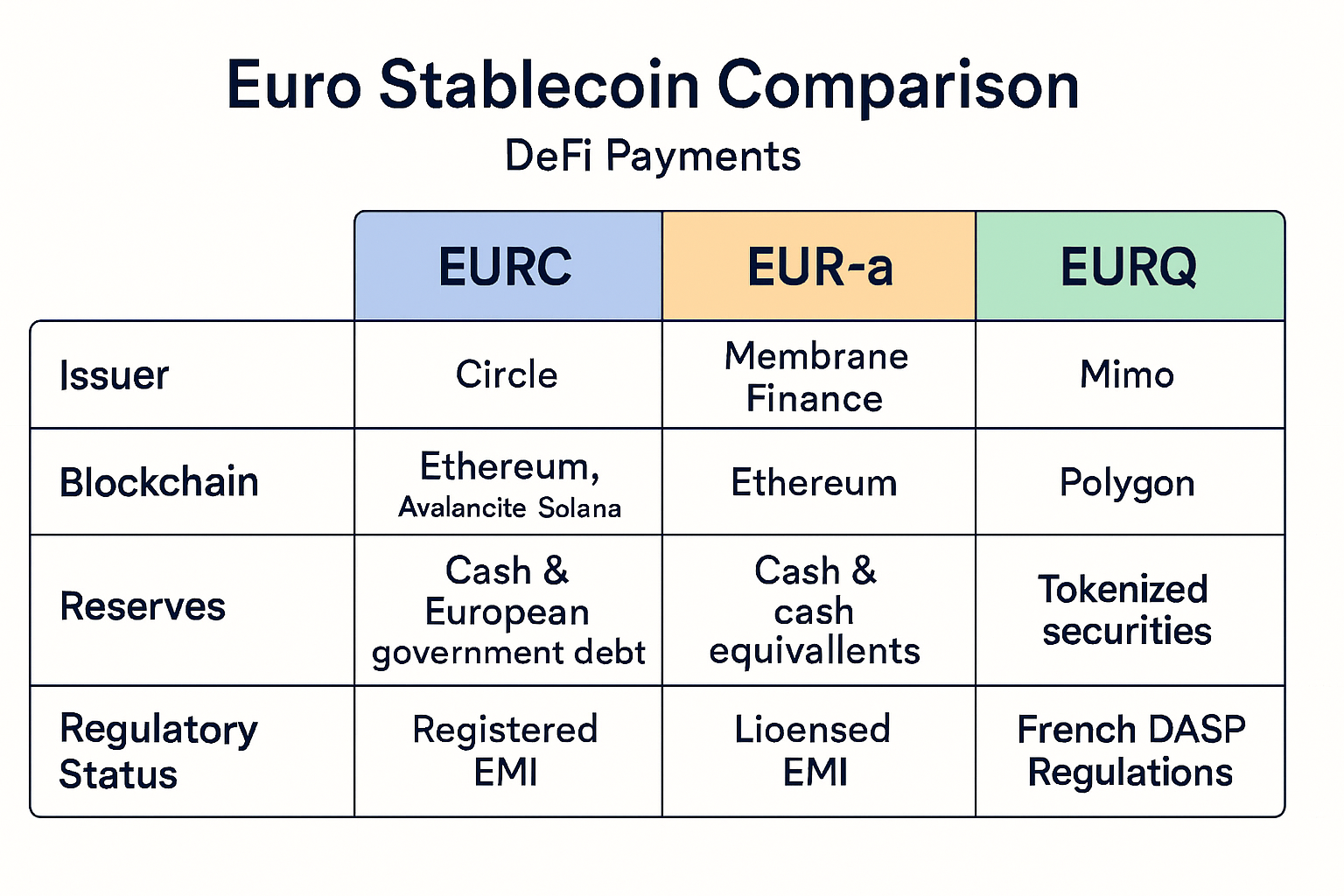

Meet the Contenders: EURC vs EURAU vs EURQ

1. EURC (Euro Coin by Circle):

Issued by Circle, the same company behind USDC, EURC is fully backed 1: 1 by euros held in regulated European banks. It boasts MiCA compliance and operates on multiple blockchains including Ethereum, Solana, Avalanche, Base, and Stellar. As of September 2025, EURC’s market capitalization stands at approximately €1.2 billion with a current price of $1.17 (source). Its broad interoperability makes it highly attractive for both DeFi protocols requiring deep liquidity and payment networks seeking seamless settlement rails.

