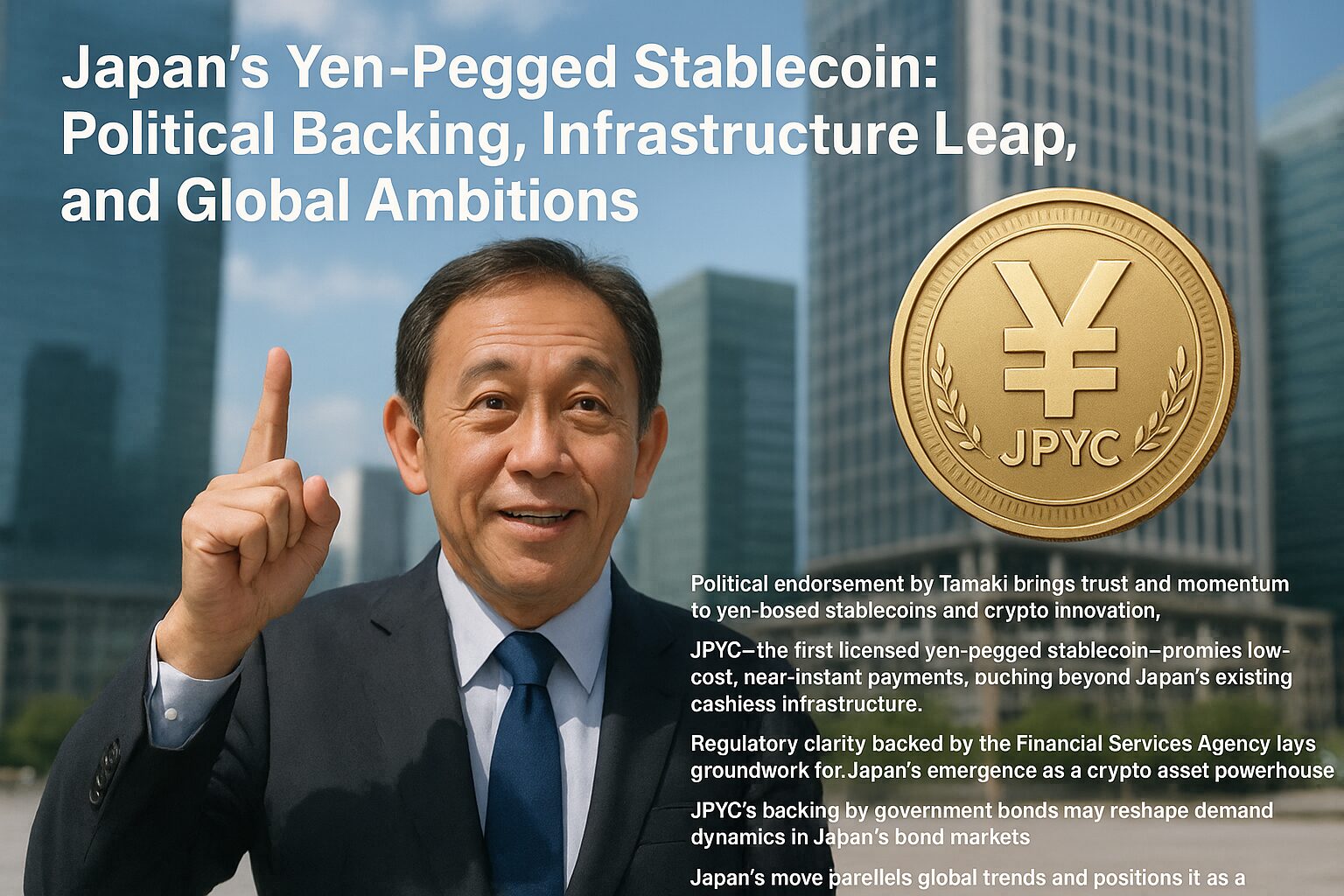

How JPYC is Transforming Yen Stablecoins in Japan’s Regulated Crypto Market

Japan’s digital asset landscape is entering a pivotal phase with the imminent launch of JPYC, the nation’s first regulated yen-backed stablecoin. Unlike previous attempts at yen stablecoins, JPYC is being rolled out under the updated Payment Services Act, with full approval from the Financial Services Agency (FSA). This marks a significant milestone for both the Japanese crypto market and global stablecoin development, as it brings together regulatory clarity, robust asset backing, and blockchain interoperability.

