JPYC: Japan’s First Regulated Yen-Pegged Stablecoin – Launch Timeline, Compliance & Impact

Japan is on the cusp of a digital finance milestone as JPYC Inc. prepares to launch the country’s first fully regulated yen-pegged stablecoin, JPYC. This development is not just a technical achievement but a regulatory first, setting a new standard for compliance and transparency in the stablecoin sector. With Japan’s Financial Services Agency (FSA) granting JPYC Inc. a funds transfer service provider license in August 2025, the stage is set for a public rollout in the coming weeks. The move is poised to reshape both domestic and cross-border payments, while potentially altering the landscape for Japanese government bonds (JGBs) and digital asset adoption in Asia.

JPYC Launch Timeline: From Regulation to Rollout

The journey of JPYC stablecoin from concept to imminent launch is a direct result of Japan’s progressive regulatory environment. Following the June 2023 implementation of the revised Payment Services Act, stablecoins in Japan are now classified as “currency-denominated assets. ” This legal clarity paved the way for JPYC Inc. to secure its FSA license, a crucial step that ensures only rigorously vetted entities can issue yen-pegged tokens.

Key milestones include:

Key Milestones in JPYC Stablecoin Development

-

June 2023: Japan’s revised Payment Services Act comes into effect, establishing a regulatory framework for stablecoins and enabling only licensed entities to issue yen-pegged tokens.

-

August 2025: JPYC Inc. secures registration as a funds transfer service provider with the Financial Services Agency (FSA), becoming Japan’s first licensed issuer of a regulated yen-pegged stablecoin.

-

Autumn 2025: Public launch of the JPYC stablecoin is scheduled, marking the first issuance of a regulated yen-backed digital asset in Japan, fully compliant with national regulations.

-

Blockchain Integration: JPYC tokens are issued on Ethereum, Avalanche, and Polygon, ensuring transparency, interoperability, and accessibility for users on major public blockchains.

-

Asset Backing and Transparency: Each JPYC token is backed 1:1 by Japanese yen and government bonds (JGBs), with immediate redemption guarantees and full reserve transparency.

With the public issuance of JPYC expected this autumn, Japan will finally join the ranks of countries offering regulated, fiat-backed stablecoins on public blockchains. The timing is pivotal, coinciding with growing global interest in non-USD stablecoins and the need for compliant digital yen solutions.

Compliance: Setting a New Benchmark for Yen-Pegged Stablecoins

Unlike earlier attempts at yen-backed tokens, JPYC is fully aligned with Japan’s stringent regulatory framework. Only licensed banks, trust companies, and registered money transfer firms can issue such tokens. JPYC Inc. has not only met these requirements but has also committed to full transparency of backing assets and immediate redemption guarantees. This is a significant departure from the opaque reserve practices seen in some global stablecoin projects.

Each JPYC token is backed 1: 1 by Japanese yen, with reserves held in domestic savings accounts and Japanese government bonds. This dual-backing structure provides both liquidity and stability, while the inclusion of JGBs as collateral could have a knock-on effect on bond market demand. The transparency of the reserve mechanism is further enhanced by regular disclosures, a requirement under Japan’s Payment Services Act.

Operational Mechanics: Blockchain Integration and User Access

JPYC’s operational model is designed for both retail and institutional adoption. Users acquire JPYC tokens via bank transfers, which are then credited to their digital wallets. The tokens are issued on leading public blockchains including Ethereum, Avalanche, and Polygon, ensuring high interoperability and auditability. This multi-chain approach not only broadens JPYC’s reach but also aligns with Japan’s vision of an open, transparent digital finance ecosystem.

Unlike most stablecoin issuers, JPYC Inc. has opted for a zero transaction fee policy. Instead, the company’s revenue comes from the interest generated on the JGBs held as reserves. This model incentivizes both adoption and long-term stability, while keeping user costs minimal.

