Japan’s Major Banks to Launch Yen-Backed Stablecoins: What This Means for Crypto Investors

Japan’s financial landscape is on the cusp of a historic shift as its three banking giants, Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group, unite to launch a yen-backed stablecoin initiative. This move, set against the backdrop of robust regulatory clarity from Japan’s Financial Services Agency (FSA), signals not only a leap in domestic digital payments but also a pivotal moment for global stablecoin dynamics. For crypto investors, this institutional embrace of blockchain technology could redefine trust, liquidity, and diversification strategies in the non-USD stablecoin ecosystem.

Japan’s Banking Titans Enter the Stablecoin Arena

The alliance between MUFG, SMFG, and Mizuho is more than just another fintech experiment, it’s an industry-wide endorsement of blockchain as the new backbone for settlements. The banks plan to issue stablecoins pegged to both the Japanese yen and the US dollar via MUFG’s Progmat platform, which supports token issuance across major blockchains including Ethereum, Polygon, Avalanche, and Cosmos. This infrastructure isn’t merely technical scaffolding; it represents a vision for interoperability and transparency that private stablecoins have struggled to achieve.

The first major corporate adopter will be Mitsubishi Corporation, which intends to use the yen-pegged stablecoin for internal settlements among its global subsidiaries. This pilot phase is expected to showcase how programmable money can streamline cross-border operations while lowering transaction costs, a long-standing pain point in international finance.