JPYC: A New Benchmark for Yen-Backed Stablecoins

JPYC is set to be issued on three major blockchains: Ethereum, Avalanche, and Polygon. This multi-chain deployment is designed to maximize accessibility and liquidity, allowing both institutional and retail users to transact with yen-pegged digital assets across leading decentralized ecosystems. Unlike most USD-based stablecoins, JPYC is fully backed by Japanese yen reserves and Japanese government bonds (JGBs), ensuring a stable 1: 1 peg and reducing both FX and counterparty risk for Japanese users.

The company’s business model diverges from the standard transaction fee approach. Instead, JPYC plans to generate revenue through interest earned on its JGB holdings, aligning incentives with long-term stability and transparency. This structure could prove especially attractive to institutional investors and family offices seeking a compliant, low-volatility digital asset denominated in their local currency.

Regulatory Foundations: How Japan Is Shaping the Stablecoin Market

Japan’s regulatory environment has been a key factor in the emergence of JPYC as a trusted stablecoin issuer. The revised Payment Services Act classifies digital currencies into three categories, enabling tokens like JPYC to operate under strict asset-backing and transparency requirements. Every JPYC token is fully redeemable for yen and supported by onshore bank deposits and JGBs, setting a high bar for consumer protection.

This regulatory clarity is expected to accelerate adoption among institutional players, who have previously been hesitant to engage with stablecoins due to legal ambiguity. By providing a clear framework, Japan is positioning itself as a global leader in compliant digital asset innovation, potentially influencing other markets in Asia and beyond.

Top 3 Benefits of Yen-Backed Stablecoins for Japanese Investors

-

Regulatory Security & Consumer Protection: JPYC is the first yen-pegged stablecoin approved by Japan’s Financial Services Agency (FSA) under the revised Payment Services Act. This ensures robust oversight, clear legal status, and enhanced consumer safeguards for investors.

-

Reduced FX Risk & Seamless Yen Integration: By being fully backed by Japanese yen and government bonds (JGBs), JPYC allows investors to transact and hold digital assets without exposure to foreign exchange volatility, making it ideal for both domestic and cross-border transactions.

-

Enhanced Blockchain Liquidity & Faster Settlements: JPYC’s issuance on Ethereum, Avalanche, and Polygon brings yen liquidity to major blockchains, enabling instant, low-cost transfers and settlements for institutional and retail investors alike.

JPYC’s Multi-Chain Strategy: Unlocking Liquidity and Use Cases

One of JPYC’s standout features is its simultaneous issuance on Ethereum, Avalanche, and Polygon. This approach offers several advantages:

- Interoperability: Users can move yen-backed liquidity seamlessly across different DeFi platforms.

- Reduced Network Congestion: Multi-chain support helps avoid bottlenecks during periods of high demand.

- Broader Ecosystem Integration: Developers can incorporate JPYC into a wide range of dApps, payment solutions, and cross-border settlement systems.

As cross-chain infrastructure matures, JPYC could become a foundational layer for both domestic and international payments, remittances, and even programmable finance applications tailored to Japan’s unique regulatory standards.

Potential Impact on Japan’s Bond Market

Backing JPYC with JGBs may also have macroeconomic implications. As demand for yen-backed stablecoins grows, so too could demand for JGBs, potentially affecting yields and liquidity in Japan’s bond market. This dynamic highlights the interconnectedness of traditional finance and blockchain-based assets, a trend that will only intensify as regulated stablecoins gain traction.