2. EURAU (Euro Tether by Auros):

Launched in July 2025 with backing from Deutsche Bank’s DWS, Galaxy Digital, and Flow Traders, EURAU targets institutional users such as financial institutions and corporate treasuries. Regulated under Germany’s BaFin authority and fully MiCA-compliant, it initially launched on Ethereum but has plans to expand its network footprint (source). Its focus on cross-border settlements positions it as a bridge between traditional finance infrastructure and programmable digital assets.

3. EURQ (Euro Q by Qredo):

EURQ is issued by Quantoz Payments under Dutch Central Bank oversight with an emphasis on programmable payments, a key feature for corporate treasuries managing complex workflows or integrating direct SEPA capabilities into their operations. Primarily available on Algorand but designed with interoperability in mind, EURQ is MiCA-compliant from launch (source). Its “programmable money” approach appeals to enterprises seeking tailored solutions rather than generic retail payments.

Comparative Analysis: Compliance, Networks and Adoption

Regulatory Compliance: All three tokens are fully MiCA-compliant, a non-negotiable standard after years of regulatory ambiguity in Europe. This ensures robust investor protections while opening doors for integration with banks and payment providers across the continent.

- EURC: Regulated across multiple jurisdictions via Circle’s banking partners; public attestations add transparency.

- EURAU: Directly supervised by BaFin; leverages Germany’s stringent financial oversight.

- EURQ: Backed by Dutch Central Bank regulation; focuses on enterprise-grade integrations.

Blockchain Support and Interoperability:

- EURC: Multi-chain support (Ethereum, Solana, Avalanche, Base, Stellar) enables broad reach within DeFi ecosystems, from lending protocols to DEXs.

- EURAU: Currently Ethereum-based but roadmap includes further expansion, catering primarily to institutional rails.

- EURQ: Built on Algorand with programmable features; ideal for enterprise workflows requiring custom logic or direct fiat rails via SEPA integration.

This diversity reflects broader trends in how digital euros are being positioned, not just as static stores of value but as adaptive tools responding to real-world business needs.

Euro Stablecoin (EURC, EURAU, EURQ) Price Prediction 2026-2031

Professional forecast for Euro-backed stablecoins based on adoption trends, regulatory environment, and market dynamics (all prices in USD)

| Year | EURC Min Price | EURC Avg Price | EURC Max Price | EURAU Min Price | EURAU Avg Price | EURAU Max Price | EURQ Min Price | EURQ Avg Price | EURQ Max Price | Market Scenario Insights |

|---|---|---|---|---|---|---|---|---|---|---|

| 2026 | $1.15 | $1.18 | $1.22 | $1.13 | $1.17 | $1.21 | $1.13 | $1.17 | $1.21 | EURC remains most liquid; EURAU/EURQ expand institutional use. Minor volatility tied to EUR/USD. |

| 2027 | $1.14 | $1.20 | $1.25 | $1.12 | $1.18 | $1.23 | $1.12 | $1.18 | $1.23 | Market cap growth; DeFi adoption rises. EURC leads, EURAU/EURQ gain with new integrations. |

| 2028 | $1.13 | $1.21 | $1.28 | $1.12 | $1.19 | $1.25 | $1.12 | $1.19 | $1.25 | Bullish: MiCA clarity boosts confidence. Bearish: Euro weakness could pressure pegs. |

| 2029 | $1.12 | $1.23 | $1.30 | $1.11 | $1.20 | $1.27 | $1.11 | $1.20 | $1.27 | Stablecoin utility broadens; programmable payments grow. Competition increases. |

| 2030 | $1.12 | $1.25 | $1.33 | $1.11 | $1.22 | $1.30 | $1.11 | $1.22 | $1.30 | Regulatory harmonization in EU/UK. EURC maintains dominance, EURAU/EURQ niche expansion. |

| 2031 | $1.10 | $1.26 | $1.35 | $1.09 | $1.23 | $1.32 | $1.09 | $1.23 | $1.32 | Market matures: tighter pegs, low volatility. EURC/EURAU/EURQ all MiCA+ compliant. |

Price Prediction Summary

Euro stablecoins are expected to maintain tight pegs to the euro, with slight price variations reflecting EUR/USD exchange rate dynamics, liquidity, and regulatory impacts. EURC is forecast to remain the leading euro stablecoin for DeFi and payments, with EURAU and EURQ expanding in institutional and programmable payment sectors. Maximum price deviations may occur during periods of heightened FX volatility or regulatory events, but overall, prices should remain within a narrow, stable range.

Key Factors Affecting Euro Coin Price

- EU’s MiCA regulation ensuring transparency and stability across euro stablecoins.

- Continued growth in DeFi and payment integrations, especially for EURC.

- Increased institutional adoption, particularly for EURAU and EURQ.

- Euro/USD exchange rate fluctuations impacting stablecoin prices on global markets.