Regulatory Clarity: The FSA’s Progressive Approach

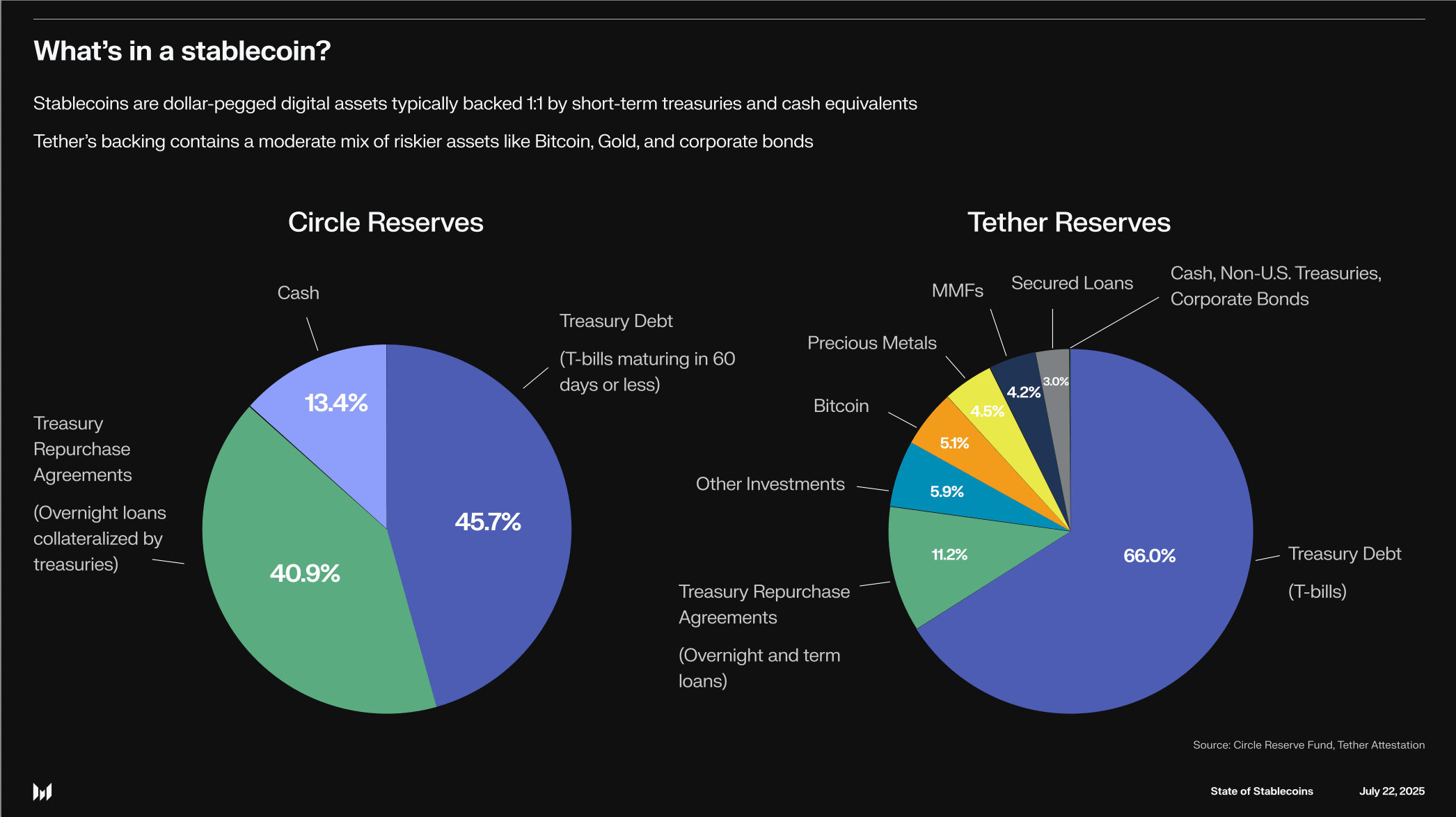

Japan’s regulatory architecture has been quietly maturing since 2023 when amendments to the Payment Services Act classified stablecoins as electronic payment instruments. This legal framework mandates 100% reserve backing for all regulated stablecoins, a critical distinction from many offshore models that have faced scrutiny over collateral transparency.

This clarity has emboldened institutional actors like JPYC, whose own regulated yen-pegged token recently received FSA approval. For investors wary of regulatory risk or opaque reserves in other jurisdictions, Japan’s approach offers a rare combination of innovation and safety. The result? A market environment where bank-backed digital assets can flourish without sacrificing compliance or consumer protection.

- JPYC: Japan’s First Regulated Yen Stablecoin Explained

- How Japan’s Stablecoin System Connects Banks, Merchants and Users On-Chain

Key Benefits of Regulated JPY Stablecoins for Crypto Investors

-

Enhanced Trust and Stability: Stablecoins issued by Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group are fully regulated and 100% reserve-backed under Japan’s Payment Services Act, offering a higher level of investor confidence compared to unregulated alternatives.

-

Increased Liquidity and Trading Pairs: The introduction of yen-backed stablecoins on leading blockchains like Ethereum, Polygon, Avalanche, and Cosmos is expected to create new JPY-denominated trading pairs, expanding options for crypto investors and arbitrage opportunities.

-

Lower Transaction Costs and Faster Settlements: By leveraging blockchain technology and bank-grade infrastructure, these stablecoins enable 24/7 settlements with reduced fees, benefiting both retail and institutional crypto investors.

-

Regulatory Clarity and Legal Protection: Japan’s 2023 Payment Services Act amendment provides clear legal status for stablecoins as electronic payment instruments, reducing regulatory uncertainty for investors and platforms that use or hold these assets.