JPYC’s Strategic Impact on Japan’s Financial Ecosystem

The launch of JPYC is expected to catalyze several key shifts in Japan’s financial markets:

- Enhanced yen liquidity on blockchain platforms, supporting DeFi protocols and digital asset trading pairs.

- Faster, lower-cost cross-border settlements for businesses and individuals transacting in yen.

- Potential uplift in demand for Japanese government bonds, as stablecoin reserves drive institutional participation in JGB markets.

- Greater regulatory confidence in digital asset adoption, setting a precedent for other non-USD stablecoins globally.

This multi-layered impact positions JPYC not just as a technical innovation but as a strategic lever for Japan’s broader digital finance ambitions. For more details on how JPYC is transforming the landscape for yen stablecoins, see our in-depth analysis here.

Market participants are closely watching JPYC’s rollout, not just for its compliance architecture but also for its potential to unlock new liquidity channels in Asia. The yen has historically been underrepresented in the global stablecoin market, with most liquidity concentrated in USD-pegged tokens like USDT and USDC. By providing a regulated, transparent alternative, JPYC could attract both domestic and international users seeking to diversify out of dollar exposure, especially as regulatory scrutiny of USD stablecoins intensifies worldwide.

For institutional investors, JPYC represents a bridge between traditional finance and on-chain assets. The use of JGBs as reserves means that stablecoin growth could directly influence government bond demand, potentially impacting yields and liquidity in the broader fixed income market. This dynamic is unique to the Japanese approach and may serve as a model for other jurisdictions considering regulated, asset-backed stablecoins.

Comparing JPYC: Yen-Pegged Innovation vs. Global Stablecoins

How does JPYC stack up against established players like USDT or USDC? The answer lies in its compliance-first philosophy and reserve transparency. While USDT and USDC are widely used, questions over reserve audits and regulatory oversight persist. In contrast, JPYC’s reserve structure is subject to Japan’s rigorous financial laws, regular disclosures, and immediate redemption guarantees, a trifecta that sets a new global benchmark for fiat-backed digital assets.

Key Differences: JPYC vs. Major USD Stablecoins

-

Regulatory Framework: JPYC is issued under Japan’s revised Payment Services Act, requiring full regulatory approval and oversight by the Financial Services Agency (FSA). In contrast, major USD stablecoins like USDT (Tether) and USDC (Circle) operate under varying regulatory regimes, with less stringent, often U.S.-centric oversight.

-

Backing Assets: Each JPYC token is backed 1:1 by Japanese yen and Japanese government bonds (JGBs). Major USD stablecoins are typically backed by a mix of U.S. dollars, short-term U.S. Treasuries, and cash equivalents, with differing levels of transparency and audit frequency.

-

Issuer Type: JPYC Inc. is a licensed funds transfer service provider in Japan. Major USD stablecoins are issued by private companies (e.g., Tether Limited for USDT, Circle for USDC), which are not required to be licensed banks or money transfer operators in most jurisdictions.

-

Revenue Model: JPYC does not charge transaction fees; it generates revenue from interest on JGB reserves. Major USD stablecoins may charge minting/redemption fees and also earn interest on reserve assets, but their fee structures and disclosures vary.

-

Blockchain Support: JPYC is issued on Ethereum, Avalanche, and Polygon blockchains. Major USD stablecoins are also multi-chain but typically have broader support across more blockchains, including Solana, Tron, and others.

-

Currency Peg: JPYC is pegged 1:1 to the Japanese yen (JPY), while major USD stablecoins are pegged to the U.S. dollar (USD), impacting their use cases and market demand in different regions.

For users, the implications are clear: JPYC offers a compliant, transparent option for yen-denominated transactions, whether for remittances, DeFi participation, or on-chain savings. For developers and enterprise partners, the multi-chain issuance opens the door to integrating yen liquidity into a wide range of dApps and payment rails.

Looking ahead, the success of JPYC could accelerate the development of yen-based DeFi protocols, cross-chain swaps, and new yield strategies anchored in JGBs. The potential for programmable finance, combining regulatory certainty with smart contract automation, could make the yen a far more prominent player in the digital asset ecosystem.