- Competition from other stablecoins and further blockchain integrations.

- Potential for new use cases (e.g., programmable money, cross-border settlements).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

When evaluating market adoption and liquidity, the differences between EURC, EURAU, and EURQ become even more pronounced. EURC is the clear leader in network effects: with a market capitalization of approximately €1.2 billion and a current price of $1.17, it is deeply integrated into both DeFi protocols and payment platforms across multiple blockchains. Its liquidity pools on Ethereum and Solana are particularly attractive for yield farming, lending, and cross-chain swaps, making it the go-to choice for users who value instant access to deep liquidity.

EURAU, while newer to the market, has quickly gained credibility thanks to its institutional pedigree and regulatory clarity under BaFin. Designed for large-scale settlements and treasury operations, EURAU’s appeal lies in its robust compliance framework, a critical factor for banks or fintechs seeking euro-denominated stablecoins that align with internal risk mandates. As it expands beyond Ethereum, expect its presence in wholesale financial applications to grow.

EURQ carves out a unique position by focusing on programmable money. Its integration with Algorand allows enterprises to automate complex payment flows, think supply chain settlements or recurring payroll disbursements, with direct SEPA connectivity for fiat on- and off-ramps. For corporates prioritizing operational efficiency over broad DeFi participation, EURQ stands out as the most tailored option.

Key Use Cases: DeFi vs Payments vs Enterprise Workflows

The optimal euro stablecoin depends largely on your intended use case:

Top Use Cases for Leading Euro Stablecoins

-

EURC (Euro Coin by Circle): Best for DeFi, multi-chain payments, and global remittances. EURC is fully backed 1:1 by euros held in regulated European banks and is MiCA-compliant. With broad support across Ethereum, Solana, Avalanche, Base, and Stellar, EURC boasts a market capitalization of approximately €1.2 billion as of September 2025. Its liquidity and integration with major DeFi protocols make it ideal for lending, trading, and cross-border payments.

-

EURAU (Euro Tether by Auros): Tailored for institutional settlements and treasury management. EURAU, launched in July 2025 and backed by Deutsche Bank’s DWS, Galaxy Digital, and Flow Traders, is regulated by Germany’s BaFin and MiCA-compliant. Initially available on Ethereum, it targets financial institutions and fintechs seeking secure, regulated euro on-chain settlement and cross-border payment solutions.

-

EURQ (Euro Q by Qredo): Optimized for programmable payments and corporate treasury operations. Issued by Quantoz Payments and regulated by the Dutch Central Bank, EURQ is MiCA-compliant and primarily runs on the Algorand blockchain. Its programmable money features and direct SEPA integration make it a strong fit for automated corporate payments and treasury workflows.

- DeFi Integration: EURC‘s multi-chain support ensures compatibility with leading DEXs (like Uniswap), lending markets (Aave), and cross-chain bridges, critical for users seeking yield opportunities or composable financial products.

- B2B Payments and Settlements: EURAU, backed by heavyweight financial institutions, is engineered for high-value transactions between banks or corporates needing regulatory certainty.

- Programmable Enterprise Solutions: EURQ‘s programmable features allow businesses to automate payments directly from treasury systems, minimizing manual intervention while maximizing transparency.

What Sets Each Apart?

The distinctions between these tokens are not merely technical, they reflect deeper macro trends in European digital finance:

- EURC: Benefits from Circle’s global brand recognition; its broad adoption makes it a natural fit for retail-facing apps as well as institutional DeFi strategies.

- EURAU: Institutional focus means it will likely see accelerated adoption among Europe’s largest banks as MiCA-compliant settlement rails become mandatory post-2025.

- EURQ: Programmability is a differentiator, expect continued innovation around smart contract-based treasury management tools leveraging this token’s flexible architecture.

Macro Outlook: The Road Ahead for Euro Stablecoins

The competitive landscape will continue to evolve as MiCA enforcement matures. While regulatory clarity has catalyzed growth, the next phase will be defined by interoperability standards, secondary market liquidity, and integration with both legacy banking rails and emerging DeFi primitives. The euro’s growing role in global trade settlements further enhances demand for robust digital euro instruments that can bridge traditional finance with programmable money ecosystems.

If you’re optimizing purely for DeFi activity or broad payments infrastructure across multiple chains, EURC remains the most versatile choice at $1.17 today. For large-scale B2B settlements where compliance risk trumps composability, EURAU offers unmatched institutional assurance. And if your business requires tailored automation at the intersection of crypto-native programmability and fiat rails, EURQ delivers enterprise-grade flexibility.

No single token will dominate every segment of this rapidly expanding market, but each brings essential innovations that together define the future of digital euros within Europe’s new regulatory paradigm.