-

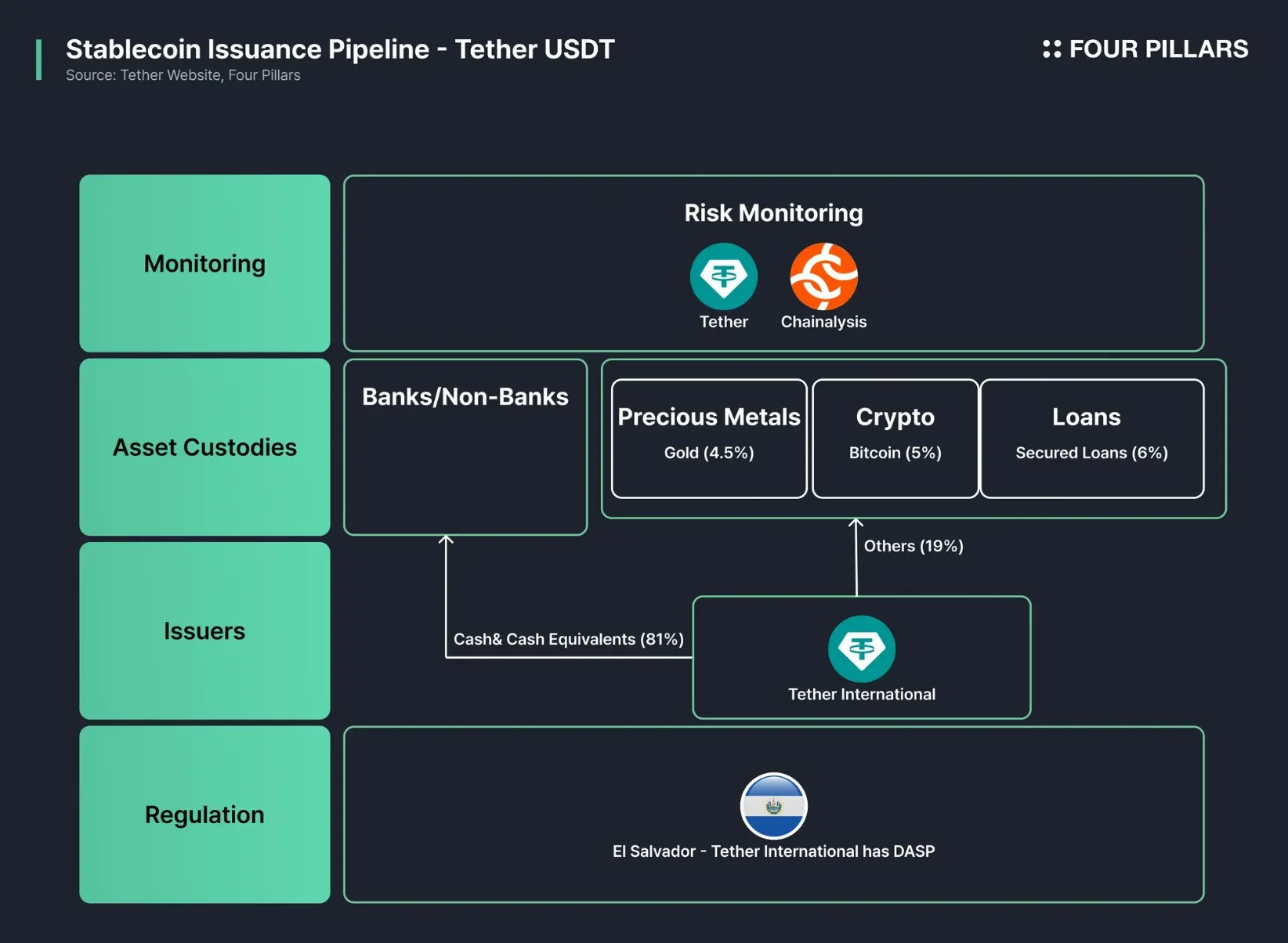

Potential Diversification Beyond USD Stablecoins: The emergence of a major, regulated JPY stablecoin challenges the dominance of Tether (USDT) and USD Coin (USDC), giving investors an alternative for hedging and global transfers.

The Strategic Impact on Crypto Markets and Investors

For years, USD-backed tokens like Tether (USDT) and USD Coin (USDC) have dominated global liquidity pools. The entry of yen-backed stablecoins, especially those issued by household-name banks, could disrupt this status quo by offering new hedging options and regional liquidity anchors. Investors who have sought non-USD exposure now have access to assets with both regulatory backing and deep-rooted institutional support.

This development may also drive further integration between traditional finance and DeFi protocols. With Progmat enabling issuance across multiple chains, and with programmable features baked into these new tokens, developers could soon build sophisticated cross-currency settlement solutions that leverage bank-grade digital assets as their foundation.