JPYC’s launch is more than a technical innovation, it’s a signal of Japan’s commitment to digital financial infrastructure that balances innovation with risk management. By anchoring the stablecoin to onshore yen deposits and government bonds, JPYC provides an alternative to USD-dominated stablecoins, directly addressing the needs of Japan’s institutional and retail investors wary of foreign exchange volatility.

With its regulatory green light, JPYC is poised to catalyze new forms of blockchain-based commerce and programmable money. For enterprises, the ability to settle in digital yen across multiple blockchains means reduced settlement times and lower operational friction. For fintech developers, JPYC becomes a programmable asset that can be integrated into smart contracts, lending protocols, and automated payment systems, opening pathways for innovation that were previously constrained by legacy banking rails.

Market Outlook: Challenges and Opportunities Ahead

The road ahead for yen-backed stablecoins like JPYC is not without obstacles. While regulatory clarity is a major advantage, it also comes with ongoing compliance costs and the need for robust transparency measures. The reliance on JGBs as collateral ties JPYC’s stability to Japanese government debt markets, which could introduce new forms of systemic risk if not managed prudently.

Nevertheless, industry projections suggest that the market cap for JPYC could reach ¥70 trillion (approximately $470 billion) by 2030 if adoption accelerates among institutional players and cross-border use cases expand. This would place JPYC among the world’s most significant non-USD stablecoins, offering a template for regulated digital currency issuance in other major economies.

What Sets JPYC Apart?

- Regulatory certainty: Full FSA approval under the revised Payment Services Act.

- Robust backing: 100% reserves in yen deposits and JGBs.

- No transaction fees: Revenue model based on interest from government bonds.

- Multi-chain deployment: Simultaneous launch on Ethereum, Avalanche, and Polygon.

For those considering diversification beyond USD-pegged assets or seeking exposure to Asia’s evolving digital currency landscape, JPYC represents a compelling case study. Its architecture demonstrates how regulatory alignment and blockchain innovation can coexist, and potentially reshape capital flows in one of the world’s largest economies.

Top Real-World Use Cases for JPYC Stablecoin

-

1. Seamless Digital Payments for E-commerceJPYC enables instant, low-cost digital payments in Japanese yen across online platforms. Its integration with Ethereum, Avalanche, and Polygon blockchains allows merchants to accept yen-denominated stablecoin payments, reducing FX risk and settlement times for both domestic and international e-commerce.

-

2. DeFi Yield Generation and Liquidity ProvisionJPYC can be used on decentralized finance (DeFi) protocols to provide yen-based liquidity pools, enabling Japanese users to earn yield or participate in lending/borrowing without FX exposure. Its regulated, fully-backed model increases trust and adoption in DeFi platforms operating on supported chains.