What’s Next: Scaling Adoption and Ecosystem Growth

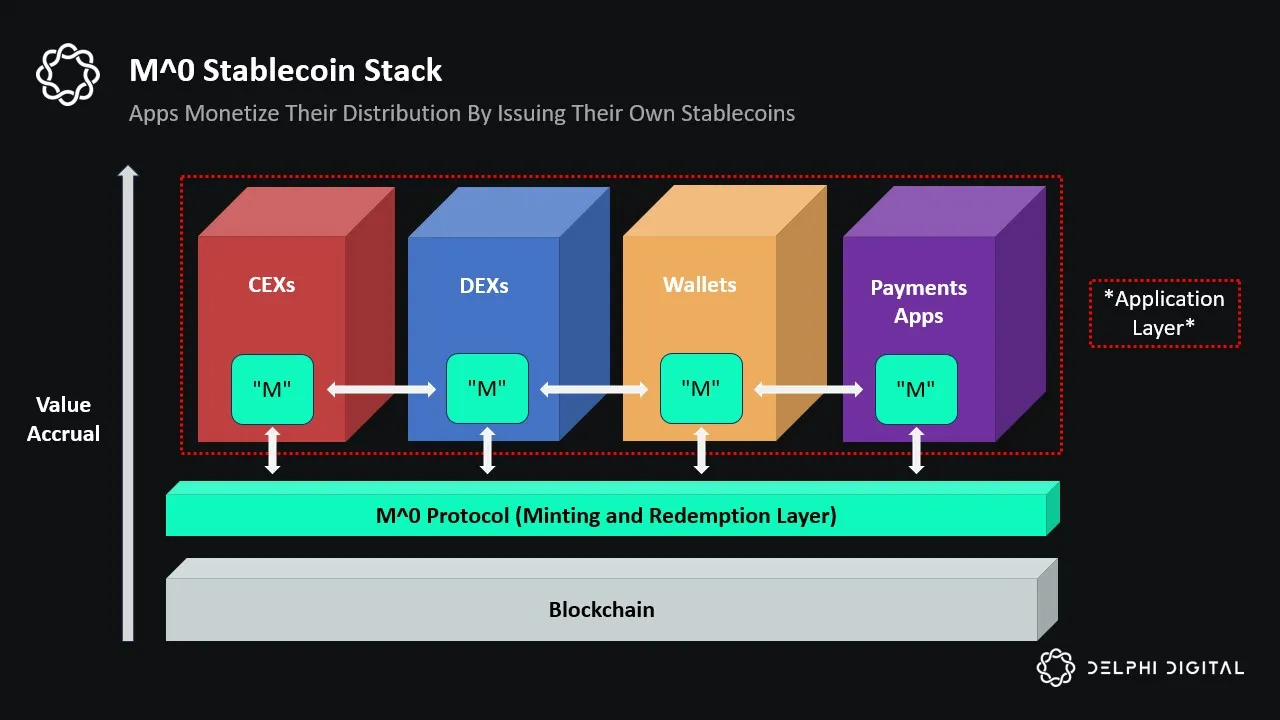

As JPYC prepares for public issuance, the focus will shift to ecosystem integration and user adoption. Partnerships with major banks, fintechs, and DeFi platforms are already in motion, aiming to embed JPYC across exchanges, wallets, and payment gateways. Regulatory clarity is expected to drive institutional confidence, while retail users benefit from lower transaction costs and instant settlement.

For those tracking the evolution of non-USD stablecoins, Japan’s approach offers a compelling playbook: prioritize compliance, ensure transparency, leverage domestic assets, and build for interoperability from day one. The coming months will be pivotal as JPYC moves from launch to scale, potentially inspiring similar initiatives across Asia and beyond.

To explore further how Japan’s stablecoin system is connecting banks, merchants, and users on-chain, visit our detailed breakdown.