The implications are profound: increased stability for Asian trading pairs, lower FX risk for regional businesses operating on-chain, and greater confidence among institutional allocators considering digital asset exposure beyond USD-centric models.

Yet, the effects are not limited to Japan’s domestic market. As yen-backed stablecoins gain traction, they could catalyze a broader shift in global stablecoin flows. For crypto investors, this means new arbitrage opportunities and the potential for more balanced liquidity between Asian and Western markets. The presence of bank-issued JPY tokens may also encourage foreign exchanges and DeFi protocols to list JPY pairs, further internationalizing the yen as a digital settlement currency.

Navigating Risks and Opportunities: What Investors Should Watch

While institutional backing and regulatory clarity offer strong tailwinds, investors should remain attentive to several evolving dynamics:

Key Risks and Opportunities for Investors in Japan’s Regulated Yen-Backed Stablecoins

-

Enhanced Stability and Trust from Major Banks: The joint issuance of yen-backed stablecoins by Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group provides a level of institutional credibility and regulatory oversight rarely seen in the stablecoin space, potentially reducing counterparty risk for investors.

-

Regulatory Clarity and 100% Reserve Backing: Japan’s amended Payment Services Act (2023) classifies stablecoins as electronic payment instruments, mandating full reserve backing. This regulatory framework offers investors greater transparency and protection compared to many offshore stablecoin issuers.

-

Increased Competition with USD-Backed Stablecoins: The entry of yen-backed coins could challenge the dominance of Tether (USDT) and USD Coin (USDC), potentially diversifying stablecoin liquidity and reducing reliance on the U.S. dollar in digital asset markets.

-

Opportunities for Faster, Cheaper Settlements: The use of MUFG’s Progmat blockchain platform enables instant, 24/7 corporate settlements, which could translate to lower transaction costs and greater efficiency for investors and businesses alike.

-

Limited Initial Use Cases and Liquidity Risks: With Mitsubishi Corporation as the first corporate user and a focus on internal settlements, investor access and secondary market liquidity may be limited at launch, potentially impacting immediate tradability.

-

Cross-Chain Compatibility and Technical Risks: While the stablecoins will be issued on multiple blockchains (Ethereum, Polygon, Avalanche, Cosmos), technical integration and smart contract vulnerabilities remain risks for investors engaging with these assets across various networks.

-

Potential for Broader Institutional Adoption: The involvement of Japan’s largest banks could accelerate the acceptance of regulated stablecoins among other financial institutions, paving the way for new investment products and increased market depth.

Regulatory risk is never fully off the table. Future amendments by the FSA or shifts in cross-border compliance standards could alter how these assets are treated outside Japan. Additionally, while Progmat’s interoperability is promising, true multi-chain liquidity will depend on adoption by both traditional institutions and crypto-native platforms.

On the opportunity side, corporate adoption, led by Mitsubishi Corporation, serves as a crucial test case for programmable finance at scale. If successful, it could inspire similar initiatives across Asia and even prompt Western banks to accelerate their own stablecoin projects. For those seeking deeper analysis of JPYC’s ongoing role in this ecosystem, see our coverage on how JPYC is transforming yen stablecoins.

The Road Ahead: Will Yen Stablecoins Challenge USD Dominance?

The question now facing investors is whether regulated JPY stablecoins can chip away at the entrenched dominance of USD-based tokens. While it’s unlikely that USDT or USDC will be dethroned overnight, Japan’s approach offers a blueprint for other G7 economies considering their own bank-led stablecoin strategies.

For portfolio managers seeking diversification or regional exposure, these developments open new doors. Yen-backed tokens could become pivotal in forex trading strategies within crypto markets or serve as safer harbors during periods of dollar volatility.

Ultimately, Japan’s banking giants are not just launching another digital asset, they are reframing what trust and transparency mean in the world of programmable money. As this project evolves toward its 2025 rollout and beyond, all eyes will be on Tokyo to see if institutional-grade non-USD stablecoins can finally deliver on the promise of a more balanced global crypto economy.