-

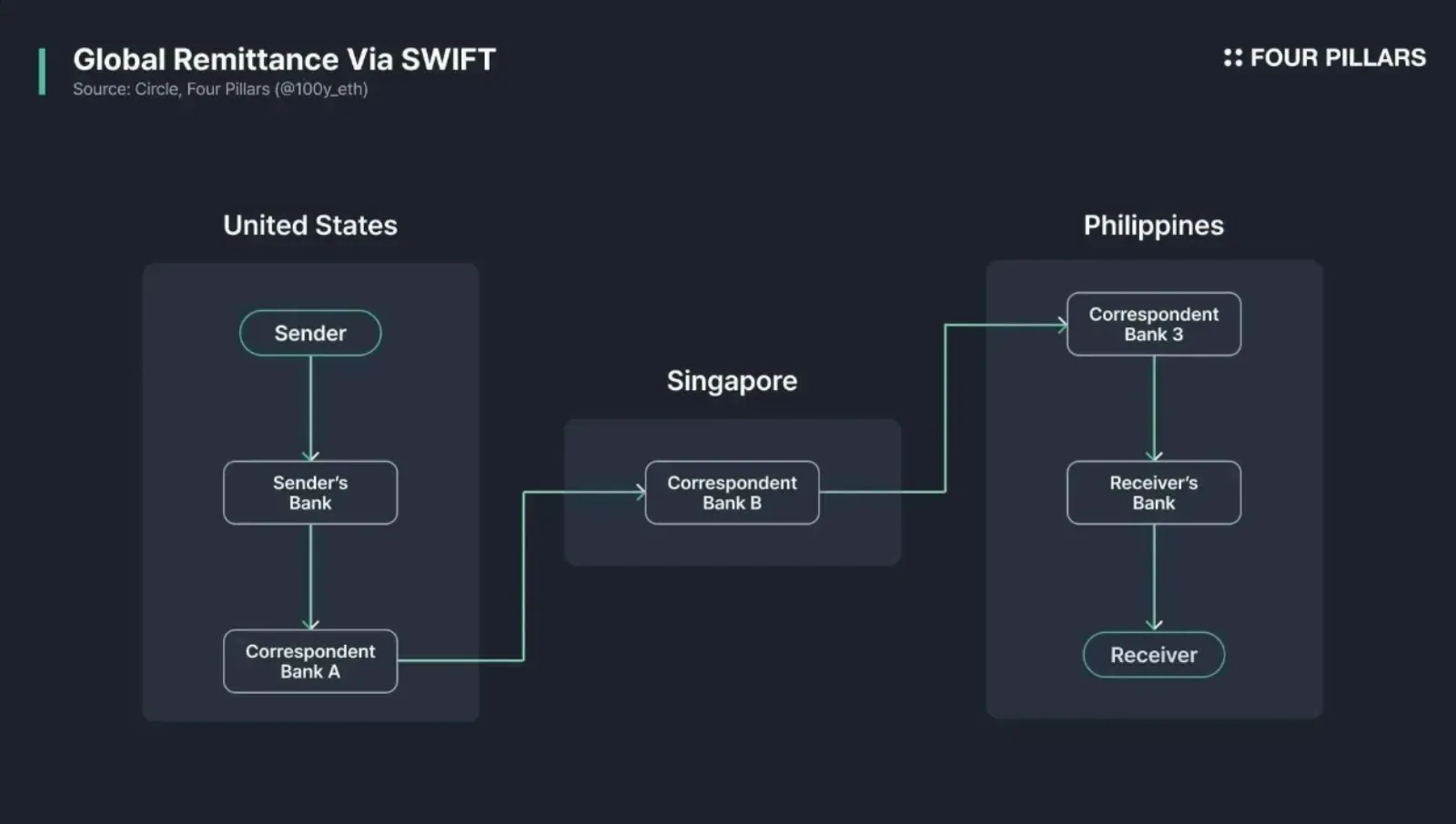

3. Efficient Cross-Border SettlementBy tokenizing the yen and backing it with Japanese government bonds, JPYC streamlines cross-border settlements. Financial institutions and businesses can transfer value globally in yen, bypassing traditional banking rails and reducing settlement costs and times.

-

4. Institutional Treasury ManagementJPYC offers a compliant, stable digital asset for Japanese institutions to manage cash reserves, hedge FX risk, and access on-chain financial services. Its full convertibility to yen and regulatory approval make it attractive for hedge funds and family offices.

-

5. On-Chain Remittances and PayrollJPYC facilitates fast, transparent, and cost-effective remittances and payroll payments for workers and freelancers in Japan and abroad, leveraging blockchain rails for real-time settlement in yen.

As Japan continues to refine its legal framework for crypto assets, potentially granting them full status as financial products, the groundwork is being laid for a broader ecosystem of regulated digital assets. If successful, JPYC could inspire similar initiatives in other jurisdictions where local currency stablecoins are still nascent or unregulated.

For a deeper dive into JPYC’s features, risks, and opportunities, see our comprehensive guide: JPYC: Japan’s First Regulated Yen Stablecoin.